- Spain

- /

- Oil and Gas

- /

- BME:REP

A Fresh Look at Repsol (BME:REP) Valuation Following Recent Share Price Uptick

Reviewed by Kshitija Bhandaru

See our latest analysis for Repsol.

Repsol’s 1-year total shareholder return of just 0.3% points to muted long-term momentum. However, its recent 6% share price uptick suggests that sentiment around the stock could be shifting as investors respond to changing energy sector dynamics and company performance.

If Repsol’s latest move has you watching the sector, now’s the ideal time to discover fast growing stocks with high insider ownership

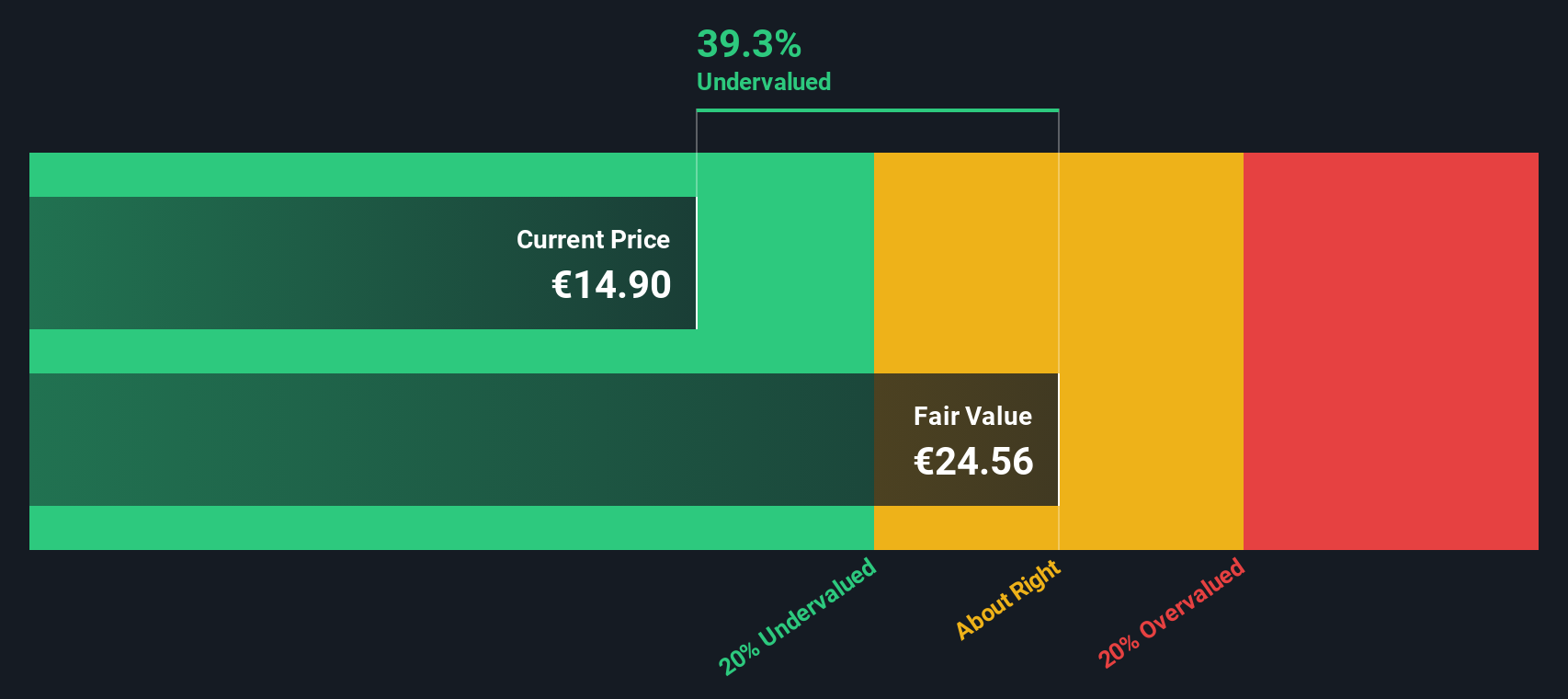

The recent rebound has prompted a key question for investors: is Repsol’s share price now undervalued given its fundamentals, or is the market fully pricing in its future growth potential?

Most Popular Narrative: Fairly Valued

With Repsol’s last close at €15.05 and the most popular narrative setting fair value at €14.45, expectations are largely in line with market pricing. This sets the stage for a close call on what’s next for the stock.

Portfolio optimization and technological upgrades should improve operational resilience, drive efficiency, and support stable earnings from both hydrocarbon and customer-focused divisions.

Want to know what makes this market consensus tick? The future outlook hinges on bold financial forecasts, aggressive margin improvements, and planned capital allocation moves. Which projections drive this fair value? Get the full story and see why there is tension between today’s price and the path ahead.

Result: Fair Value of €14.45 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory costs and a slower shift to renewables may hinder Repsol’s growth story. These factors could potentially undermine analyst forecasts for future profitability.

Find out about the key risks to this Repsol narrative.

Another View: Our DCF Perspective

Taking a critical look from another angle, the Simply Wall St DCF model values Repsol at around €24.64 per share. This places the current share price significantly below this estimate. This suggests the market could be underestimating Repsol’s long-term cash flow potential. However, the question remains whether these optimistic forecasts can withstand real-world volatility.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Repsol for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Repsol Narrative

If you have a different perspective or want to investigate the numbers for yourself, you can craft your own view of Repsol’s outlook in just a few minutes. Do it your way

A great starting point for your Repsol research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Open new possibilities and stay ahead in today’s market. Don’t wait while others seize opportunities. These stock themes are moving fast.

- Capitalize on ground-breaking advances in quantum computing and spot early leaders when you check out these 26 quantum computing stocks.

- Take advantage of robust income streams by reviewing these 19 dividend stocks with yields > 3% offering outstanding yields and strong track records.

- Uncover tomorrow’s technology disruptors by sizing up these 24 AI penny stocks poised to set the pace in artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:REP

Repsol

Operates as a multi-e energy company in Spain, Peru, the United States, Portugal, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives