As European markets navigate the complexities of U.S. trade policy uncertainties and economic adjustments, the pan-European STOXX Europe 600 Index recently snapped a ten-week streak of gains. Despite these challenges, increased spending plans in defense and infrastructure by Germany and the EU offer potential stabilizing effects for investors looking at dividend stocks. In such an environment, solid dividend stocks can provide a measure of stability through consistent income streams, making them attractive for those seeking to balance risk with reliable returns in uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.31% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.14% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.90% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 5.00% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.70% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.17% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.35% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.32% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.85% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.52% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

A.P. Møller - Mærsk (CPSE:MAERSK B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: A.P. Møller - Mærsk A/S operates as an integrated logistics company in Denmark and internationally, with a market cap of DKK205.05 billion.

Operations: A.P. Møller - Mærsk A/S generates its revenue from several key segments: Ocean ($37.39 billion), Terminals ($4.47 billion), and Logistics & Services ($14.92 billion).

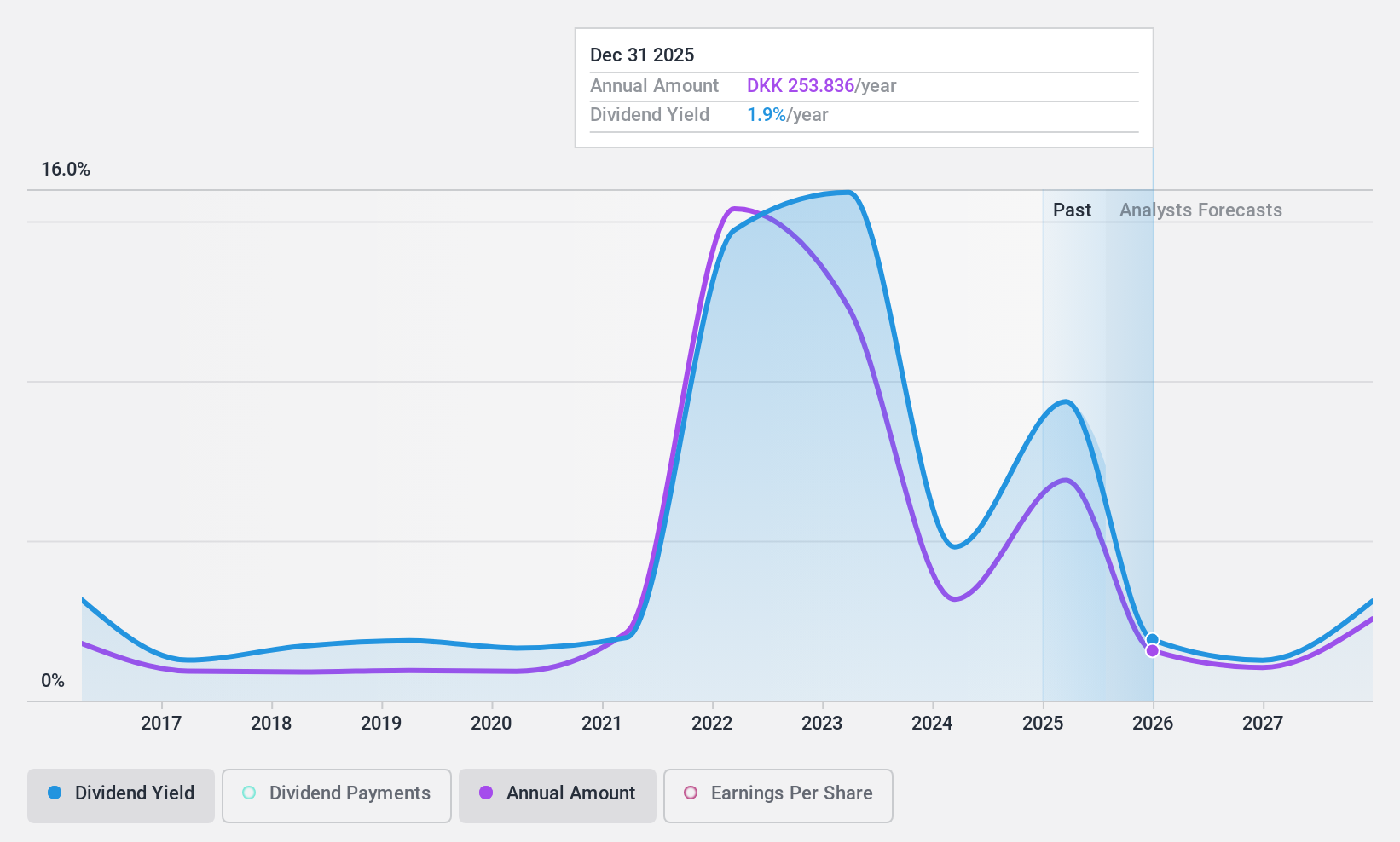

Dividend Yield: 8%

A.P. Møller - Mærsk offers a compelling dividend profile with a payout ratio of 40.1%, indicating dividends are well covered by earnings and cash flows (33.5%). Despite past volatility, its dividend yield is among the top 25% in Denmark, supported by recent earnings growth and strategic initiatives like the partnership with Inmarsat for enhanced fleet connectivity. However, future earnings are forecasted to decline significantly, which could impact long-term dividend sustainability.

- Get an in-depth perspective on A.P. Møller - Mærsk's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that A.P. Møller - Mærsk is priced lower than what may be justified by its financials.

Infotel (ENXTPA:INF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Infotel SA is a company that designs, develops, markets, and maintains software solutions focused on security, performance, and management on a global scale with a market cap of €275.77 million.

Operations: Infotel SA generates revenue primarily from its Services segment, which accounts for €286.69 million, and its Software segment, contributing €11.53 million.

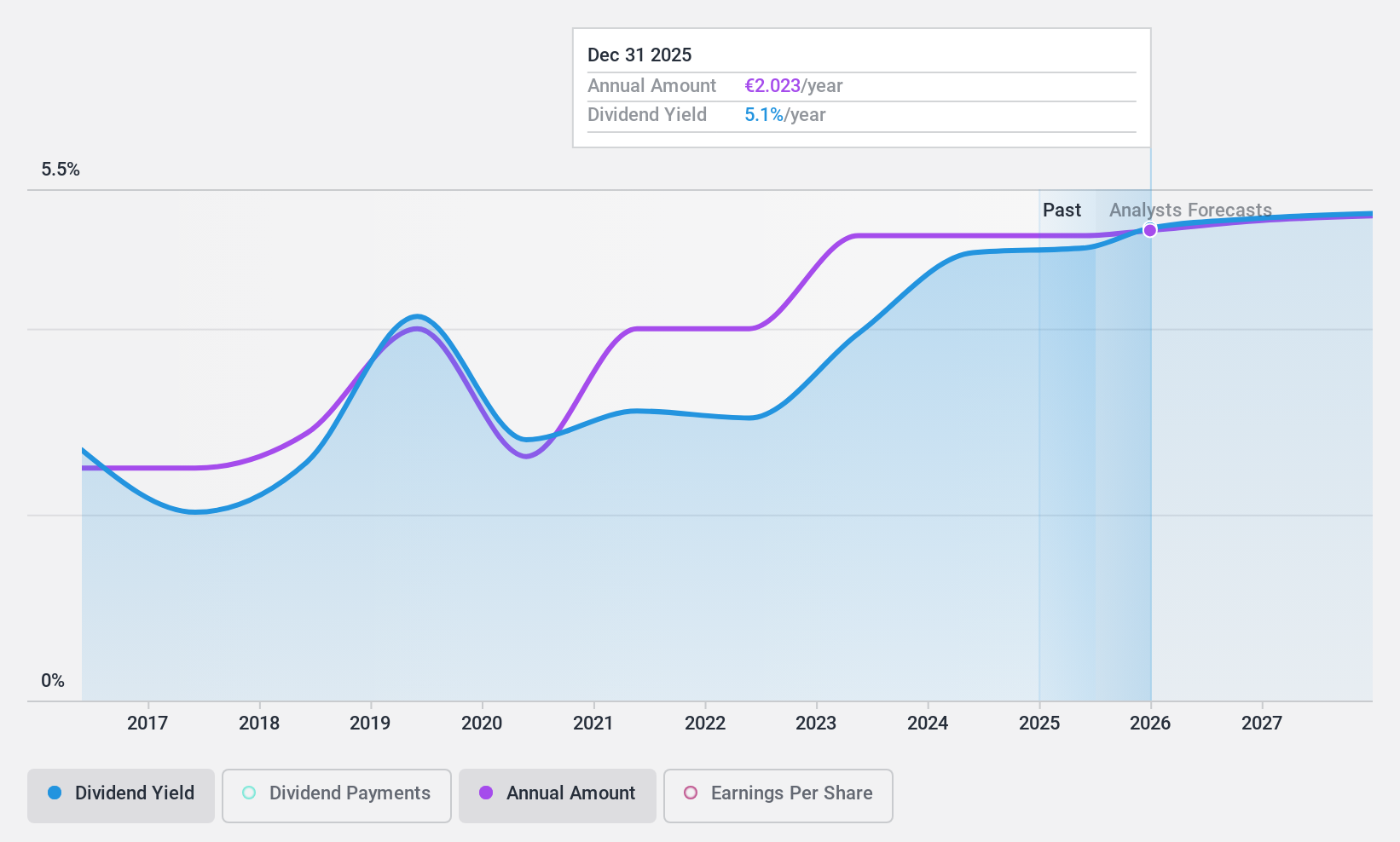

Dividend Yield: 5.1%

Infotel's dividend payments are supported by an 83.3% payout ratio, indicating coverage by earnings, and a cash payout ratio of 40.9%, suggesting strong cash flow backing. Despite a history of volatility and unreliability in dividend stability over the past decade, recent increases have been noted. The company trades at good value compared to peers but offers a lower yield than top French market payers. A recent share buyback program may influence future shareholder returns positively.

- Navigate through the intricacies of Infotel with our comprehensive dividend report here.

- According our valuation report, there's an indication that Infotel's share price might be on the cheaper side.

Sodexo (ENXTPA:SW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sodexo S.A. is a global provider of food services and facilities management, with a market cap of €11.30 billion.

Operations: Sodexo S.A.'s revenue is primarily derived from its operations in North America (€11.11 billion), Europe (€8.45 billion), and the Rest of the World (€4.24 billion).

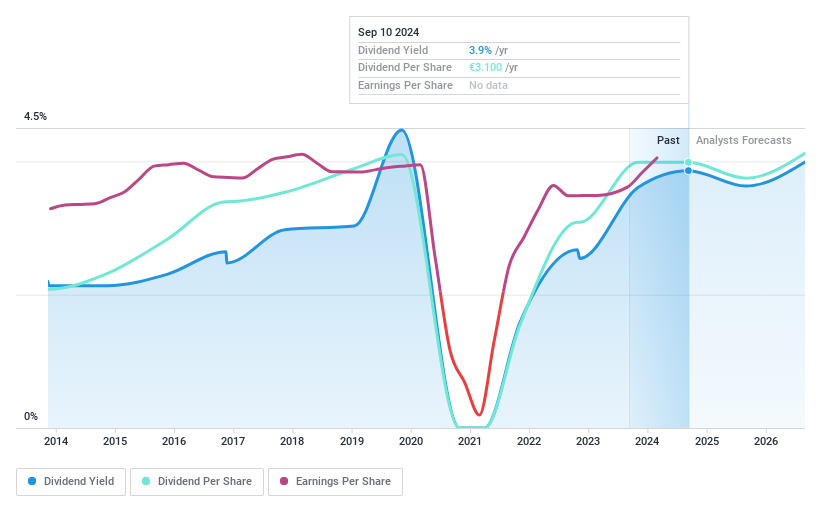

Dividend Yield: 3.4%

Sodexo's dividend yield is lower than the top French market payers, with a payout ratio of 52.6% indicating coverage by earnings and a cash payout ratio of 40.3%, suggesting solid cash flow support. Despite historical volatility in dividends, recent growth has been observed. The company's financial position shows high debt levels, but it trades at good value relative to peers. Recent leadership changes could enhance operational efficiency and strategic focus in key sectors like higher education and government services.

- Click to explore a detailed breakdown of our findings in Sodexo's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Sodexo shares in the market.

Next Steps

- Investigate our full lineup of 229 Top European Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:INF

Infotel

Designs, develops, markets, and maintains software solutions in the areas of security, performance, and management worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives