- Spain

- /

- Energy Services

- /

- BME:TRE

3 European Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

As the European market continues to show resilience with the STOXX Europe 600 Index marking its longest streak of weekly gains since 2012, investors are keenly observing opportunities amidst mixed economic signals and inflation concerns. In this environment, growth companies with high insider ownership often attract attention as they can indicate strong internal confidence in a company’s future prospects.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| TF Bank (OM:TFBANK) | 15.6% | 20% |

| Elicera Therapeutics (OM:ELIC) | 27.8% | 97.2% |

| Vow (OB:VOW) | 12.9% | 120.9% |

| Pharma Mar (BME:PHM) | 11.9% | 40.1% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| XTPL (WSE:XTP) | 27.9% | 118% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 89.9% |

| Ortoma (OM:ORT B) | 27.7% | 73.4% |

| Circus (XTRA:CA1) | 26% | 51.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Técnicas Reunidas (BME:TRE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Técnicas Reunidas, S.A. is an engineering and construction company that specializes in designing and managing industrial plant projects globally, with a market cap of approximately €1.25 billion.

Operations: The company's revenue is primarily derived from its Natural Gas segment at €2.55 billion, followed by Refining at €669.71 million, and Petrochemical at €655.17 million, with additional contributions from Low Carbon Technologies amounting to €111.52 million.

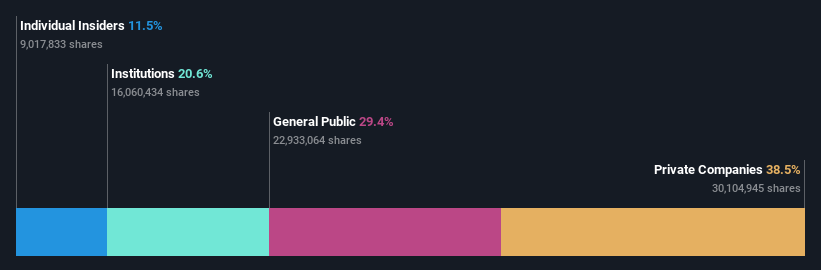

Insider Ownership: 11.5%

Técnicas Reunidas demonstrates solid growth potential, with earnings projected to rise by 17.5% annually, outpacing the Spanish market. Recent earnings showed substantial improvement, with net income increasing to €89.94 million from €60.95 million the previous year. Despite a volatile share price and no recent insider trading activity, its price-to-earnings ratio of 14.9x suggests it is undervalued compared to the broader market's 18.5x, enhancing its appeal as a growth stock with high insider ownership in Europe.

- Navigate through the intricacies of Técnicas Reunidas with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Técnicas Reunidas' current price could be inflated.

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a private equity firm that focuses on direct, secondary, and primary investments in private equity, real estate, infrastructure, and debt with a market cap of CHF36.02 billion.

Operations: The company's revenue segments include CHF1.19 billion from Private Equity, CHF254.90 million from Infrastructure, CHF218.90 million from Private Credit, and CHF190.90 million from Real Estate.

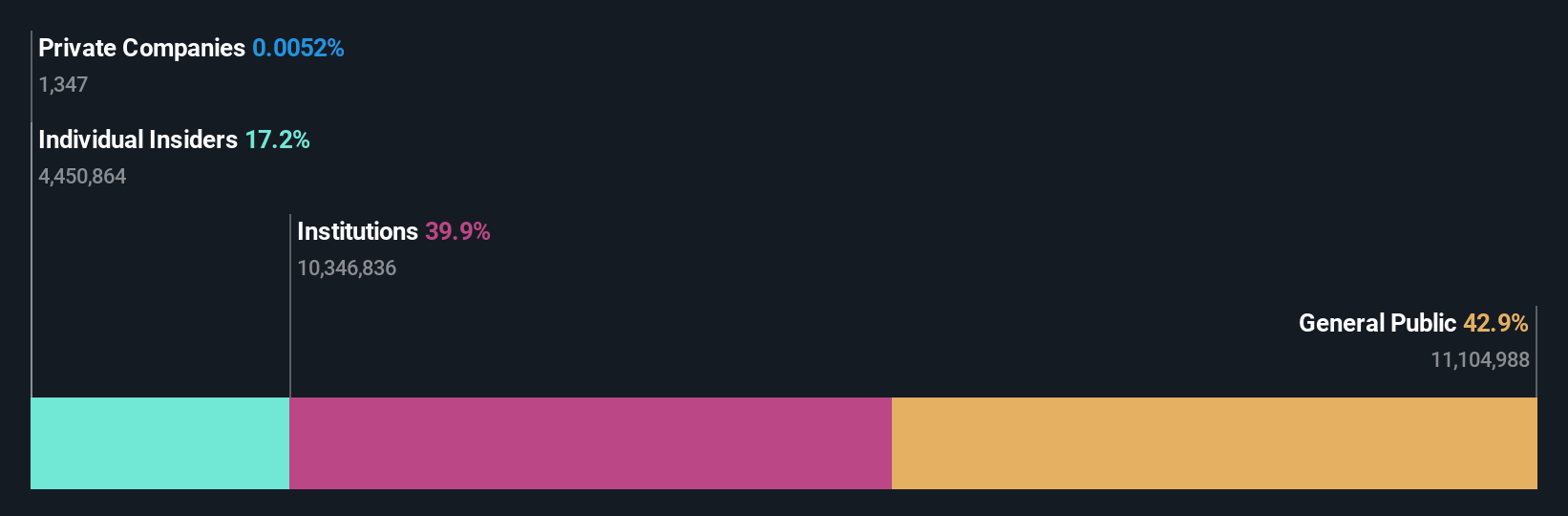

Insider Ownership: 17%

Partners Group Holding is pursuing strategic acquisitions to enhance its real estate vertical, focusing on financially accretive opportunities. The company forecasts new client assets between US$26 billion and US$31 billion for 2025, including growth from acquiring Empira Group. Despite high debt levels and a dividend not fully covered by earnings, Partners Group's revenue and earnings are expected to grow at 14.6% annually, outpacing the Swiss market. Return on equity is projected to be very high at 52.7%.

- Get an in-depth perspective on Partners Group Holding's performance by reading our analyst estimates report here.

- Our valuation report here indicates Partners Group Holding may be overvalued.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform facilitating the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €672.87 million.

Operations: The company generates revenue through its Demand Side Platforms (DSP) at €100.55 million and Supply Side Platforms (SSP) at €390.27 million.

Insider Ownership: 25.9%

Verve Group SE has seen substantial insider buying over the past three months, indicating confidence from within despite a volatile share price. The company is trading at 70.7% below its estimated fair value, presenting potential investment appeal. Although profit margins have decreased from last year, earnings are forecast to grow significantly at 28.5% annually, surpassing the German market's growth rate of 16.9%. Recent earnings showed strong sales growth but declining annual net income and EPS compared to last year.

- Unlock comprehensive insights into our analysis of Verve Group stock in this growth report.

- In light of our recent valuation report, it seems possible that Verve Group is trading behind its estimated value.

Taking Advantage

- Take a closer look at our Fast Growing European Companies With High Insider Ownership list of 218 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Técnicas Reunidas, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Técnicas Reunidas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:TRE

Técnicas Reunidas

An engineering and construction company, designs and manages industrial plant projects worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives