As the pan-European STOXX Europe 600 Index marks its longest streak of weekly gains since August 2012, driven by strong company results and defense stock performance, the European market remains a focal point for investors amid global uncertainties such as U.S. trade policies and mixed inflation data across major economies like Germany and France. In this environment, identifying high-growth tech stocks requires a keen understanding of their potential to navigate economic challenges while capitalizing on technological advancements and market trends that may drive future growth opportunities.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Pharma Mar | 23.58% | 40.13% | ★★★★★★ |

| Bonesupport Holding | 30.50% | 48.59% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Yubico | 21.27% | 26.82% | ★★★★★★ |

| Truecaller | 20.03% | 24.78% | ★★★★★★ |

| Xbrane Biopharma | 73.73% | 139.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

| Elliptic Laboratories | 49.89% | 89.90% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

cBrain (CPSE:CBRAIN)

Simply Wall St Growth Rating: ★★★★★★

Overview: cBrain A/S is a software company that offers solutions for government, private, education, and non-profit sectors both in Denmark and internationally, with a market cap of DKK2.71 billion.

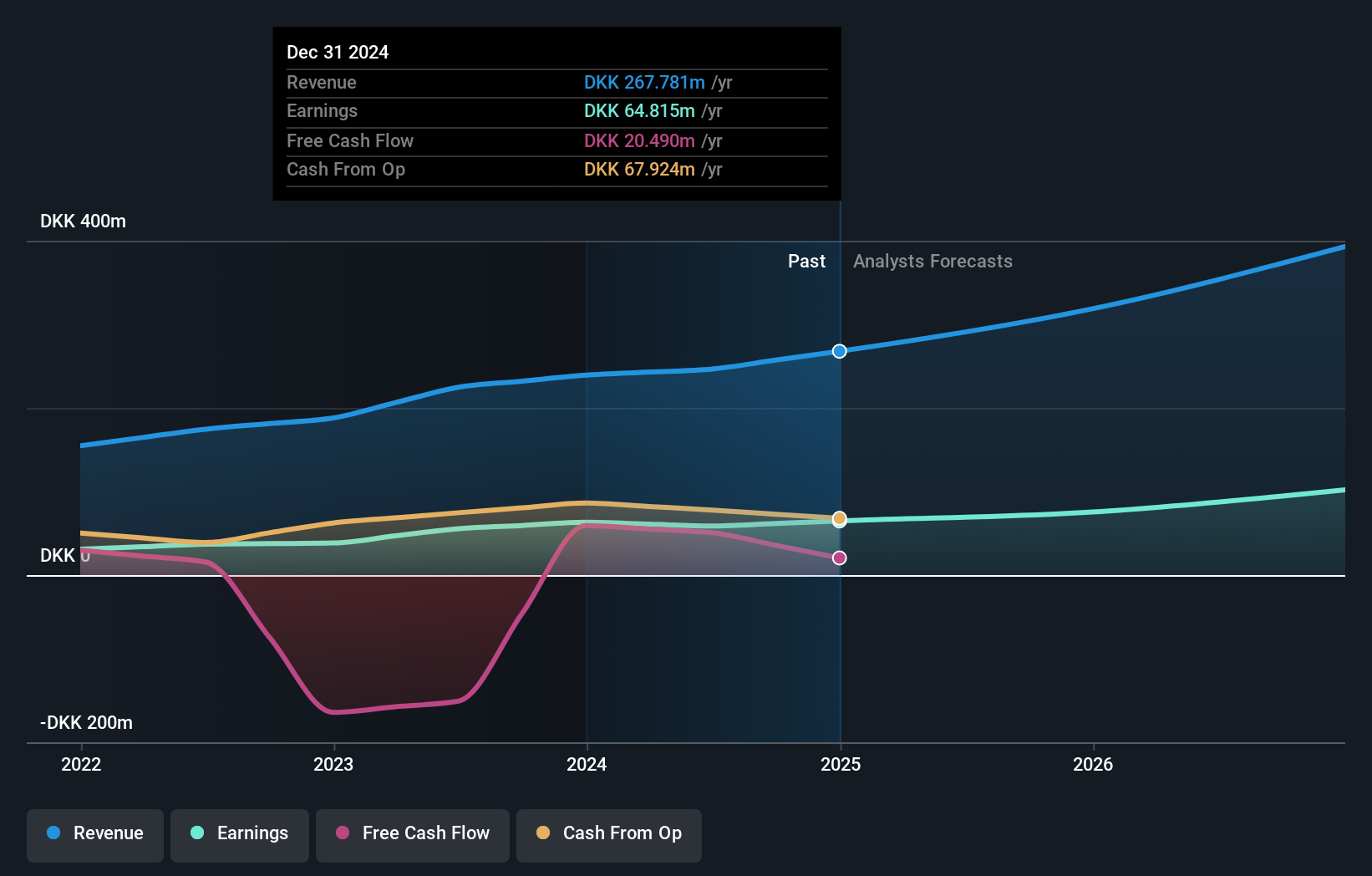

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to DKK267.78 million.

cBrain, a Danish software company, is demonstrating robust growth with earnings expected to surge by 35.3% annually, outpacing the local market's 9.5%. This performance is supported by a significant revenue increase forecast at 25.2% per year, also well above Denmark's average. Despite its earnings growth last year lagging behind the broader software industry, cBrain maintains a strong trajectory with high-quality earnings and positive free cash flow. The firm recently projected a revenue rise of 10-15% for 2025 and an EBT increase of 18-23%, reflecting confidence in its operational strategy and market position. With an anticipated high return on equity of 30.7%, cBrain continues to strengthen its financial base while rewarding shareholders with increased dividends, signaling a promising outlook for sustained growth and shareholder value enhancement.

- Click to explore a detailed breakdown of our findings in cBrain's health report.

Gain insights into cBrain's past trends and performance with our Past report.

Netcompany Group (CPSE:NETC)

Simply Wall St Growth Rating: ★★★★☆☆

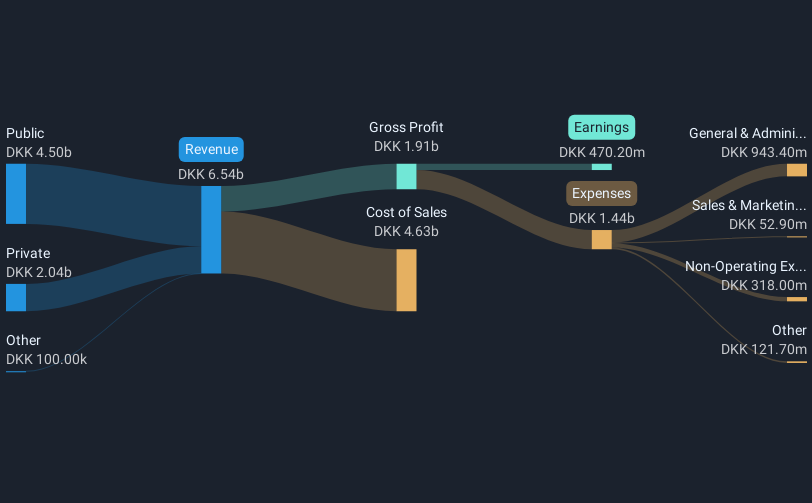

Overview: Netcompany Group A/S delivers essential IT solutions to both private and public sectors across several countries including Denmark, Norway, the UK, and others, with a market capitalization of DKK13.35 billion.

Operations: With a market capitalization of DKK13.35 billion, Netcompany Group A/S generates its revenue primarily from public sector contracts amounting to DKK4.50 billion and private sector engagements totaling DKK2.04 billion, showcasing its diverse client base across various European countries.

Netcompany Group has shown a notable performance with a 54.9% earnings growth over the past year, surpassing the broader IT industry's growth of 2%. This Danish tech firm is expected to see its earnings grow by 23.3% annually over the next three years, significantly outpacing the local market's average of 9.5%. Despite challenges such as public spending delays in the U.K., Netcompany continues to innovate, focusing on strategic markets and maintaining robust revenue projections between 5% and 10% for 2025. Their commitment to R&D is evident from their latest financials, where they reported substantial investment in this area, fostering further innovation and competitive edge in high-growth tech sectors across Europe.

- Get an in-depth perspective on Netcompany Group's performance by reading our health report here.

Evaluate Netcompany Group's historical performance by accessing our past performance report.

USU Software (HMSE:OSP2)

Simply Wall St Growth Rating: ★★★★☆☆

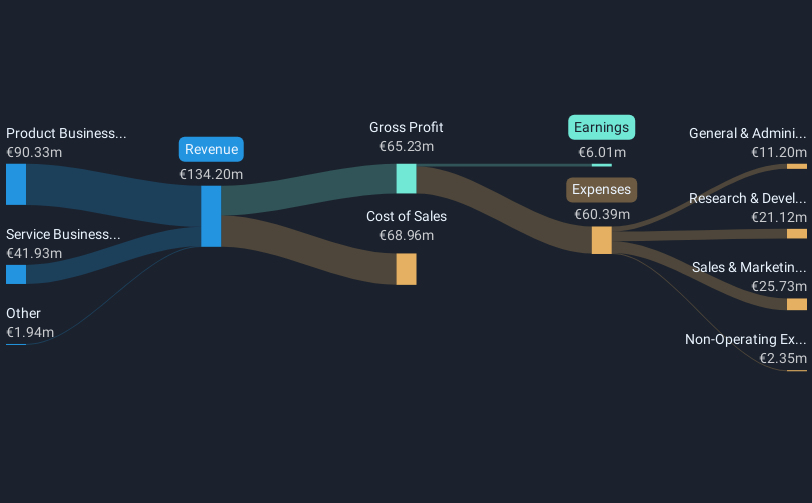

Overview: USU Software AG, along with its subsidiaries, delivers software and service solutions for IT and customer service management both in Germany and internationally, with a market capitalization of €232.85 million.

Operations: The company generates revenue through its Product Business, contributing €90.33 million, and its Service Business, adding €41.93 million. The focus is on delivering software and service solutions for IT and customer service management across various markets.

USU Software AG is making significant strides in the tech sector, evidenced by its recent launch of USU FinOps, aimed at optimizing cloud cost management—a critical need across industries. This innovation follows their strategic client acquisitions, including a major laboratory automation provider and two notable ITSM contracts with a Swiss financial institution and a German systems integrator. These developments highlight USU's commitment to expanding its service offerings and enhancing client operations through SaaS solutions. With an annual revenue growth forecast at 10% and earnings expected to surge by 30.7% per year, USU is positioning itself as a robust contender in Europe’s tech landscape, underpinned by targeted R&D investments that drive continuous product enhancement and market competitiveness.

- Unlock comprehensive insights into our analysis of USU Software stock in this health report.

Gain insights into USU Software's historical performance by reviewing our past performance report.

Summing It All Up

- Click through to start exploring the rest of the 244 European High Growth Tech and AI Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade cBrain, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if cBrain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:CBRAIN

cBrain

A software company, provides software solutions for government, private, education, and non-profit sectors in Denmark, rest of the European Union, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives