- United Arab Emirates

- /

- Real Estate

- /

- DFM:DEYAAR

Undiscovered Gems To Explore This November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and a cautious Federal Reserve rate-cutting outlook, small-cap stocks have faced heightened volatility, underperforming their large-cap counterparts. Despite these challenges, this environment can uncover unique opportunities for investors willing to explore lesser-known companies with strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| United Wire Factories | NA | 4.86% | 0.19% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Elecnor (BME:ENO)

Simply Wall St Value Rating: ★★★★★★

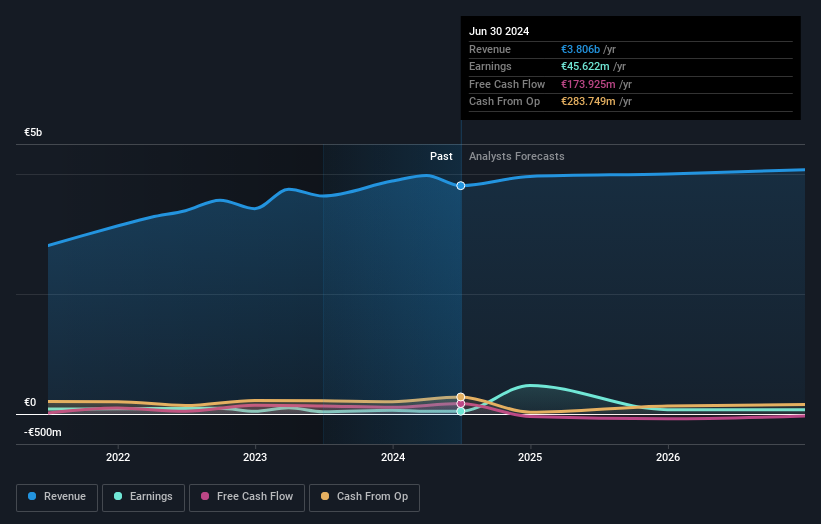

Overview: Elecnor, S.A. is involved in the development, construction, and operation of projects and services both in Spain and internationally with a market capitalization of approximately €1.74 billion.

Operations: Elecnor generates revenue primarily from its Elecnor segment, amounting to approximately €3.81 billion.

Elecnor, a notable player in the construction sector, shows strong financial health with its interest payments well covered by EBIT at 9.1 times, indicating solid earnings quality. Its debt situation has significantly improved over the past five years, with a reduction in the debt-to-equity ratio from 202.5% to 18.6%, and it currently holds more cash than total debt. Despite these strengths, Elecnor's earnings growth of 19.7% over the past year lagged behind the broader construction industry's growth of 38%. Looking ahead, forecasts suggest an average annual decline in earnings by 30.1% for the next three years.

- Unlock comprehensive insights into our analysis of Elecnor stock in this health report.

Explore historical data to track Elecnor's performance over time in our Past section.

Deyaar Development PJSC (DFM:DEYAAR)

Simply Wall St Value Rating: ★★★★★★

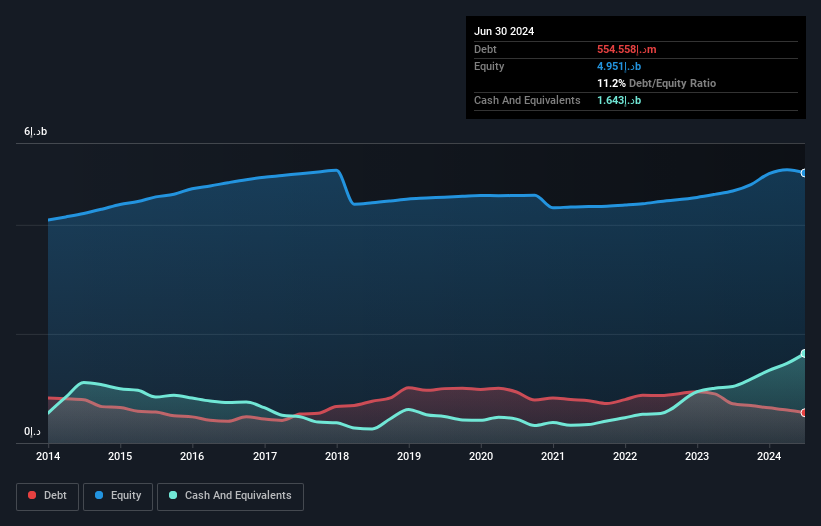

Overview: Deyaar Development PJSC, along with its subsidiaries, engages in property investment, development, and management services both within the United Arab Emirates and internationally, with a market capitalization of AED3.11 billion.

Operations: Deyaar generates revenue primarily from three segments: property development activities (AED1.02 billion), properties and facilities management (AED151.74 million), and hospitality (AED113.49 million).

Deyaar, a notable player in the real estate sector, has shown impressive earnings growth of 161% over the past year, outpacing the industry average of 83%. This performance was bolstered by a significant one-off gain of AED159M. The company stands on solid financial ground with cash exceeding total debt and a debt-to-equity ratio reduced to 11% from 22% over five years. Its price-to-earnings ratio at 6.1x highlights its value compared to the AE market's average of 13.6x. Additionally, Deyaar's interest payments are comfortably covered by EBIT at a multiple of 10.5 times.

- Delve into the full analysis health report here for a deeper understanding of Deyaar Development PJSC.

Assess Deyaar Development PJSC's past performance with our detailed historical performance reports.

Shiyue Daotian Group (SEHK:9676)

Simply Wall St Value Rating: ★★★★★☆

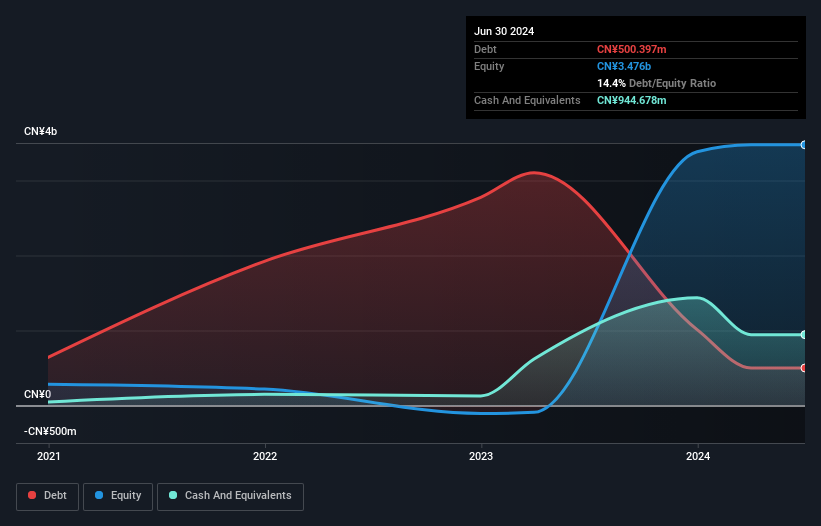

Overview: Shiyue Daotian Group Co., Ltd. focuses on manufacturing and selling pantry staple food products in the People's Republic of China, with a market capitalization of HK$10.60 billion.

Operations: The company generates revenue primarily from rice products, contributing CN¥3.80 billion, followed by whole grain, bean, and other products at CN¥1.04 billion. Dried food and other products add CN¥422.83 million to the total revenue stream.

Shiyue Daotian Group, a smaller player in the food industry, recently turned profitable with net income reaching CNY 125.76 million for the first half of 2024, bouncing back from a net loss of CNY 24.3 million last year. Sales increased to CNY 2.62 billion from CNY 2.23 billion over the same period, highlighting robust revenue growth. Despite high volatility in its share price recently and significant insider selling within three months, the company boasts high-quality earnings and strong debt coverage with EBIT covering interest payments by a factor of 16.3x, suggesting financial resilience amidst market fluctuations.

- Take a closer look at Shiyue Daotian Group's potential here in our health report.

Gain insights into Shiyue Daotian Group's past trends and performance with our Past report.

Taking Advantage

- Unlock our comprehensive list of 4738 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DEYAAR

Deyaar Development PJSC

Provides property investment, development, and management services in the United Arab Emirates and internationally.

Flawless balance sheet with proven track record.