- Denmark

- /

- Marine and Shipping

- /

- CPSE:DFDS

Take Care Before Diving Into The Deep End On DFDS A/S (CPH:DFDS)

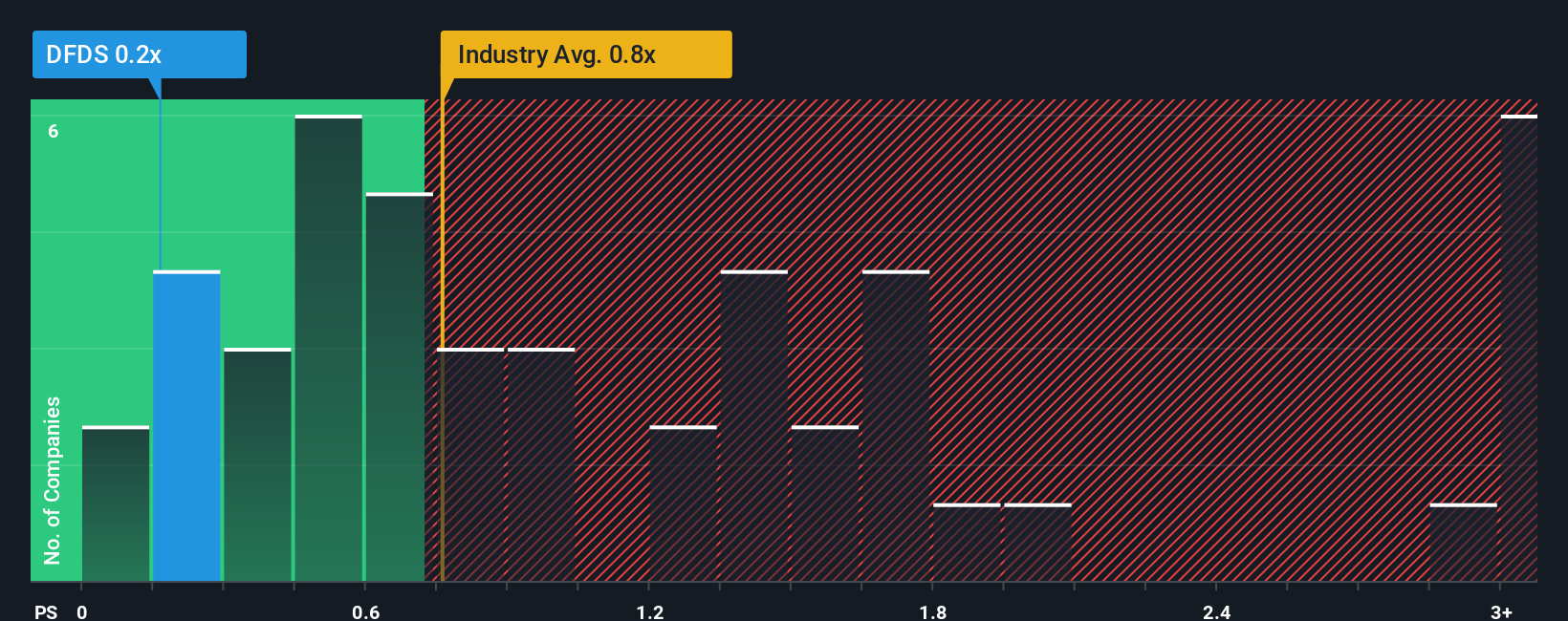

DFDS A/S' (CPH:DFDS) price-to-sales (or "P/S") ratio of 0.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Shipping industry in Denmark have P/S ratios greater than 0.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for DFDS

How Has DFDS Performed Recently?

DFDS could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on DFDS.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, DFDS would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.6%. Pleasingly, revenue has also lifted 31% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth will show minor resilience over the next three years growing only by 3.8% per annum. Meanwhile, the broader industry is forecast to contract by 1.7% per annum, which would indicate the company is doing better than the majority of its peers.

In light of this, it's quite peculiar that DFDS' P/S sits below the majority of other companies. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

What We Can Learn From DFDS' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of DFDS' analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

Plus, you should also learn about these 2 warning signs we've spotted with DFDS (including 1 which can't be ignored).

If these risks are making you reconsider your opinion on DFDS, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:DFDS

DFDS

Provides logistics solutions and services in Denmark and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026