- Denmark

- /

- Marine and Shipping

- /

- CPSE:MAERSK B

Maersk (CPSE:MAERSK B) Valuation Check After a Year of Solid Share Price Gains

Reviewed by Simply Wall St

A.P. Møller - Mærsk (CPSE:MAERSK B) has quietly outperformed over the past year, with the stock up around 16%. That is a solid move for a shipping heavyweight facing softer revenue and earnings.

See our latest analysis for A.P. Møller - Mærsk.

That steady climb reflects shifting sentiment more than booming fundamentals, with a resilient year to date share price return and a strong multi year total shareholder return suggesting that momentum is cautiously rebuilding as investors reassess long term cash generation.

If Maersk’s recent gains have you thinking about what else could rerate, this is a good moment to explore fast growing stocks with high insider ownership.

Yet with earnings under pressure and the share price still ahead of analyst targets, investors face a key question: is Maersk quietly undervalued after years of compounding returns, or is the market already pricing in the next growth cycle?

Most Popular Narrative: 10.2% Overvalued

With the most followed narrative putting fair value below the current DKK13,220 share price, the gap hinges on how sustainable Maersk’s margins really are.

The ongoing decline in average freight rates due to industry overcapacity, combined with intensifying digitalization and the rise of asset light competing platforms, poses a structural challenge to Maersk's pricing power and long term revenue growth; if investors are discounting these headwinds, forecasts for sustained high profitability or outsized long term earnings may be too optimistic.

Want to know which margin assumptions must hold up to defend this richer valuation, and how falling revenues still underpin ambitious earnings targets? The narrative spells out the exact profitability path and future multiple the market would need to embrace. Curious how those moving parts combine into one punchy fair value call? Read on to see the numbers behind the story.

Result: Fair Value of $11,991.74 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating efficiency gains from the Gemini network and stronger terminal pricing power could support higher margins than analysts currently bake into their models.

Find out about the key risks to this A.P. Møller - Mærsk narrative.

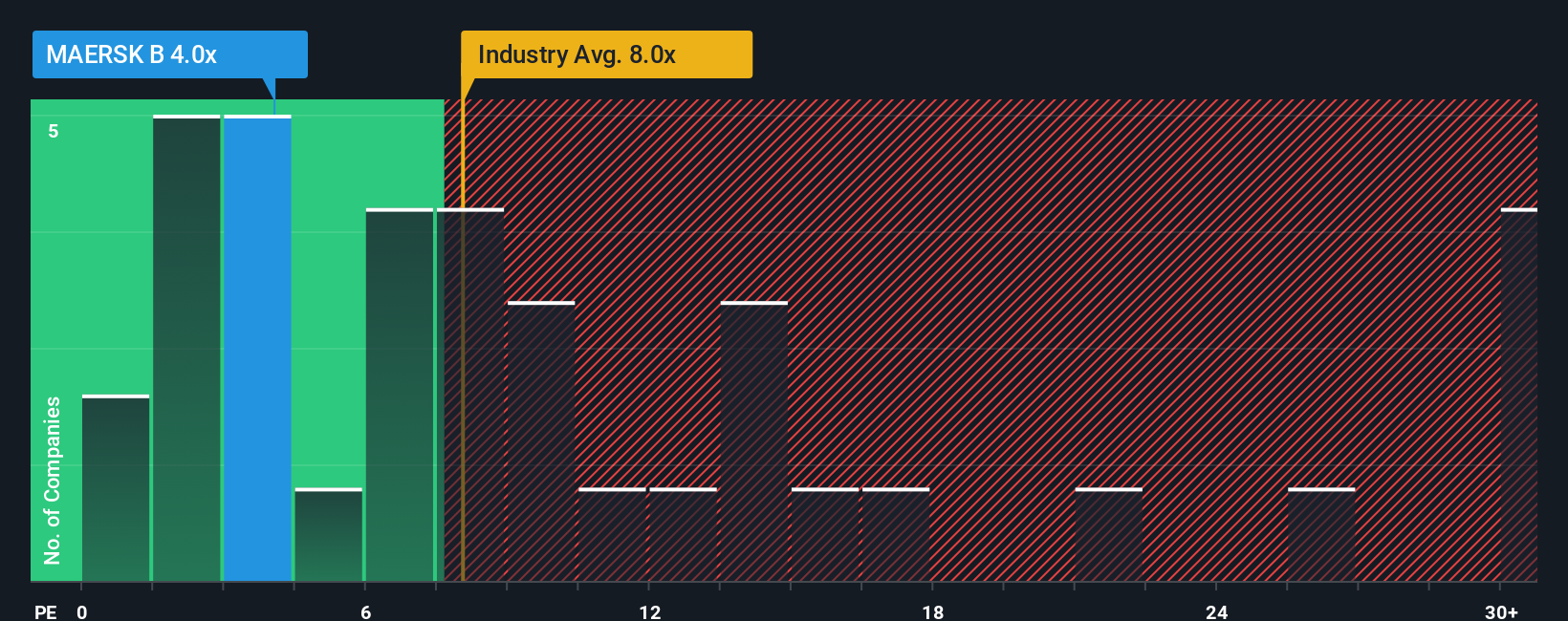

Another Angle on Valuation

While the narrative suggests Maersk is about 10% overvalued, its 6.2x price to earnings ratio tells a different story. That is far below the 17.7x peer average and 9.1x for European shippers, even if above its 3.2x fair ratio. This leaves investors to weigh the value gap versus the downside risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own A.P. Møller - Mærsk Narrative

If you are not fully convinced by this view, or would rather dive into the numbers yourself, you can build a fresh narrative in just a few minutes: Do it your way.

A great starting point for your A.P. Møller - Mærsk research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Smart investors never stop hunting for the next edge, so use the Simply Wall St Screener now to uncover high conviction ideas before the crowd catches on.

- Target reliable income streams by scanning these 15 dividend stocks with yields > 3% and lock onto companies rewarding shareholders with robust, above average payouts.

- Ride the next wave of innovation by focusing on these 26 AI penny stocks. These stocks are reshaping industries with real world artificial intelligence solutions.

- Strengthen your portfolio’s value core by filtering for these 909 undervalued stocks based on cash flows. Then shortlist businesses trading below their estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:MAERSK B

A.P. Møller - Mærsk

Operates as an integrated logistics company in Denmark and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026