- Spain

- /

- Healthcare Services

- /

- BME:CBAV

Shareholders Of Clínica Baviera (BME:CBAV) Must Be Happy With Their 177% Total Return

It might be of some concern to shareholders to see the Clínica Baviera, S.A. (BME:CBAV) share price down 16% in the last month. But that scarcely detracts from the really solid long term returns generated by the company over five years. Indeed, the share price is up an impressive 142% in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Of course, that doesn't necessarily mean it's cheap now.

View our latest analysis for Clínica Baviera

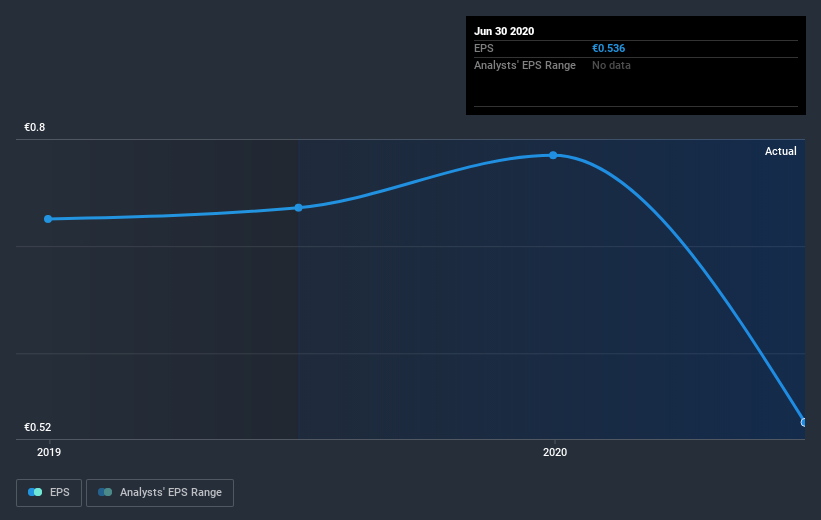

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Clínica Baviera moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We've already covered Clínica Baviera's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Clínica Baviera shareholders, and that cash payout contributed to why its TSR of 177%, over the last 5 years, is better than the share price return.

A Different Perspective

While it's never nice to take a loss, Clínica Baviera shareholders can take comfort that their trailing twelve month loss of 9.9% wasn't as bad as the market loss of around 12%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 23% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Clínica Baviera better, we need to consider many other factors. Take risks, for example - Clínica Baviera has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you’re looking to trade Clínica Baviera, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:CBAV

Clínica Baviera

A medical company, operates a network of ophthalmology clinics in Spain and Europe.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives