- Spain

- /

- Commercial Services

- /

- BME:FCC

Those who invested in Fomento de Construcciones y Contratas (BME:FCC) five years ago are up 128%

It hasn't been the best quarter for Fomento de Construcciones y Contratas, S.A. (BME:FCC) shareholders, since the share price has fallen 12% in that time. But at least the stock is up over the last five years. However we are not very impressed because the share price is only up 31%, less than the market return of 127%. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 18% decline over the last twelve months.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Fomento de Construcciones y Contratas' earnings per share are down 5.9% per year, despite strong share price performance over five years.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

We note that the dividend is higher than it was previously - always nice to see. Maybe dividend investors have helped support the share price. The revenue growth of about 9.3% per year might also encourage buyers.

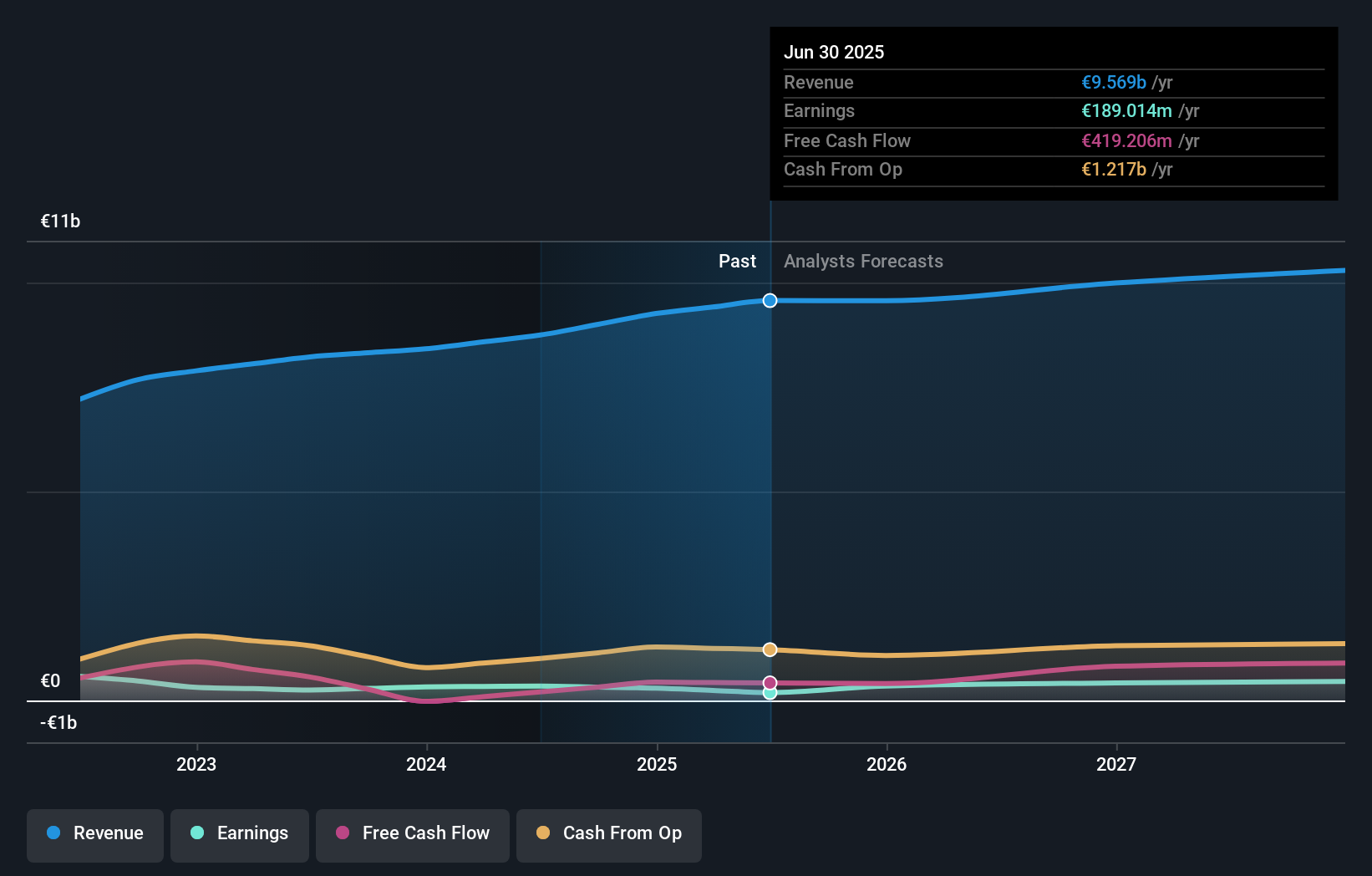

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Fomento de Construcciones y Contratas the TSR over the last 5 years was 128%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Fomento de Construcciones y Contratas provided a TSR of 24% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 18% over half a decade It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 3 warning signs we've spotted with Fomento de Construcciones y Contratas .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Spanish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:FCC

Fomento de Construcciones y Contratas

Engages in the environmental services, water management, infrastructure development, and real estate businesses in Europe and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives