- Spain

- /

- Hospitality

- /

- BME:NHH

Strong week for NH Hotel Group (BME:NHH) shareholders doesn't alleviate pain of three-year loss

NH Hotel Group, S.A. (BME:NHH) shareholders should be happy to see the share price up 20% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 28% in the last three years, falling well short of the market return.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for NH Hotel Group

Because NH Hotel Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years NH Hotel Group saw its revenue shrink by 44% per year. That means its revenue trend is very weak compared to other loss making companies. With revenue in decline, the share price decline of 9% per year is hardly undeserved. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

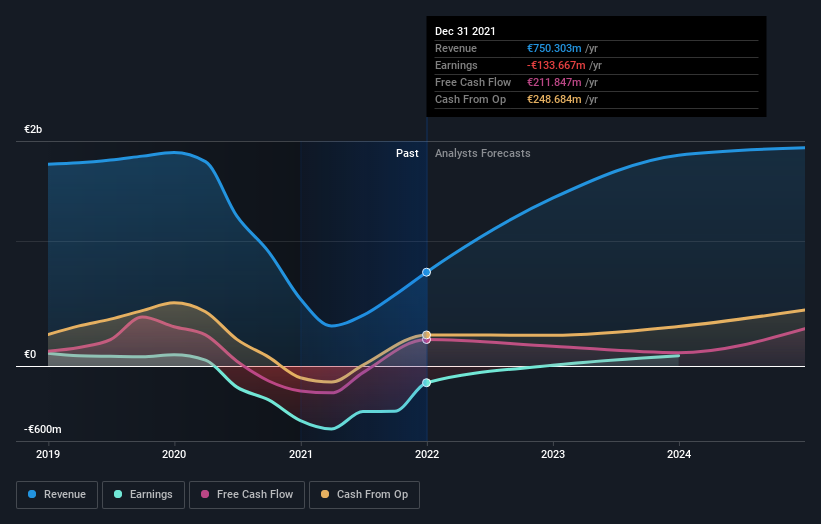

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between NH Hotel Group's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that NH Hotel Group's TSR, which was a 24% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

We regret to report that NH Hotel Group shareholders are down 6.9% for the year. Unfortunately, that's worse than the broader market decline of 0.5%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.3% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for NH Hotel Group that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:NHH

Minor Hotels Europe & Americas

Operates hotels in Spain, Italy, Southern Europe, the United States, Central Europe, Benelux, Latin America, and Central Services.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives