- United Arab Emirates

- /

- Industrials

- /

- DFM:DIC

December 2024's Top Penny Stocks To Keep An Eye On

Reviewed by Simply Wall St

As global markets grapple with cautious Federal Reserve commentary and political uncertainty, investors are navigating a complex landscape marked by interest rate adjustments and economic growth fluctuations. Amid these broader market dynamics, penny stocks remain an intriguing area for potential investment. Despite their somewhat outdated name, these stocks often represent smaller or newer companies that can offer significant opportunities for growth when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.74 | MYR437.82M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,841 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amanat Holdings PJSC, with a market cap of AED2.70 billion, invests in companies and enterprises within the education and healthcare sectors through its subsidiaries.

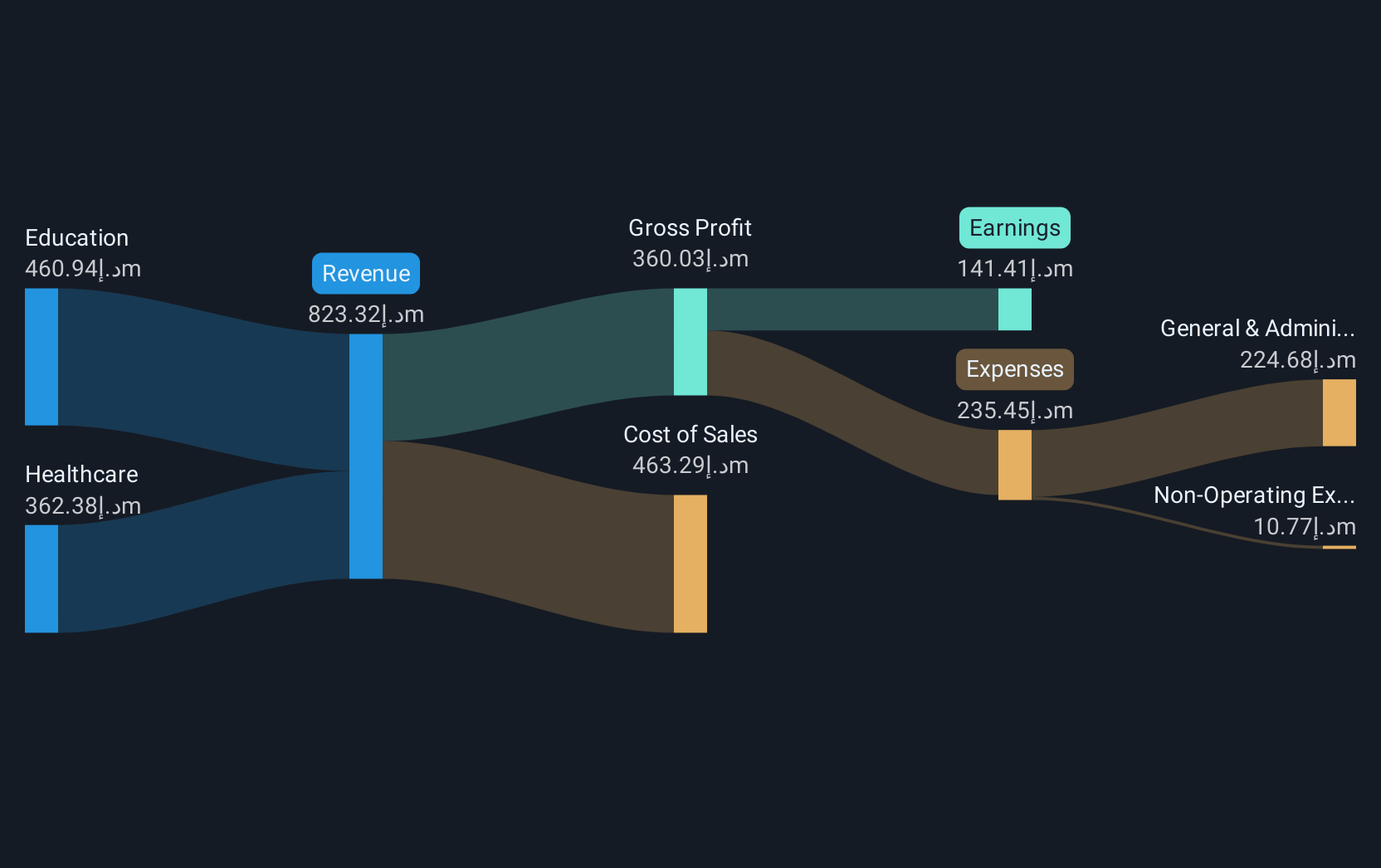

Operations: The company generates revenue from two primary segments: Education, contributing AED395.21 million, and Healthcare, contributing AED394.11 million.

Market Cap: AED2.7B

Amanat Holdings PJSC, with a market cap of AED2.70 billion, operates in the education and healthcare sectors. Despite generating significant revenue from both segments—AED395.21 million in Education and AED394.11 million in Healthcare—the company remains unprofitable, with losses increasing at 13.9% annually over the past five years. The recent earnings report shows a net loss of AED11.11 million for Q3 2024, despite an increase in sales to AED132.86 million compared to last year’s figures. While Amanat has more cash than debt and covers interest payments adequately, its dividend is not well-supported by earnings or cash flows.

- Click to explore a detailed breakdown of our findings in Amanat Holdings PJSC's financial health report.

- Gain insights into Amanat Holdings PJSC's past trends and performance with our report on the company's historical track record.

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dubai Investments PJSC operates in property, investment, manufacturing, contracting, and services sectors both within the United Arab Emirates and internationally, with a market cap of AED9.10 billion.

Operations: The company's revenue is derived from three main segments: Property (AED2.21 billion), Manufacturing, Contracting and Services (AED1.24 billion), and Investments (AED330.77 million).

Market Cap: AED9.1B

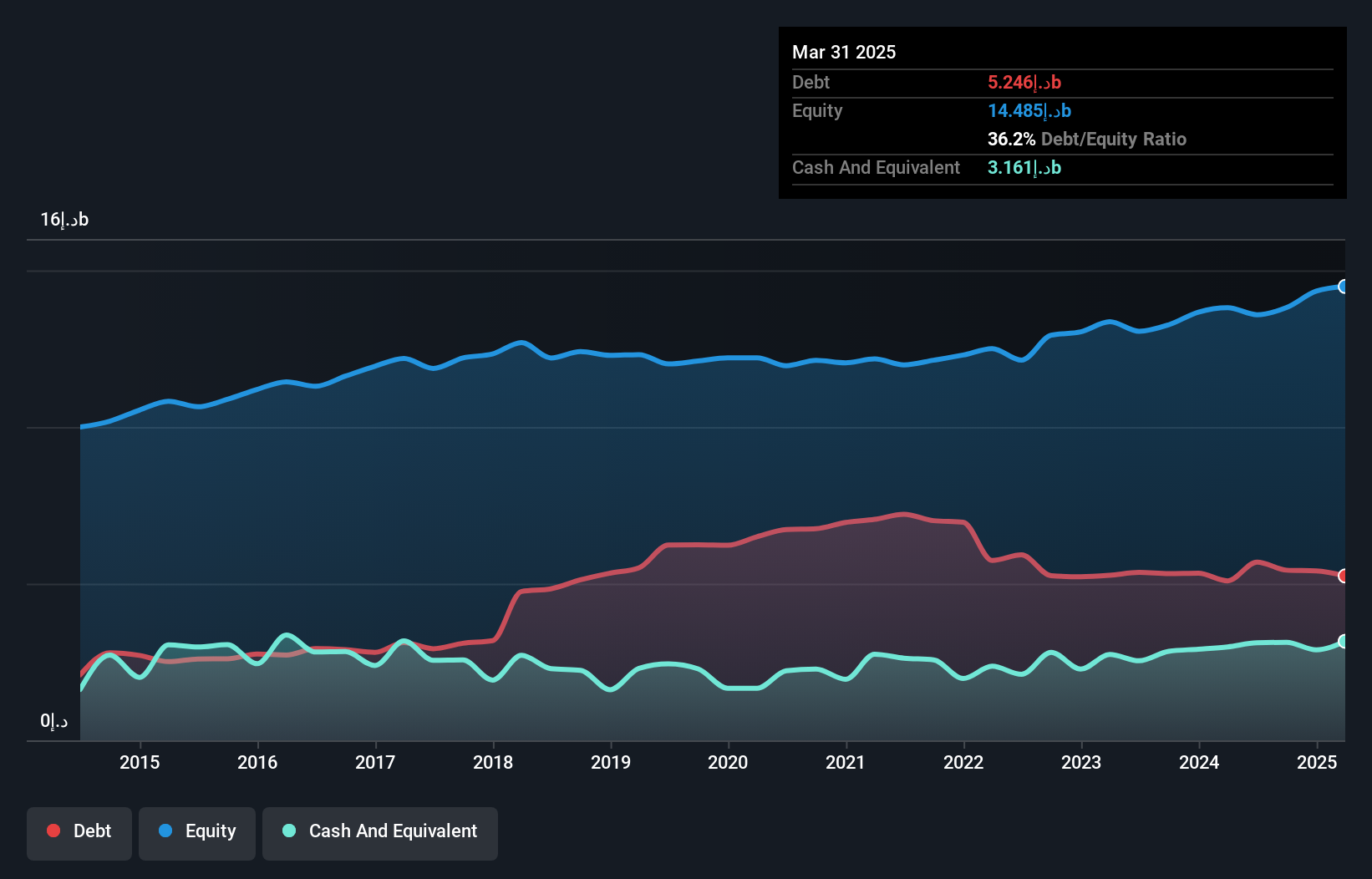

Dubai Investments PJSC, with a market cap of AED9.10 billion, operates across diverse sectors including property and manufacturing. Recent earnings showed a slight revenue decline to AED2.96 billion for the first nine months of 2024, though net income reached AED650.51 million due to large one-off gains impacting results. Despite stable weekly volatility and satisfactory debt levels, challenges include lower profit margins compared to last year and interest coverage below ideal levels at 2.8x EBIT. The seasoned management team has not diluted shareholders recently, but dividend stability remains uncertain amidst fluctuating profits and low return on equity at 6.7%.

- Click here to discover the nuances of Dubai Investments PJSC with our detailed analytical financial health report.

- Examine Dubai Investments PJSC's earnings growth report to understand how analysts expect it to perform.

Serko (NZSE:SKO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Serko Limited is a Software-as-a-Service company offering online travel booking and expense management solutions across New Zealand, Australia, North America, Europe, and internationally, with a market cap of NZ$463.08 million.

Operations: The company generates revenue primarily from the provision of software solutions, amounting to NZ$74.45 million.

Market Cap: NZ$463.08M

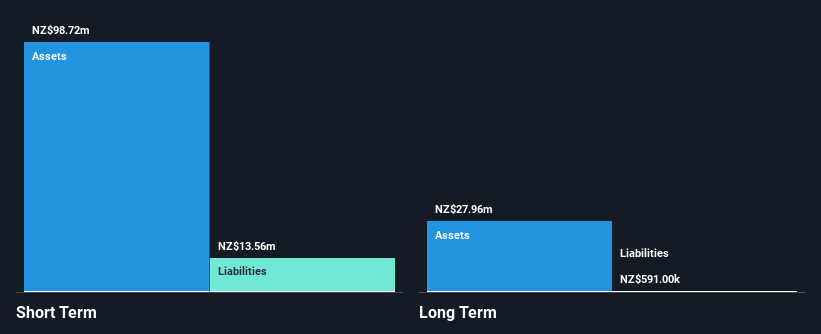

Serko Limited, with a market cap of NZ$463.08 million, is navigating the penny stock landscape amidst its unprofitability and negative return on equity of -12.28%. Despite this, it boasts a robust cash runway exceeding three years and no debt obligations. Recent developments include an expansion in travel booking capabilities through an integration with Amadeus, enhancing its Zeno platform's airline retailing features. While earnings guidance for 2025 anticipates income between NZ$85 million to NZ$92 million, recent half-year results showed revenue growth to NZ$42.72 million but continued net losses at NZ$5.11 million compared to the previous year’s figures.

- Unlock comprehensive insights into our analysis of Serko stock in this financial health report.

- Assess Serko's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Gain an insight into the universe of 5,841 Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DIC

Dubai Investments PJSC

Engages in property, investment, manufacturing, contracting, and services businesses in the United Arab Emirates and internationally.

Excellent balance sheet average dividend payer.