- Spain

- /

- Auto Components

- /

- BME:GEST

If You Had Bought Gestamp Automoción's (BME:GEST) Shares Three Years Ago You Would Be Down 37%

It is doubtless a positive to see that the Gestamp Automoción, S.A. (BME:GEST) share price has gained some 43% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 37% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Check out our latest analysis for Gestamp Automoción

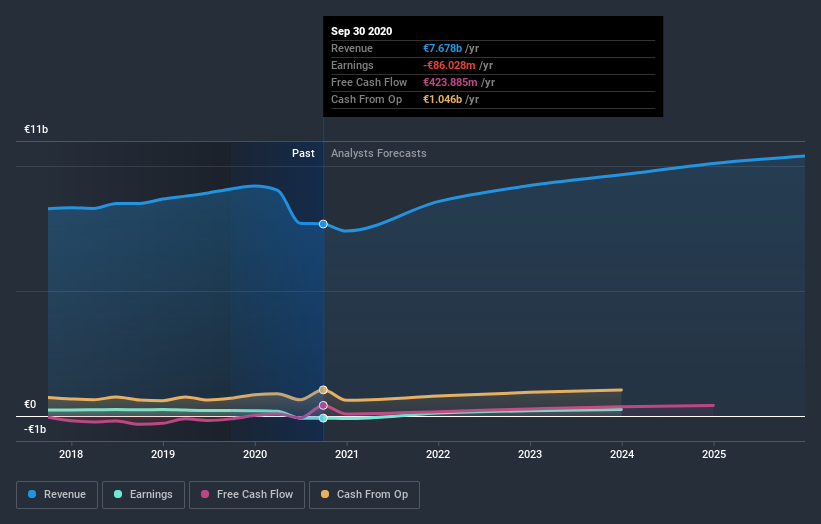

Gestamp Automoción isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, Gestamp Automoción's revenue dropped 0.09% per year. That is not a good result. The annual decline of 11% per year in that period has clearly disappointed holders. That makes sense given the lack of either profits or revenue growth. Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Gestamp Automoción is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Gestamp Automoción stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Gestamp Automoción the TSR over the last 3 years was -34%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Gestamp Automoción shareholders have gained 5.4% (in total) over the last year. That's including the dividend. What is absolutely clear is that is far preferable to the dismal 10% average annual loss suffered over the last three years. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. It's always interesting to track share price performance over the longer term. But to understand Gestamp Automoción better, we need to consider many other factors. For instance, we've identified 3 warning signs for Gestamp Automoción (1 is significant) that you should be aware of.

But note: Gestamp Automoción may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

When trading Gestamp Automoción or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:GEST

Gestamp Automoción

Designs, develops, manufactures, and sells metal automotive components in Western Europe, Eastern Europe, Mercosur, North America, and Asia.

Undervalued slight.