Improved Revenues Required Before Bavarian Nordic A/S (CPH:BAVA) Shares Find Their Feet

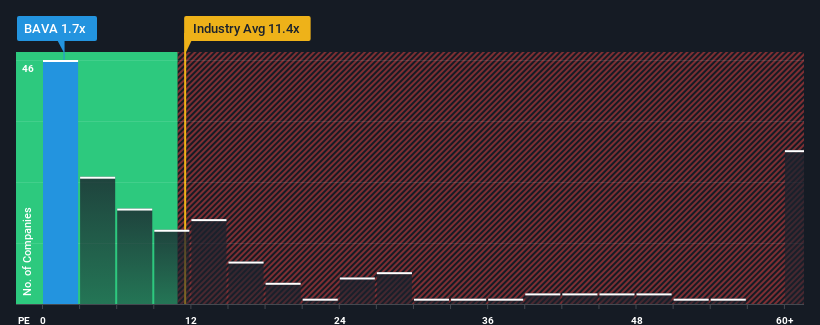

Bavarian Nordic A/S' (CPH:BAVA) price-to-sales (or "P/S") ratio of 1.7x might make it look like a strong buy right now compared to the Biotechs industry in Denmark, where around half of the companies have P/S ratios above 11.4x and even P/S above 29x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Bavarian Nordic

What Does Bavarian Nordic's P/S Mean For Shareholders?

Bavarian Nordic certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bavarian Nordic.Is There Any Revenue Growth Forecasted For Bavarian Nordic?

Bavarian Nordic's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 124%. The strong recent performance means it was also able to grow revenue by 281% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 10.0% per annum as estimated by the five analysts watching the company. With the industry predicted to deliver 31% growth per annum, that's a disappointing outcome.

In light of this, it's understandable that Bavarian Nordic's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Bavarian Nordic's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Bavarian Nordic's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Bavarian Nordic (1 doesn't sit too well with us!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Bavarian Nordic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:BAVA

Bavarian Nordic

Develops, manufactures, and supplies life-saving vaccines.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026