The Santa Fe Group (CPH:SFG) Share Price Is Down 94% So Some Shareholders Are Rather Upset

It's not possible to invest over long periods without making some bad investments. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of Santa Fe Group A/S (CPH:SFG); the share price is down a whopping 94% in the last three years. That would certainly shake our confidence in the decision to own the stock. The more recent news is of little comfort, with the share price down 83% in a year. Shareholders have had an even rougher run lately, with the share price down 35% in the last 90 days.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Santa Fe Group

Santa Fe Group isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

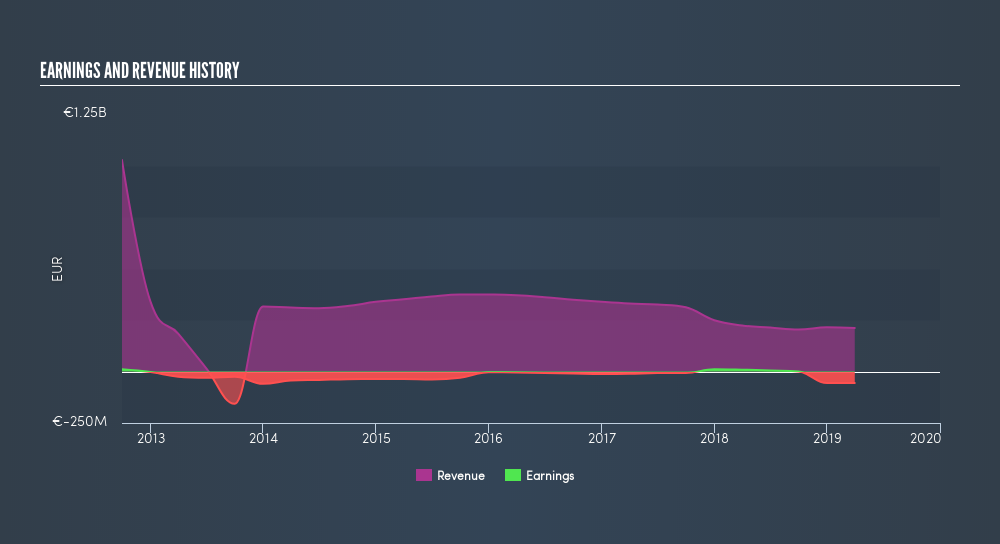

In the last three years Santa Fe Group saw its revenue shrink by 23% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 61%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

If you are thinking of buying or selling Santa Fe Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 2.2% in the last year, Santa Fe Group shareholders lost 83%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 41% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About CPSE:OKEAC

Flawless balance sheet with low risk.

Market Insights

Community Narratives