- Spain

- /

- Construction

- /

- BME:MDF

Duro Felguera (BME:MDF) hikes 61% this week, taking five-year gains to 51%

Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. For example, long term Duro Felguera, S.A. (BME:MDF) shareholders have enjoyed a 51% share price rise over the last half decade, well in excess of the market return of around 21% (not including dividends).

Since the stock has added €45m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Duro Felguera

Duro Felguera wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last 5 years Duro Felguera saw its revenue shrink by 11% per year. Even though revenue hasn't increased, the stock actually gained 9%, per year, during the same period. It's probably worth checking other factors such as the profitability, to try to understand the share price action. It may not be reflecting the revenue.

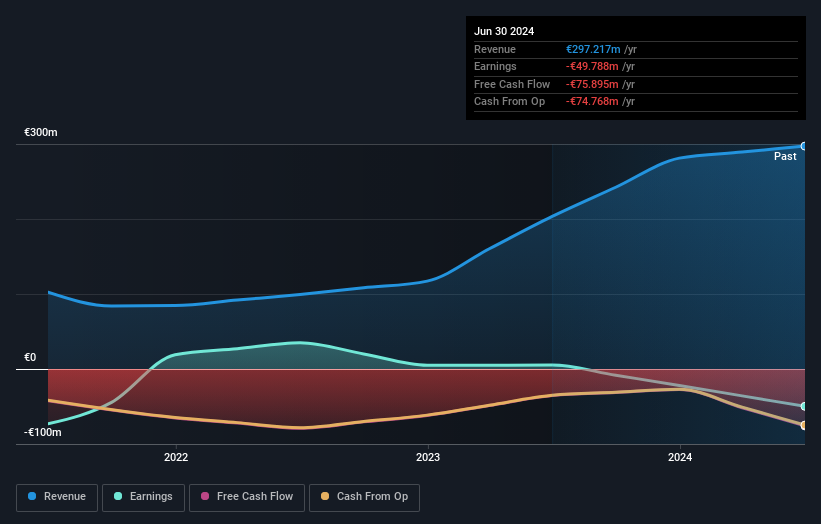

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Duro Felguera shareholders are down 18% for the year, but the market itself is up 21%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 9%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Duro Felguera better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Duro Felguera you should know about.

But note: Duro Felguera may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Spanish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:MDF

Duro Felguera

Duro Felguera, S.A. executes turnkey projects for the energy and industrial sectors in Spain, Latin America, Europe, Africa, the Middle East, Pacific Asia, and internationally.

Slight and slightly overvalued.

Market Insights

Community Narratives