- Spain

- /

- Healthcare Services

- /

- BME:ATRY

Did You Miss Atrys Health's (BME:ATRY) Whopping 387% Share Price Gain?

For us, stock picking is in large part the hunt for the truly magnificent stocks. Not every pick can be a winner, but when you pick the right stock, you can win big. One bright shining star stock has been Atrys Health, S.A. (BME:ATRY), which is 387% higher than three years ago. Also pleasing for shareholders was the 21% gain in the last three months. But this could be related to the strong market, which is up 14% in the last three months.

See our latest analysis for Atrys Health

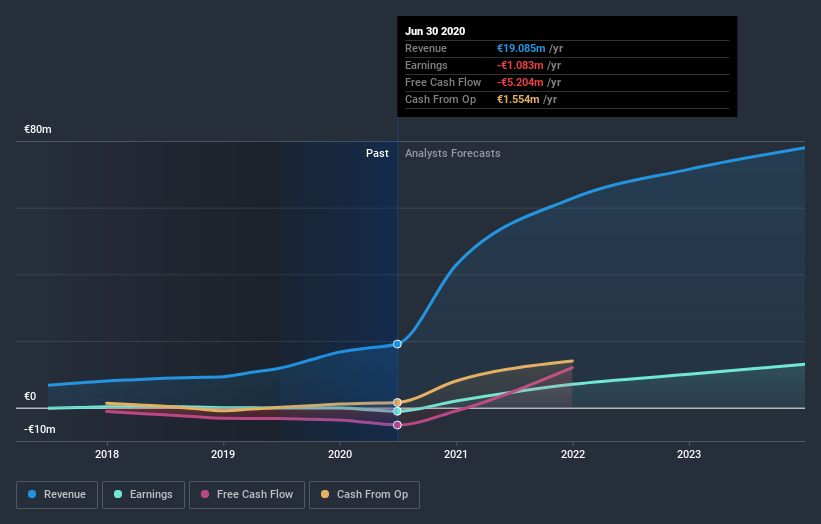

Because Atrys Health made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years Atrys Health has grown its revenue at 36% annually. That's well above most pre-profit companies. And it's not just the revenue that is taking off. The share price is up 70% per year in that time. It's always tempting to take profits after a share price gain like that, but high-growth companies like Atrys Health can sometimes sustain strong growth for many years. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Atrys Health's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Atrys Health's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Atrys Health's TSR, at 392% is higher than its share price return of 387%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We're pleased to report that Atrys Health rewarded shareholders with a total shareholder return of 90% over the last year. That's better than the annualized TSR of 70% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting Atrys Health on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Atrys Health (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

Of course Atrys Health may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you decide to trade Atrys Health, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Atrys Health, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:ATRY

Atrys Health

Provides diagnostic services and medical treatments in Spain, Portugal, and Latin America.

Reasonable growth potential and fair value.