- Denmark

- /

- Life Sciences

- /

- CPSE:CHEMM

Does ChemoMetec's (CPSE:CHEMM) Dividend Highlight a Conservative Approach to Capital Allocation?

Reviewed by Sasha Jovanovic

- At its Annual General Meeting held on 9 October 2025, ChemoMetec A/S approved a dividend distribution of DKK 7 per share of nominal value DKK 1.

- This move highlights the company's focus on returning capital to shareholders and may signal confidence in its ongoing financial stability.

- We'll explore how the approved dividend underscores ChemoMetec's shareholder priorities and affects its overall investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is ChemoMetec's Investment Narrative?

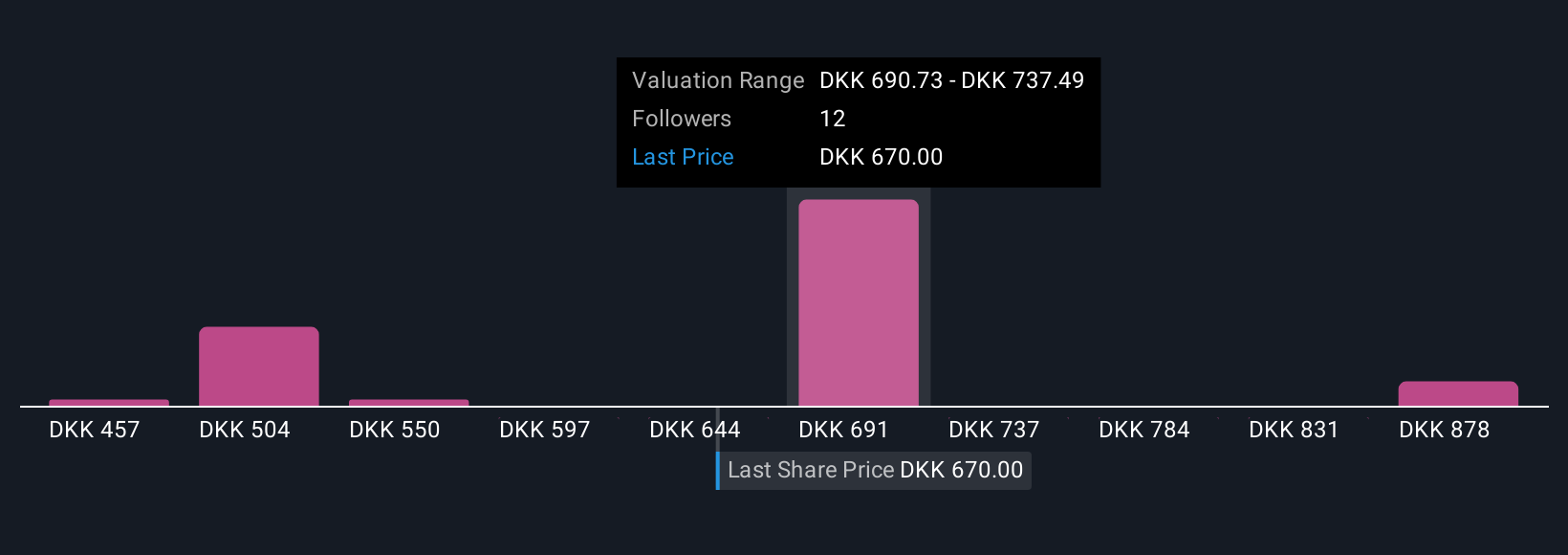

For investors eyeing ChemoMetec, the big picture centers on the company’s commitment to shareholder returns, ongoing profit growth, and ambition to outpace broader market trends in Danish life sciences. The DKK 7 dividend now approved isn’t likely to materially alter key short-term catalysts, which continue to include management’s ability to deliver on the newly raised revenue guidance and navigate an industry where ChemoMetec remains priced well above its peers. However, the latest dividend move reinforces confidence in ChemoMetec’s capital allocation strategy and underlines the management’s belief in current financial health. Risks remain, most notably, the company’s high valuation relative to peers and questions around how the new management team sustains recent earnings momentum. All eyes stay on whether future performance continues to justify the premium already priced into the shares. But, despite recent performance, the valuation gap to peers is worth keeping an eye on.

ChemoMetec's share price has been on the slide but might be up to 24% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 6 other fair value estimates on ChemoMetec - why the stock might be worth 32% less than the current price!

Build Your Own ChemoMetec Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ChemoMetec research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free ChemoMetec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ChemoMetec's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:CHEMM

ChemoMetec

Engages in the development, production, and sale of analytical equipment for cell counting and analysis the United States, Canada, Europe, and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives