- Denmark

- /

- Life Sciences

- /

- CPSE:CHEMM

A Closer Look at ChemoMetec (CPSE:CHEMM) Valuation Following Fresh Dividend Approval

Reviewed by Kshitija Bhandaru

ChemoMetec (CPSE:CHEMM) shareholders received some welcome news at the company’s recent annual general meeting, where a dividend of DKK 7 per share was approved. This move reflects management’s confidence in ChemoMetec’s financial strength and ongoing performance.

See our latest analysis for ChemoMetec.

ChemoMetec’s recent dividend announcement comes after a robust stretch for shareholders, with the stock’s 1-year total return topping 61.7%. Momentum has accelerated noticeably in recent months as investors responded to improved financials and the confidence reflected in management’s latest moves.

If you’re looking for other opportunities with strong growth and engaged management teams, now is an ideal moment to discover fast growing stocks with high insider ownership

With shares up more than 60 percent over the past year and financials trending higher, is ChemoMetec still undervalued at current levels, or has the market already priced in all of its future growth prospects?

Price-to-Earnings of 62.6x: Is it justified?

ChemoMetec’s current price-to-earnings ratio stands at 62.6x. This positions the stock as significantly more expensive than both its industry and peer averages based on the last close of DKK 670.

The price-to-earnings ratio (P/E) measures how much investors are willing to pay for one Danish krone of company earnings. High P/E ratios are often seen in companies anticipated to deliver strong growth, high profitability, or those that possess competitive advantages in their sector.

While the company has posted rapid earnings gains and healthy margins, such a high multiple suggests the market is pricing in continued outperformance for years to come. However, compared to the European Life Sciences sector average P/E of 35x and peer average of 19.1x, ChemoMetec’s premium is substantial. Relative to its estimated fair price-to-earnings ratio of 17.2x, the gap is even wider, indicating considerable optimism from current investors.

Explore the SWS fair ratio for ChemoMetec

Result: Price-to-Earnings of 62.6x (OVERVALUED)

However, slowing revenue growth or unexpected market volatility could quickly dampen investor optimism and challenge the premium valuation currently enjoyed by ChemoMetec.

Find out about the key risks to this ChemoMetec narrative.

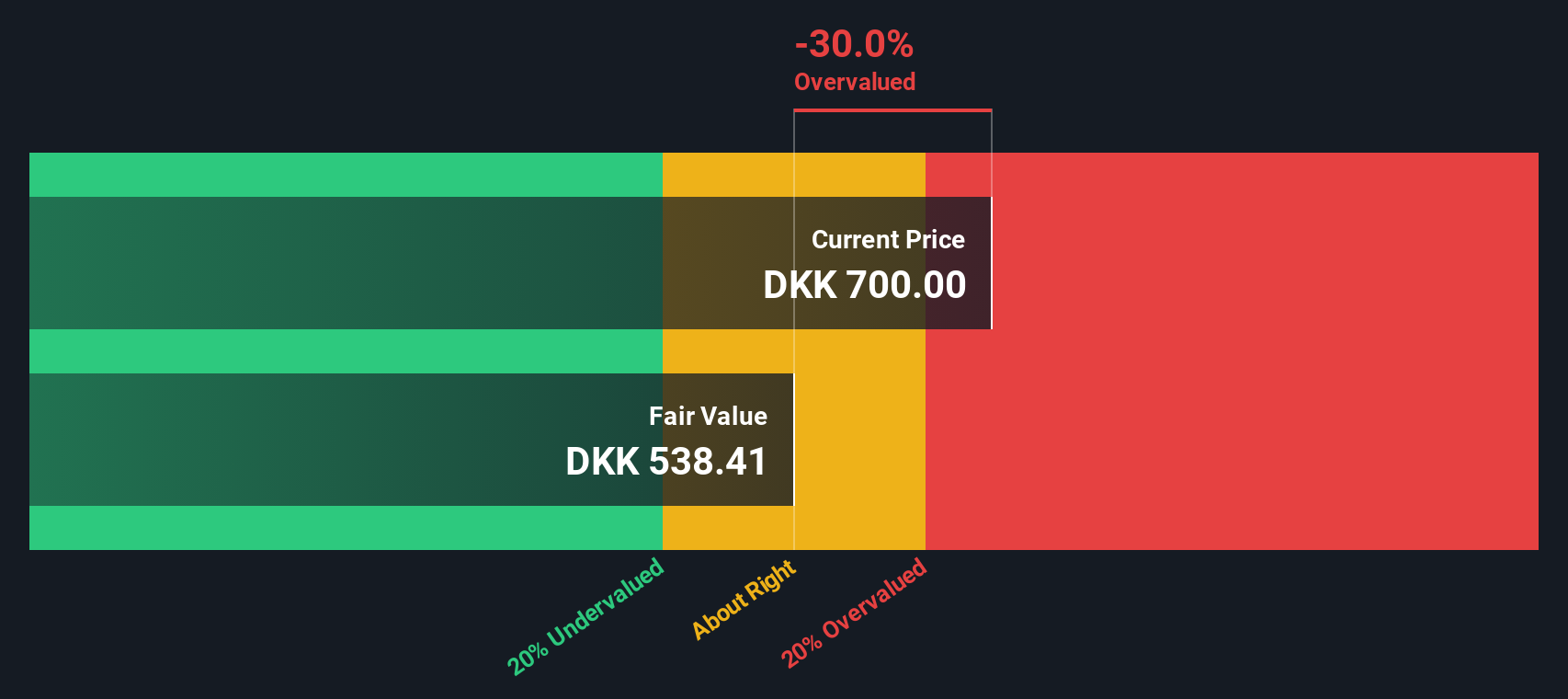

Another View: The SWS DCF Model

While the price-to-earnings approach suggests ChemoMetec is priced for perfection, our SWS DCF model presents a different story. The DCF places fair value at DKK 541.2 per share, which is below today’s price. This implies ChemoMetec could be overvalued if cash flow projections prove accurate. Is the market being too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ChemoMetec for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ChemoMetec Narrative

If you have a different perspective or want to dig deeper into the numbers, you can build your own view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ChemoMetec.

Looking for more investment ideas?

Smart investors keep their edge by spotting fresh opportunities early. Put yourself in the driver’s seat and use these powerful screeners so you never let top picks pass you by.

- Tap into income potential by checking out these 18 dividend stocks with yields > 3% offering attractive yields that can strengthen your portfolio’s cash flow.

- Uncover tomorrow’s innovators and see which firms are harnessing AI trends by browsing these 24 AI penny stocks right now.

- Supercharge your returns and seek value with these 871 undervalued stocks based on cash flows showing stocks trading below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:CHEMM

ChemoMetec

Engages in the development, production, and sale of analytical equipment for cell counting and analysis the United States, Canada, Europe, and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives