- Denmark

- /

- Consumer Services

- /

- CPSE:SHAPE

Will Shape Robotics (CPH:SHAPE) Spend Its Cash Wisely?

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Shape Robotics (CPH:SHAPE) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Shape Robotics

When Might Shape Robotics Run Out Of Money?

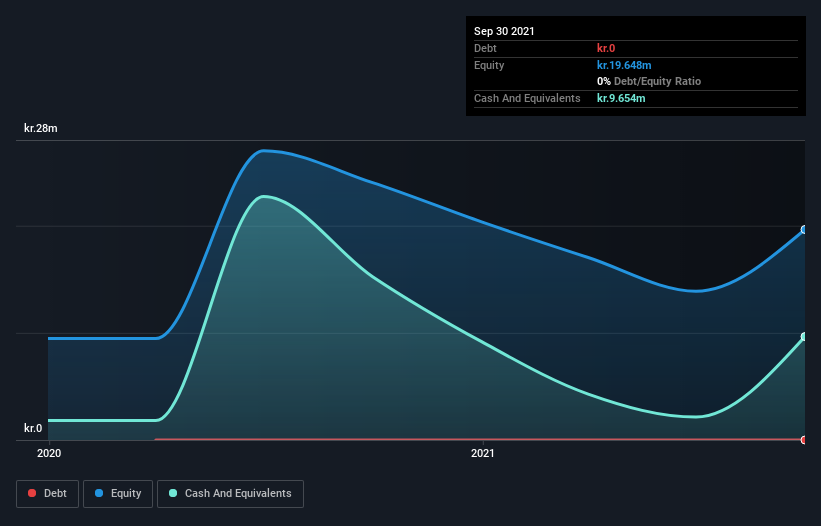

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In September 2021, Shape Robotics had kr.9.7m in cash, and was debt-free. Importantly, its cash burn was kr.16m over the trailing twelve months. That means it had a cash runway of around 7 months as of September 2021. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. Depicted below, you can see how its cash holdings have changed over time.

How Is Shape Robotics' Cash Burn Changing Over Time?

In our view, Shape Robotics doesn't yet produce significant amounts of operating revenue, since it reported just kr.6.5m in the last twelve months. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. Over the last year its cash burn actually increased by 8.2%, which suggests that management are increasing investment in future growth, but not too quickly. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. Admittedly, we're a bit cautious of Shape Robotics due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Easily Can Shape Robotics Raise Cash?

Since its cash burn is increasing (albeit only slightly), Shape Robotics shareholders should still be mindful of the possibility it will require more cash in the future. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of kr.156m, Shape Robotics' kr.16m in cash burn equates to about 11% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is Shape Robotics' Cash Burn A Worry?

On this analysis of Shape Robotics' cash burn, we think its cash burn relative to its market cap was reassuring, while its cash runway has us a bit worried. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. Taking a deeper dive, we've spotted 6 warning signs for Shape Robotics you should be aware of, and 3 of them are potentially serious.

Of course Shape Robotics may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:SHAPE

Shape Robotics

An educational technology company, engages in the provision of intelligent classroom solutions, educational robots, software, and specific services primarily to educational institutions.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Kyocera: The Hidden AI Enabler

Santos: Undervalued After Takeover Fallout

Realty Income - A Fundamental and Historical Valuation

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks