Unfortunately for shareholders, when Zealand Pharma A/S (CPH:ZEAL) reported results for the period to December 2021, its auditors, Ernst & Young LLP, expressed uncertainty about whether it can continue as a going concern. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares.

Since the company probably needs cash fairly quickly, it may be in a position where it has to accept whatever terms it can get. So current risks on the balance sheet could have a big impact on how shareholders fare from here. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

See our latest analysis for Zealand Pharma

What Is Zealand Pharma's Net Debt?

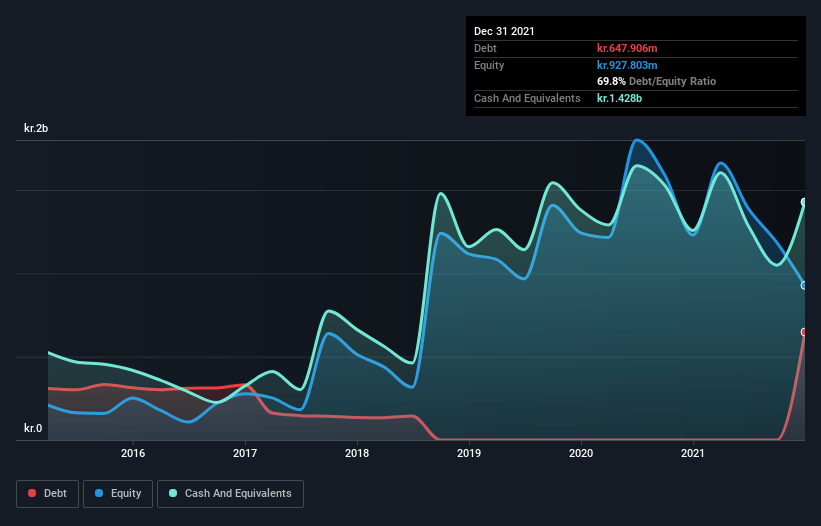

You can click the graphic below for the historical numbers, but it shows that as of December 2021 Zealand Pharma had kr.647.9m of debt, an increase on none, over one year. However, it does have kr.1.43b in cash offsetting this, leading to net cash of kr.780.2m.

How Healthy Is Zealand Pharma's Balance Sheet?

We can see from the most recent balance sheet that Zealand Pharma had liabilities of kr.334.3m falling due within a year, and liabilities of kr.805.5m due beyond that. Offsetting this, it had kr.1.43b in cash and kr.110.4m in receivables that were due within 12 months. So it can boast kr.398.7m more liquid assets than total liabilities.

This surplus suggests that Zealand Pharma has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Zealand Pharma has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Zealand Pharma can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Zealand Pharma had a loss before interest and tax, and actually shrunk its revenue by 17%, to kr.293m. That's not what we would hope to see.

So How Risky Is Zealand Pharma?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Zealand Pharma lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through kr.1.2b of cash and made a loss of kr.1.0b. But at least it has kr.780.2m on the balance sheet to spend on growth, near-term. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. We're too cautious to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. That's because we find it more comfortable to invest in companies that always keep the balance sheet reasonably strong. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Zealand Pharma , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Zealand Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:ZEAL

Zealand Pharma

A biotechnology company, engages in the discovery, development, and commercialization of peptide-based medicines in Denmark and the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives