Fluidra (BME:FDR): Assessing Valuation as Uptrend Draws Investor Attention

Reviewed by Simply Wall St

Most Popular Narrative: 4% Undervalued

According to the most widely followed narrative, Fluidra is considered around 4% undervalued compared to its fair value estimate, suggesting some room for price appreciation as fundamentals develop.

Ongoing product innovation and expansion into connected devices and smart pool solutions, bolstered by progress on the Aiper acquisition, align with growing consumer and regulatory focus on energy efficiency, water quality, and automated pool management. This opens up opportunities for higher-value product sales and premiumization, thereby benefiting future net margins.

What is really driving this valuation call? The narrative hinges on a combination of ambitious growth targets and an expected transformation in Fluidra’s business mix. Want to uncover the bold assumptions, especially around future profitability and how analysts forecast earnings to rise, even as the stock trades at a premium? Find out what is fueling these numbers and why the consensus predicts valuation upside that is not obvious from surface-level metrics.

Result: Fair Value of €25.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued weakness in the U.S. dollar or persistent inflation could both weigh on Fluidra’s growth outlook and put pressure on its future profit margins.

Find out about the key risks to this Fluidra narrative.Another View: Price Tags Still Look High

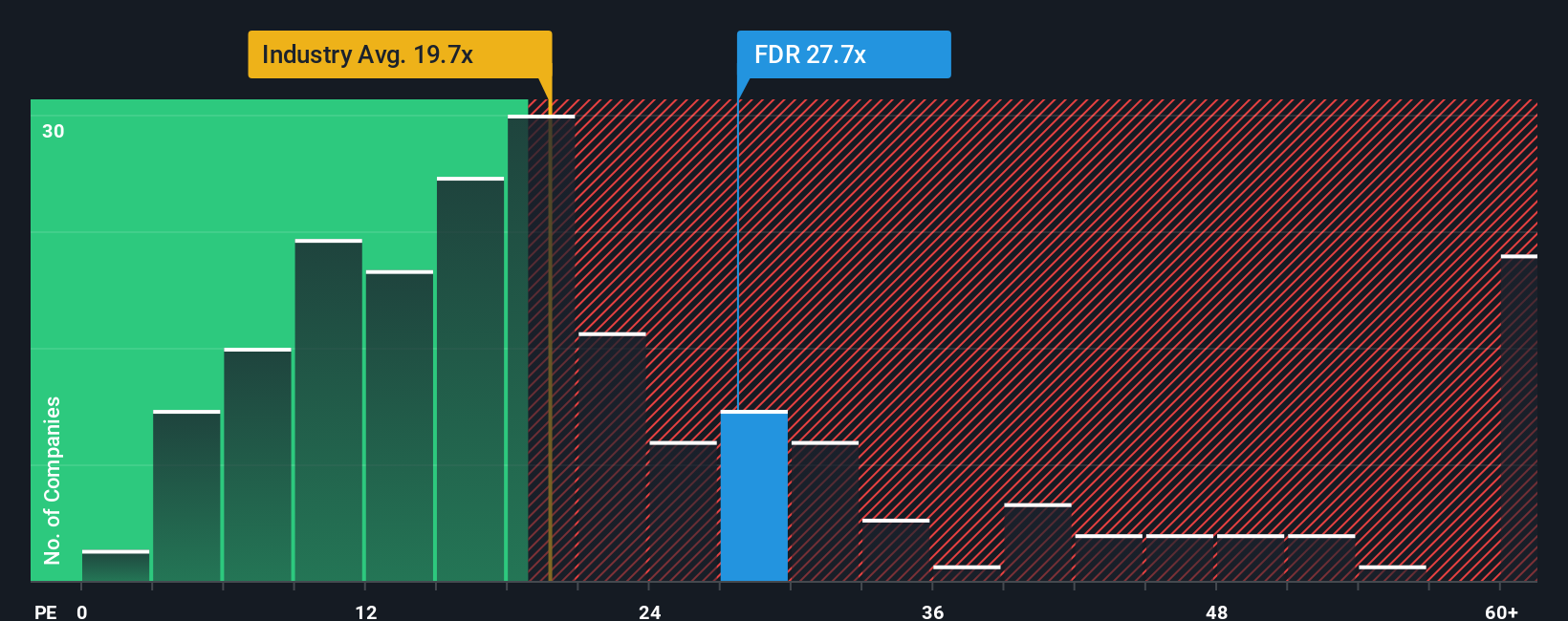

Some investors take a closer look at how Fluidra is priced against industry norms and see a different story. According to this approach, the shares appear expensive compared to similar European companies. This could suggest that market confidence is already reflected in the price, or there could be potential for a surprise.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fluidra Narrative

If you see Fluidra’s story differently, or simply want to follow your own research path, you can build a narrative in just a few minutes. Do it your way.

A great starting point for your Fluidra research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your portfolio by targeting unique stock opportunities with the Simply Wall Street Screener. Miss this and you might overlook tomorrow’s top performers.

- Tap into fast-rising tech by checking out AI penny stocks companies making breakthroughs in machine learning and automation.

- Boost your returns and stability with dividend stocks with yields > 3% that deliver reliable income and resilient performance, even in choppy markets.

- Uncover hidden gems with strong balance sheets using our penny stocks with strong financials, where growth potential meets smart financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BME:FDR

Fluidra

Designs, manufactures, distributes, and markets accessories and machinery for swimming-pools, irrigation and water treatment, and residential and commercial pool purification market worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives