Is BBVA’s 101% Shareholder Return a Sign of Fair Value in 2025?

Reviewed by Bailey Pemberton

- Wondering if Banco Bilbao Vizcaya Argentaria’s impressive run means it's undervalued, fairly priced, or starting to look expensive? Let’s get right to the numbers and clear up the mystery behind the stock’s recent appeal.

- Shares have been climbing rapidly, with a 3.8% jump in the last week, 11.7% over the past month, and a massive 101.0% total return for shareholders in just the past year alone.

- Behind these moves are a wave of positive headlines, including successful expansion efforts in Europe and Latin America, as well as upbeat updates on digital banking growth. Investors have been quick to respond to news of regulatory stability and ongoing buyback programs, both of which have supported further confidence in the bank’s outlook.

- On our simple six-point valuation check, Banco Bilbao Vizcaya Argentaria scores a 4 out of 6. This means it passes most but not all undervaluation tests. Next, we will dig into the most popular valuation methods used by analysts, and stay tuned because we will reveal a smarter way to interpret these scores at the end.

Approach 1: Banco Bilbao Vizcaya Argentaria Excess Returns Analysis

The Excess Returns valuation model focuses on how efficiently a company uses its equity to generate returns above its cost of capital. This approach measures how much value Banco Bilbao Vizcaya Argentaria creates for shareholders beyond what could be achieved with a risk-free investment, taking into account the company’s ability to deliver sustainable returns over time.

For Banco Bilbao Vizcaya Argentaria, several key metrics stand out:

- Book Value: €10.02 per share

- Stable EPS: €2.06 per share (Source: Weighted future Return on Equity estimates from 15 analysts.)

- Cost of Equity: €1.06 per share

- Excess Return: €1.01 per share

- Average Return on Equity: 18.26%

- Stable Book Value: €11.30 per share (Source: Weighted future Book Value estimates from 8 analysts.)

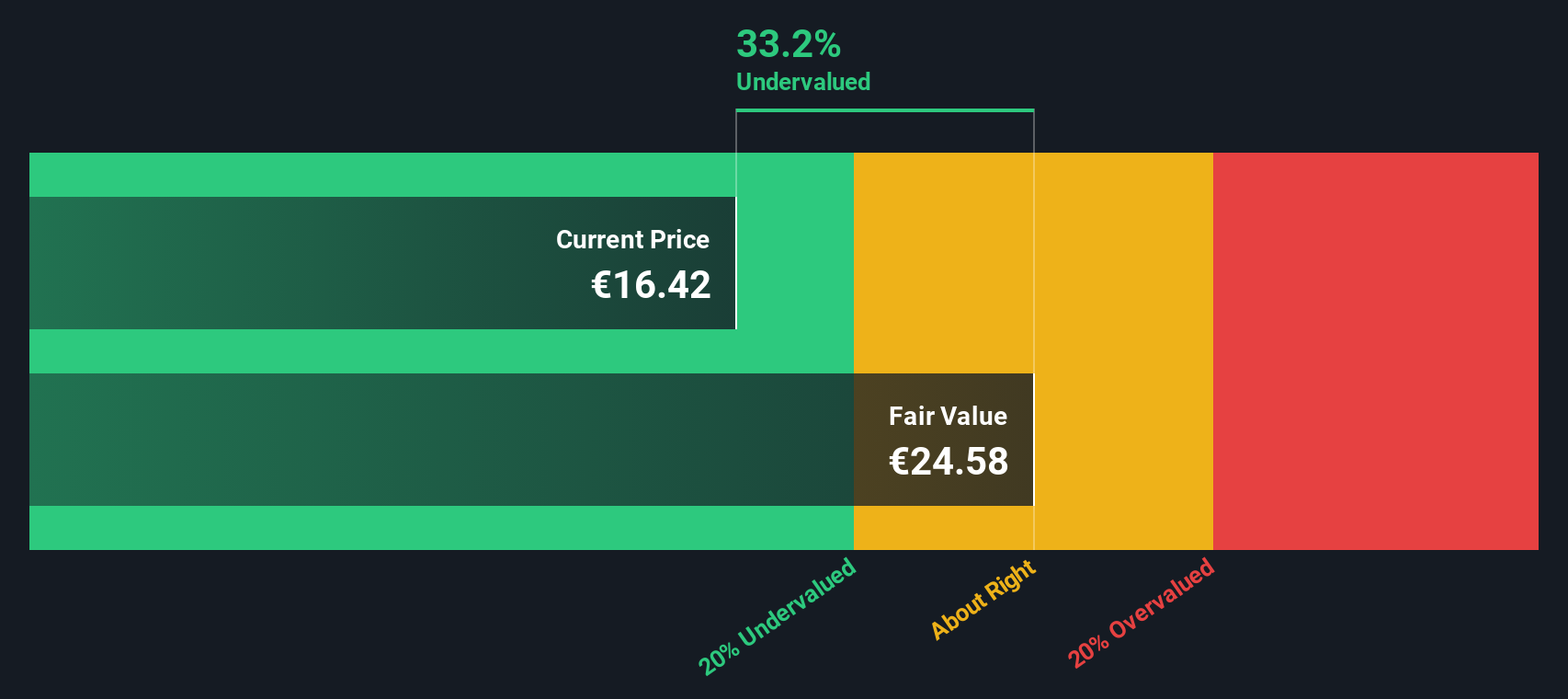

Using these inputs, the Excess Returns model estimates Banco Bilbao Vizcaya Argentaria’s fair value at €25.74 per share. With the current share price trading at a 30.3% discount to this intrinsic value, the shares appear significantly undervalued according to this framework. Investors may interpret this as a signal that the stock offers a margin of safety at current levels.

Result: UNDERVALUED

Our Excess Returns analysis suggests Banco Bilbao Vizcaya Argentaria is undervalued by 30.3%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

Approach 2: Banco Bilbao Vizcaya Argentaria Price vs Earnings

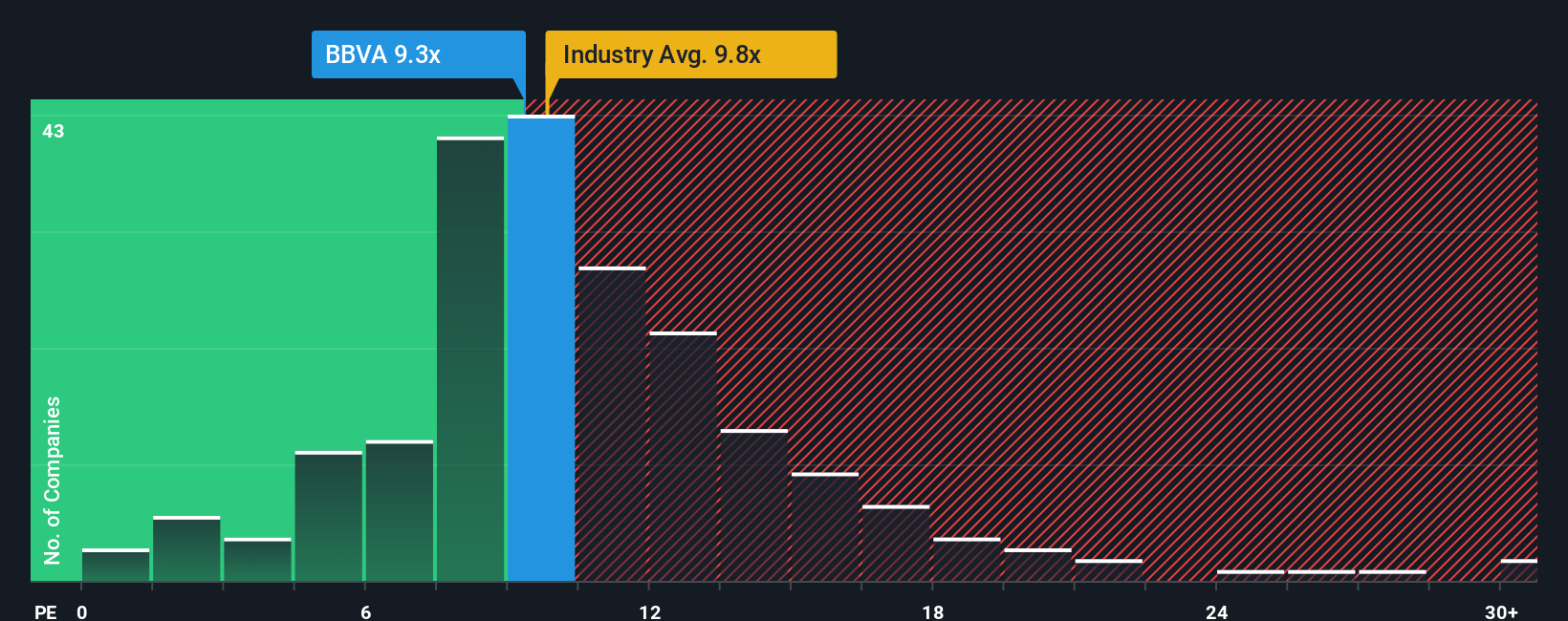

The price-to-earnings (PE) ratio is widely used to value established, profitable companies like Banco Bilbao Vizcaya Argentaria, as it helps investors gauge how much the market is willing to pay for each euro of the bank’s earnings. This metric is especially relevant for banks, where consistent profits and stable earnings streams are common.

The “right” PE ratio can vary depending on expectations for future growth and the level of risk in the business. Companies with higher expected earnings growth, or those viewed as lower risk, typically deserve a higher PE ratio. Lower growth or higher risk often leads to a lower multiple.

Banco Bilbao Vizcaya Argentaria’s current PE ratio is 10.3x, which sits just below its peer average of 10.6x and closely matches the European banking industry average of 10.2x. Simply Wall St’s proprietary Fair Ratio for the stock, which adjusts for factors like its earnings growth, risk profile, profit margins, industry context, and market cap, is 11.35x. This tailored benchmark goes beyond simple peer or industry comparisons and provides a more precise indication of what Banco Bilbao Vizcaya Argentaria’s multiple should be given its unique attributes.

Comparing the Fair Ratio of 11.35x to the current PE of 10.3x suggests that the stock is trading at a reasonable discount to its intrinsic value based on expected performance and sector outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Banco Bilbao Vizcaya Argentaria Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story behind the numbers; it connects your perspective on a company, like Banco Bilbao Vizcaya Argentaria, to a clear financial forecast and a personal estimate of fair value. Instead of relying solely on static models, Narratives empower you to map out what you think will happen with key drivers such as revenue, earnings, and margins, and see how your expectations translate into a fair value for the stock.

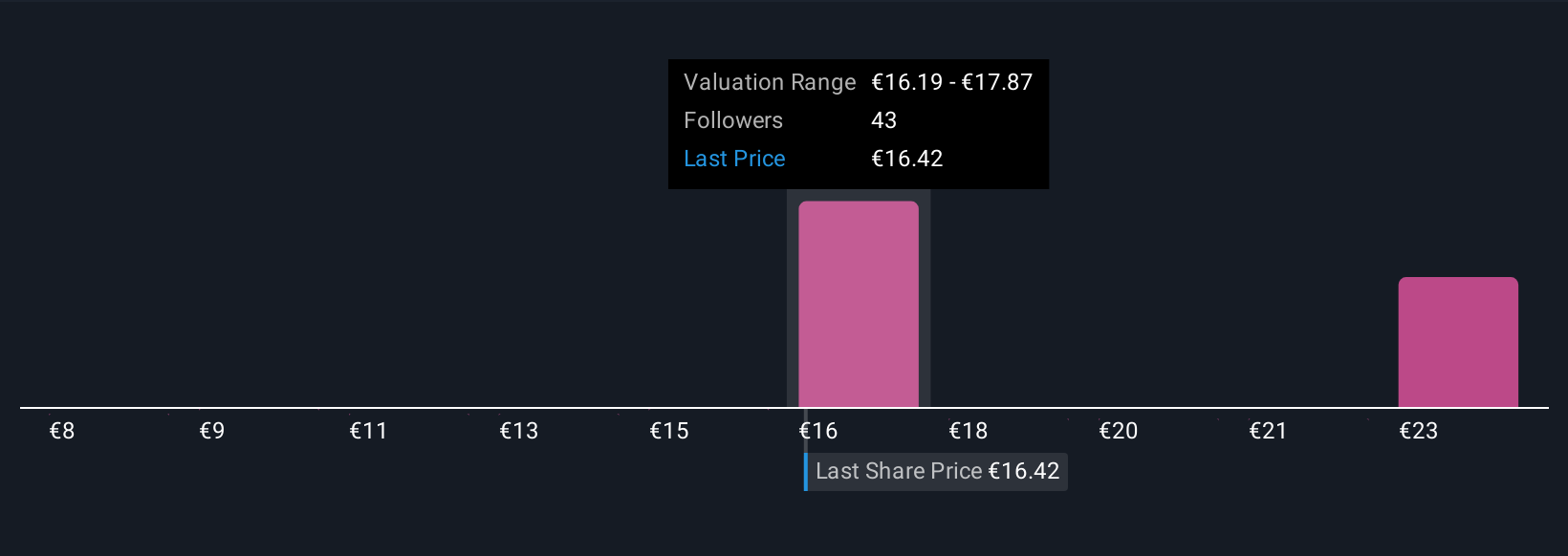

Available for free to everyone on Simply Wall St’s Community page, Narratives make investment decision-making accessible and dynamic. Narratives help you decide when to buy or sell by comparing your fair value to the current share price, and automatically update as new information emerges, whether it is news, financial results, or shifts in industry outlook. For Banco Bilbao Vizcaya Argentaria, some investors expect the stock is worth as much as €18.0, while the most conservative view puts its fair value at just €11.7, based on differing stories about future profit growth, risks, and economic environments.

Ultimately, Narratives transform static numbers into actionable insights, empowering you to invest with clarity and confidence as the company’s story evolves.

Do you think there's more to the story for Banco Bilbao Vizcaya Argentaria? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Bilbao Vizcaya Argentaria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BBVA

Banco Bilbao Vizcaya Argentaria

Provides retail banking, wholesale banking, and asset management services primarily in Spain, Mexico, Turkey, South America, rest of Europe, the United States, and Asia.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives