A Look at BBVA (BME:BBVA) Valuation Following Recent Surge in Shareholder Returns

Reviewed by Simply Wall St

Banco Bilbao Vizcaya Argentaria (BME:BBVA) shares have gained traction over the past month, drawing interest from investors monitoring European banks. The company’s recent performance offers insight into how financial institutions are navigating a changing economic landscape.

See our latest analysis for Banco Bilbao Vizcaya Argentaria.

BBVA’s share price has surged 89% year-to-date, with momentum accelerating as investors warm to the bank’s rising profitability and steady growth. Over the past year, the total shareholder return stands at a remarkable 91%, and long-term holders have enjoyed a huge 618% five-year total return.

If strong runs like BBVA’s make you wonder what else is on the move, it is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With such powerful returns and a surge in sentiment, the real question now is whether BBVA’s strong fundamentals leave room for further upside, or if the market is already capturing the bank’s future growth prospects in its valuation.

Most Popular Narrative: Fairly Valued

With Banco Bilbao Vizcaya Argentaria’s last close at €17.54, the most popular narrative puts its fair value just a fraction below, suggesting the market price now closely reflects analysts’ future expectations. This sets the stage for a deeper look into the main drivers shaping the consensus valuation.

BBVA is well-positioned to benefit from the continued expansion of the middle class and rising financial inclusion in high-growth emerging markets like Mexico and Turkey. These factors support sustained loan growth and fee-generating activity which can positively impact top-line revenue and long-term earnings potential. The bank's ongoing investment and leadership in digital transformation, including increased AI-driven productivity and cost-containment initiatives, should drive further cost efficiencies, improve customer acquisition, and enhance net margins over time.

What’s the secret behind this finely balanced valuation? The analysts’ fair value calculation relies on bold assumptions about revenue expansion, earnings momentum, and a strong profit margin outlook. This mix of high-stakes growth projections and careful financial modeling could surprise anyone expecting only modest gains. Ready to uncover the specific forces and numbers driving this consensus view?

Result: Fair Value of €17.45 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened volatility in emerging markets or sharper-than-expected interest rate declines in Spain and Mexico could quickly challenge the current outlook.

Find out about the key risks to this Banco Bilbao Vizcaya Argentaria narrative.

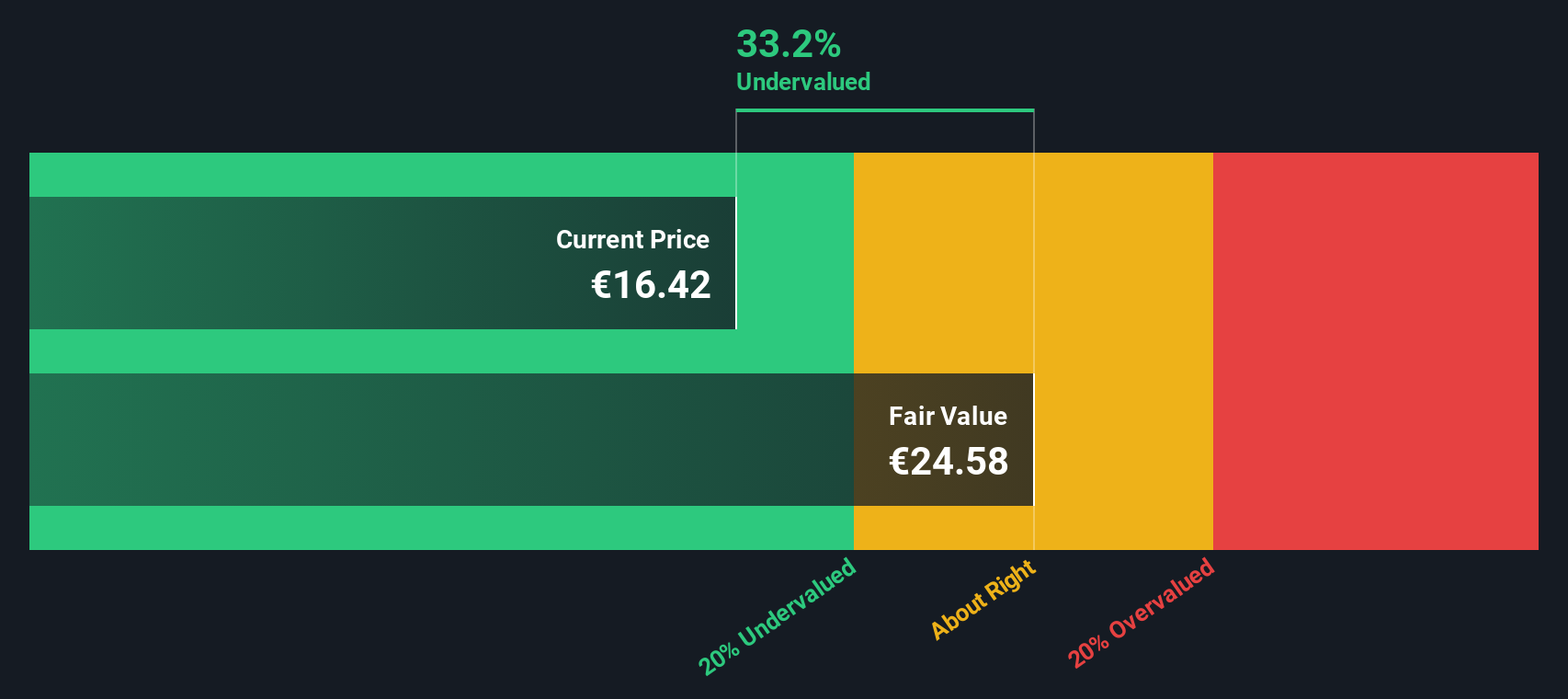

Another View: Discounted Cash Flow Model

Looking at BBVA through the lens of our DCF model adds a different perspective. The SWS DCF estimate puts fair value at €25.77, so the current price trades well below this level. This suggests the market might be missing some long-run potential. Which outlook should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Banco Bilbao Vizcaya Argentaria for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Banco Bilbao Vizcaya Argentaria Narrative

If you see the numbers differently or are curious to shape your own story, dive into the data, draw your own conclusions, and Do it your way.

A great starting point for your Banco Bilbao Vizcaya Argentaria research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors constantly scan the horizon for their next big opportunity. Open up a broader world of stock ideas that match your goals by checking out these unique strategies below. There are plenty of exciting picks you won't want to miss.

- Tap into the future of healthcare by backing innovators transforming patient outcomes with AI and advanced diagnostics via these 33 healthcare AI stocks.

- Catch high-yield opportunities by reviewing these 20 dividend stocks with yields > 3% that consistently reward shareholders with solid returns above 3%.

- Step into the world of blockchain and digital assets with these 82 cryptocurrency and blockchain stocks. These game changers are redefining what’s possible in finance and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Bilbao Vizcaya Argentaria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BBVA

Banco Bilbao Vizcaya Argentaria

Provides retail banking, wholesale banking, and asset management services primarily in Spain, Mexico, Turkey, South America, rest of Europe, the United States, and Asia.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives