- Spain

- /

- Oil and Gas

- /

- BME:REP

What Does Recent Oil Price Volatility Mean for Repsol Shares in 2025?

Reviewed by Bailey Pemberton

If you are considering what’s next for Repsol stock, you are far from alone. With the price closing at €15.045 most recently, and shares providing a remarkable 210.8% return over the past five years, it is only natural to wonder if the momentum can continue. In just the past year, Repsol stock is up 29.3%. Even zooming in, the last 30 days delivered a 6.0% gain, though the most recent week shaved off some of those gains, down 2.4%. Investors watching oil prices and shifting energy sentiment have kept Repsol in focus, as global market developments have flagged both new risks and growth potential for energy companies such as this one.

No doubt, Repsol’s journey has had some hiccups, but the longer-term trajectory looks resilient. Of course, today’s price is only half the story. What it actually means for you as an investor depends on whether the stock is fairly valued or still hiding further upside. Using a quantitative lens, Repsol’s valuation score currently sits at 2 out of 6, meaning it passes two of the major undervaluation checks. That suggests it could be cheaper than some peers, but perhaps not excessively so.

So, how do these valuation methods stack up, and what should you make of that score? Here is a breakdown of how the major valuation checks rate Repsol, followed by a look at an even more powerful way to judge whether this stock is still a smart buy.

Repsol scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Repsol Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows, which are the profits the business will generate, and discounting those amounts back to today's value. This process accounts for the time value of money and risk.

For Repsol, the current Free Cash Flow stands at €1.51 billion. Analyst forecasts estimate a steady increase, with projected Free Cash Flow reaching €2.38 billion by 2029. Across the next decade, projections (part analyst data, part extrapolation) anticipate FCF climbing from €2.02 billion in 2026, with a gradual rise and some fluctuations. This demonstrates long-term stability in the company's ability to generate cash.

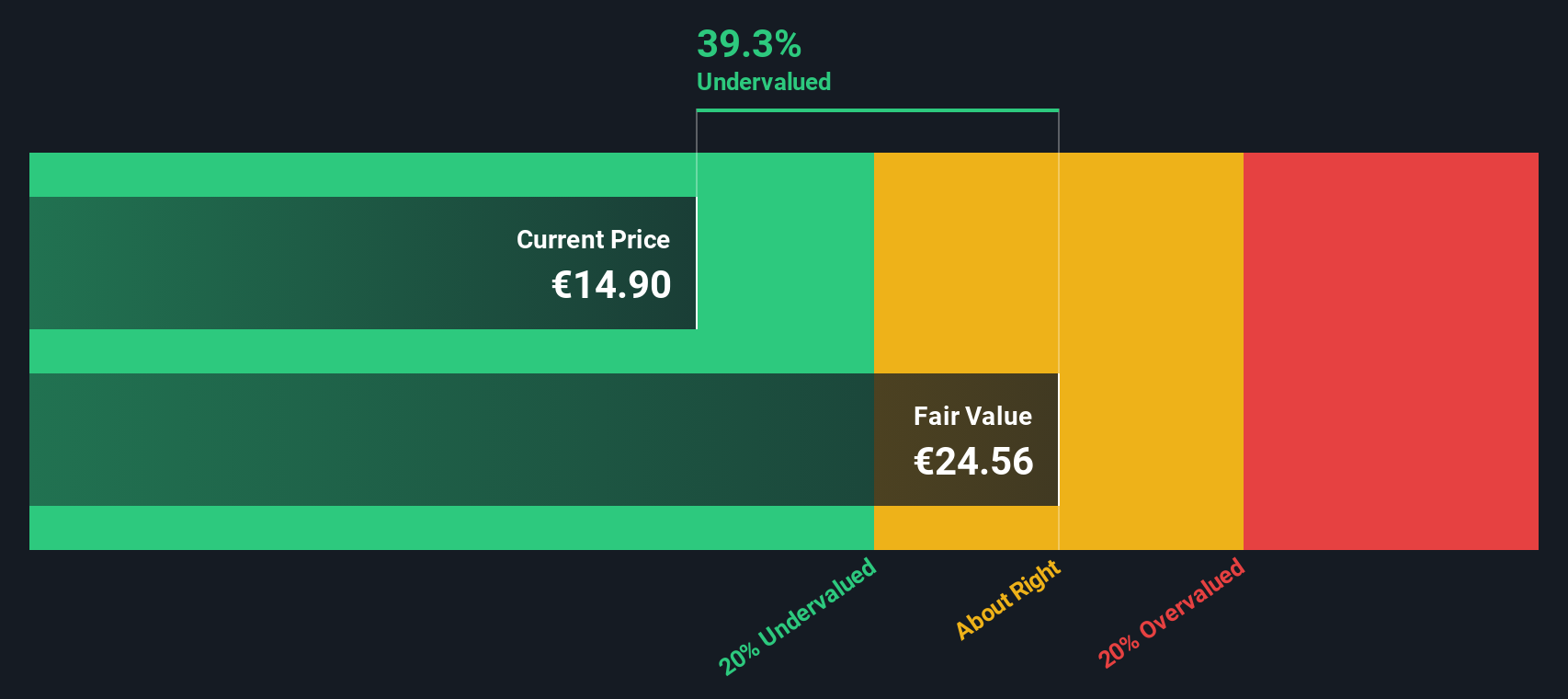

Based on these projections, the resulting DCF model estimates Repsol’s fair value at €24.64 per share. With the latest price at €15.05, this implies the shares are trading at a 38.9% discount to their intrinsic value, which suggests meaningful undervaluation by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Repsol is undervalued by 38.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Repsol Price vs Earnings (PE)

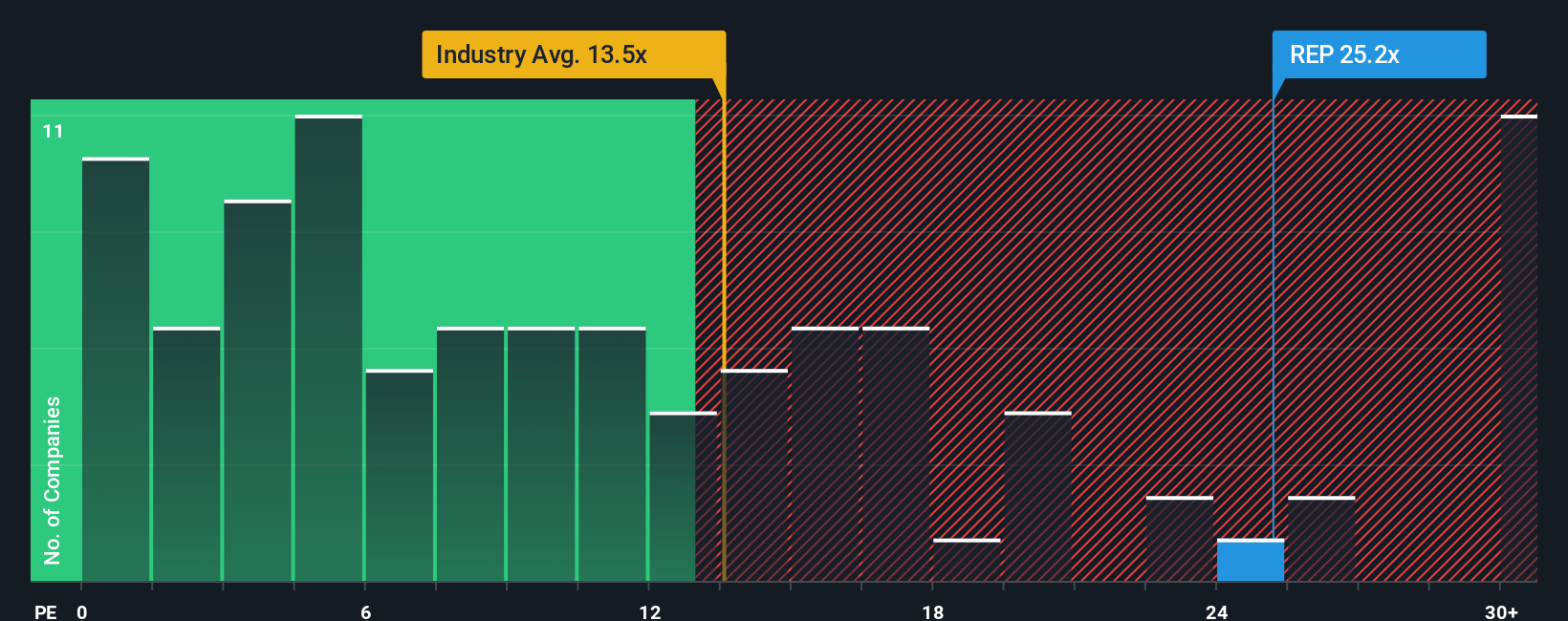

For profitable companies like Repsol, the Price-to-Earnings (PE) ratio is one of the most popular and practical ways to assess valuation. The PE ratio helps investors compare the price of a stock against its earnings, giving a quick sense of how much the market is willing to pay per euro of profit. Typically, higher ratios reflect stronger growth expectations or lower perceived risk, while lower numbers suggest slower growth or more uncertainty. What qualifies as a “fair” PE depends on many things, such as growth prospects, debt levels, or competitive positioning. Companies with brighter growth prospects, less debt, or stronger competitive positions can often command higher multiples.

Repsol's current PE ratio stands at 25x, which is notably higher than both the peer average of 13x and the wider oil and gas industry average of 13x. At first glance, this premium could be cause for concern, but context matters. That is where the “Fair Ratio” comes in, a figure calculated by Simply Wall St, which takes account of factors like Repsol’s projected earnings growth, profit margins, industry context, risks, and even its market capitalization. Repsol’s Fair PE Ratio is calculated at 25x, matching its current market multiple.

Unlike simple peer or industry comparisons, the Fair Ratio gives you a truer picture of whether the stock’s valuation is justified, reflecting all the nuances that can set one company apart from another. In this case, since Repsol’s actual PE is nearly identical to its Fair Ratio, the stock appears to be valued about right according to this methodology.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Repsol Narrative

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal, story-driven perspective about a company. It is where you combine your expectations (like revenue growth and margins) with your reasoning behind those numbers to create your own fair value estimate. Instead of just relying on formulas or historical figures, Narratives help investors link a company’s story and future potential directly to financial forecasts and fair value, providing richer insight than numbers alone.

Narratives are easy to use and are available right on Simply Wall St’s Community page, where millions of investors share and compare their views. They make decision making straightforward by showing, at a glance, whether your Narrative’s fair value signals the stock is undervalued or overvalued compared to the current price, and update automatically as new data or news is released.

For example, with Repsol, the most optimistic users are predicting robust growth from renewables and refining, setting their fair value as high as €18.00 per share. The most cautious expect tougher regulatory pressures and put their target as low as €11.00. This illustrates just how Narratives can reflect the full range of investor insight.

Do you think there's more to the story for Repsol? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:REP

Repsol

Operates as a multi-e energy company in Spain, Peru, the United States, Portugal, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives