- Spain

- /

- Auto Components

- /

- BME:CIE

CIE Automotive (BME:CIE) Margin Improvement Reinforces Bullish Narratives Despite Slower Revenue Growth

Reviewed by Simply Wall St

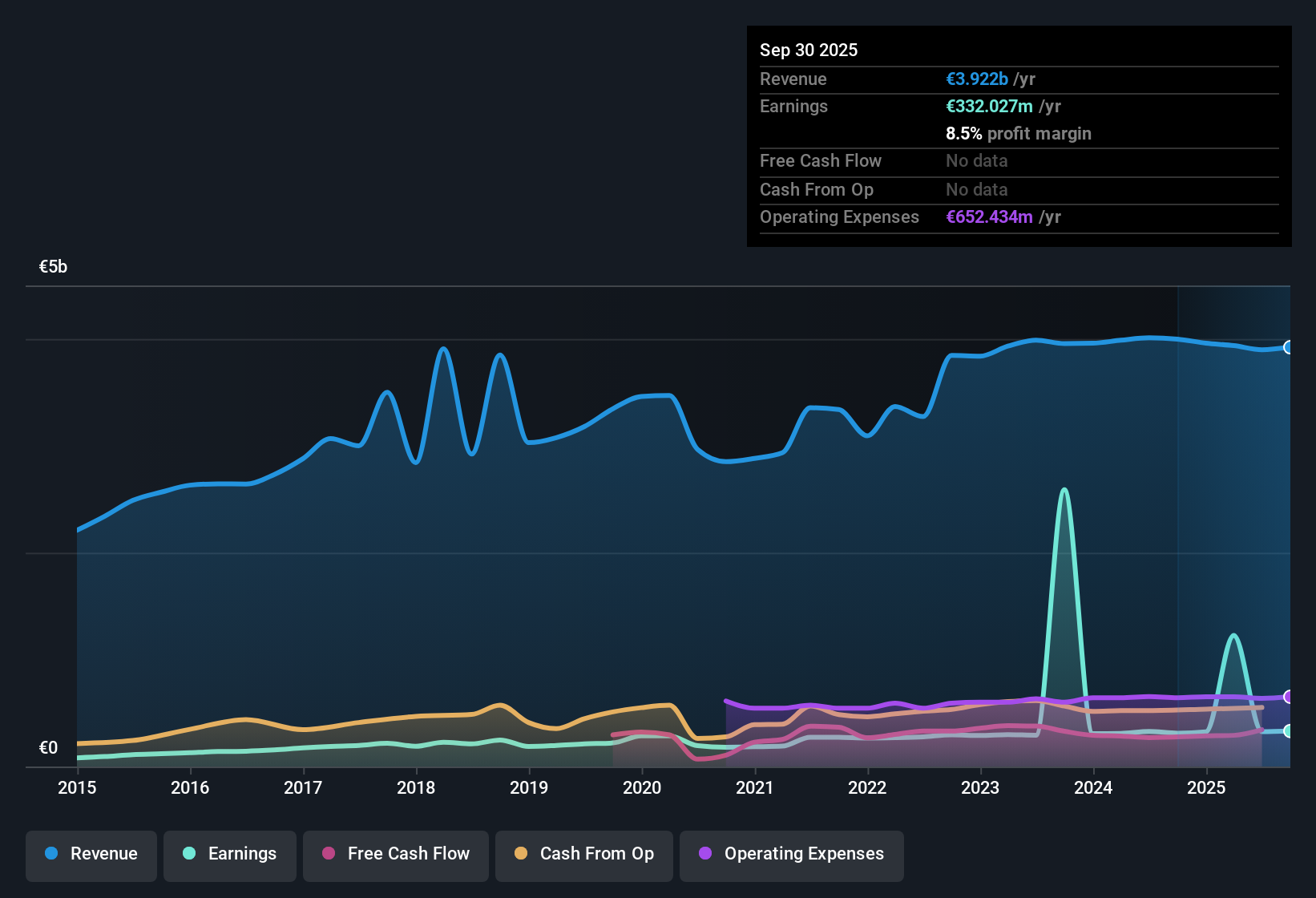

CIE Automotive (BME:CIE) reported earnings growth of 24.4% per year over the past five years, with current net profit margins at 8.4%, up from last year's 8.2%. The company’s earnings are projected to grow by 6.6% per year, outpacing the local market’s 5.1%. Its Price-To-Earnings Ratio at 10.9x stands below both the industry average of 12.7x and its peer group’s 32.3x. For investors, the solid jump in profit margins and ongoing growth prospects set the stage for positive sentiment, even if revenue expansion is comparatively slower.

See our full analysis for CIE Automotive.Next, we will look at how these earnings figures measure up against the main narratives the market follows. This will highlight where the data supports or challenges investor expectations.

See what the community is saying about CIE Automotive

Utilization Rates Signal Resilience in Brazil and India

- Brazil operations run near 90%+ capacity utilization and India at approximately 80%, allowing CIE to capture emerging market demand as global automotive components markets expand.

- According to analysts' consensus view, diversified presence in these growth regions underpins CIE's revenue growth and buffers against regional volatility.

- This broad footprint supports long-term contracts and revenue stability, even if traditional markets like Europe grow more slowly.

- Operational efficiency in high-utilization facilities helps sustain recurring EBITDA margins above 19% across key geographies.

See what the community is saying about CIE Automotive

📊 Read the full CIE Automotive Consensus Narrative.

DCF Fair Value Shows Deep Discount

- With the current share price at €29.70 and a DCF fair value of €41.13, CIE trades at a substantial discount of about 31%, offering notable upside versus its fundamental valuation.

- Per the analysts' consensus view, this discount is reinforced by a price-to-earnings ratio of 10.9x, which is not only well below its peer average of 32.3x but also lower than the European auto components sector at 12.7x.

- These valuation multiples suggest that the market is cautious about CIE’s slower revenue growth. However, the current trading level appears undemanding based on profit trends and margin durability.

- Consensus narrative also points to the analyst price target of €32.25, only 9% higher than today, showing a tighter consensus on upside than the DCF value may suggest.

Minor Financial Risks, Strong Cash Flow Buffer

- Major risks are not identified, but there are minor concerns flagged over CIE’s overall financial position and dividend sustainability, with net debt/EBITDA at a historic low of 1.2x, supporting capacity for growth investments.

- Per the analysts' consensus view, ongoing strong cash flow and a solid balance sheet allow the company to weather industry fluctuations and support strategic M&A, offsetting flagged issues around dividend steadiness and sector-specific competition.

- Robust cash reserves and a commitment to cost discipline have allowed sustained margin improvement and supported continued profit growth, even if near-term revenue trend lags the wider Spanish market.

- The consensus narrative underscores CIE’s ability to maintain stable earnings and liquidity, positioning it well for future market opportunities and risk management.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CIE Automotive on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh take on these results? Put your viewpoint in the spotlight and shape your own narrative in just a few minutes. Do it your way.

A great starting point for your CIE Automotive research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While CIE Automotive’s profit margins are strong, its comparatively slow revenue growth and minor concerns about dividend sustainability may temper long-term returns.

If you want to find companies delivering more dependable and growing dividends, check out these 1979 dividend stocks with yields > 3% for opportunities offering stronger income potential and payout reliability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CIE

CIE Automotive

Designs, manufactures, and sells automotive components and sub-assemblies.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives