- Denmark

- /

- Transportation

- /

- CPSE:NTG

Subdued Growth No Barrier To NTG Nordic Transport Group A/S' (CPH:NTG) Price

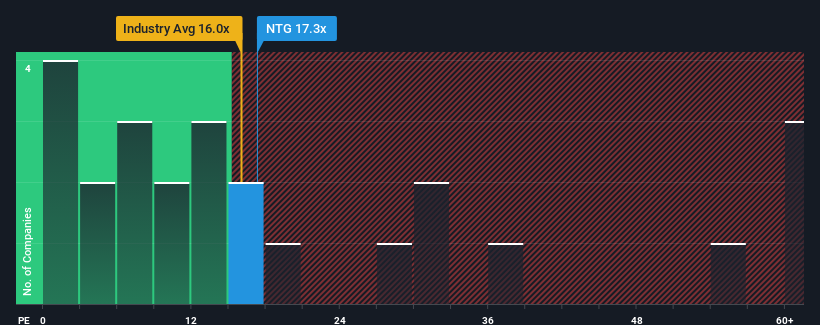

With a price-to-earnings (or "P/E") ratio of 17.3x NTG Nordic Transport Group A/S (CPH:NTG) may be sending bearish signals at the moment, given that almost half of all companies in Denmark have P/E ratios under 12x and even P/E's lower than 7x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, NTG Nordic Transport Group's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for NTG Nordic Transport Group

Does Growth Match The High P/E?

In order to justify its P/E ratio, NTG Nordic Transport Group would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's bottom line. Even so, admirably EPS has lifted 1,025% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 2.5% as estimated by the five analysts watching the company. With the market predicted to deliver 19% growth , the company is positioned for a weaker earnings result.

In light of this, it's alarming that NTG Nordic Transport Group's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

What We Can Learn From NTG Nordic Transport Group's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that NTG Nordic Transport Group currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for NTG Nordic Transport Group with six simple checks on some of these key factors.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if NTG Nordic Transport Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:NTG

NTG Nordic Transport Group

Provides asset-light freight forwarding services through road, rail, air, and ocean in Denmark, Sweden, the United States, Germany, Finland, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026