- Denmark

- /

- Life Sciences

- /

- CPSE:CHEMM

ChemoMetec A/S (CPH:CHEMM) Stock Rockets 32% As Investors Are Less Pessimistic Than Expected

The ChemoMetec A/S (CPH:CHEMM) share price has done very well over the last month, posting an excellent gain of 32%. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

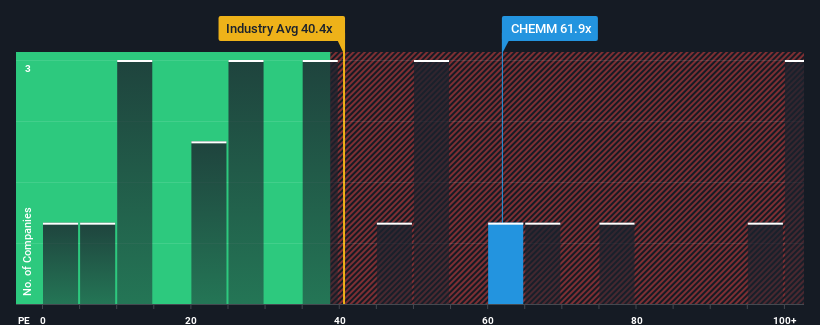

After such a large jump in price, given close to half the companies in Denmark have price-to-earnings ratios (or "P/E's") below 14x, you may consider ChemoMetec as a stock to avoid entirely with its 61.9x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, ChemoMetec's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for ChemoMetec

Is There Enough Growth For ChemoMetec?

There's an inherent assumption that a company should far outperform the market for P/E ratios like ChemoMetec's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 54% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 17% per year during the coming three years according to the three analysts following the company. That's shaping up to be similar to the 16% per year growth forecast for the broader market.

With this information, we find it interesting that ChemoMetec is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

ChemoMetec's P/E is flying high just like its stock has during the last month. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that ChemoMetec currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for ChemoMetec you should be aware of.

You might be able to find a better investment than ChemoMetec. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:CHEMM

ChemoMetec

Engages in the development, production, and sale of analytical equipment for cell counting and analysis the United States, Canada, Europe, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives