H. Lundbeck (CPH:HLUN B) Third Quarter 2024 Results

Key Financial Results

- Revenue: kr.5.72b (up 16% from 3Q 2023).

- Net income: kr.777.0m (up 15% from 3Q 2023).

- Profit margin: 14% (in line with 3Q 2023).

- EPS: kr.0.78 (up from kr.0.68 in 3Q 2023).

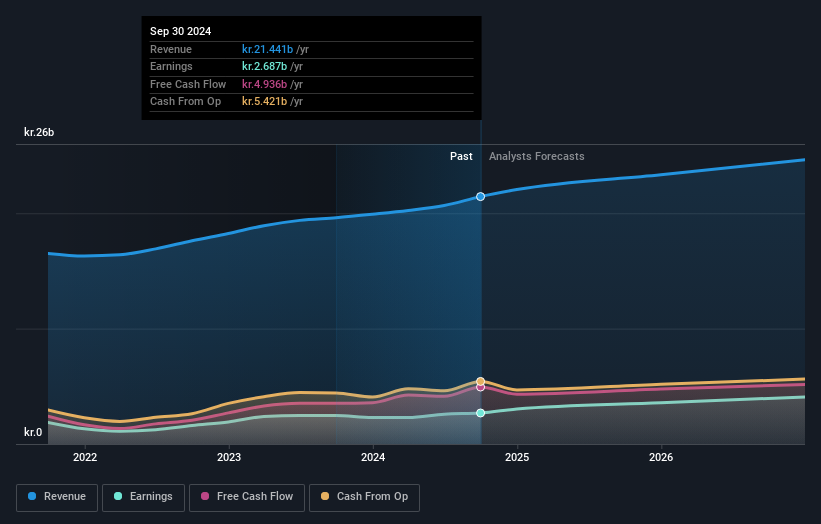

All figures shown in the chart above are for the trailing 12 month (TTM) period

H. Lundbeck Revenues and Earnings Beat Expectations

Revenue exceeded analyst estimates by 4.6%. Earnings per share (EPS) also surpassed analyst estimates by 5.9%.

Looking ahead, revenue is forecast to grow 3.7% p.a. on average during the next 3 years, compared to a 7.3% growth forecast for the Pharmaceuticals industry in Europe.

Performance of the market in Denmark.

The company's shares are up 4.5% from a week ago.

Balance Sheet Analysis

While earnings are important, another area to consider is the balance sheet. We have a graphic representation of H. Lundbeck's balance sheet and an in-depth analysis of the company's financial position.

Valuation is complex, but we're here to simplify it.

Discover if H. Lundbeck might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:HLUN B

H. Lundbeck

A biopharmaceutical company, engages in the research, development, production, and sale of pharmaceuticals for the treatment of psychiatric and neurological disorders in Europe, United States, and internationally.

Undervalued with excellent balance sheet.