- Denmark

- /

- Healthtech

- /

- CPSE:NNIT

Do These 3 Checks Before Buying NNIT A/S (CPH:NNIT) For Its Upcoming Dividend

It looks like NNIT A/S (CPH:NNIT) is about to go ex-dividend in the next 3 days. Ex-dividend means that investors that purchase the stock on or after the 11th of March will not receive this dividend, which will be paid on the 15th of March.

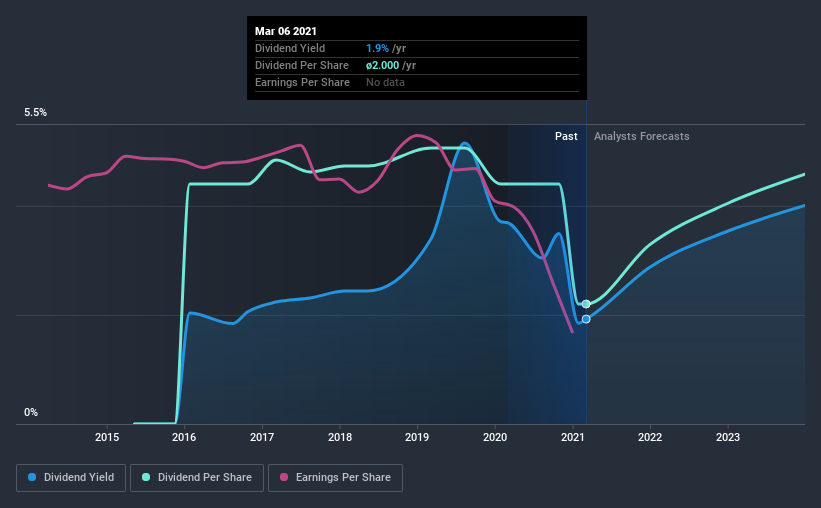

NNIT's next dividend payment will be kr.1.00 per share. Last year, in total, the company distributed kr.2.00 to shareholders. Based on the last year's worth of payments, NNIT stock has a trailing yield of around 1.9% on the current share price of DKK104. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for NNIT

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Last year NNIT paid out 98% of its profits as dividends to shareholders, suggesting the dividend is not well covered by earnings. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out 25% of its free cash flow as dividends last year, which is conservatively low.

It's good to see that while NNIT's dividends were not well covered by profits, at least they are affordable from a cash perspective. Still, if the company continues paying out such a high percentage of its profits, the dividend could be at risk if business turns sour.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. NNIT's earnings per share have fallen at approximately 19% a year over the previous five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. NNIT's dividend payments per share have declined at 13% per year on average over the past five years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

The Bottom Line

Has NNIT got what it takes to maintain its dividend payments? It's never great to see earnings per share declining, especially when a company is paying out 98% of its profit as dividends, which we feel is uncomfortably high. However, the cash payout ratio was much lower - good news from a dividend perspective - which makes us wonder why there is such a mis-match between income and cashflow. It's not that we think NNIT is a bad company, but these characteristics don't generally lead to outstanding dividend performance.

With that being said, if you're still considering NNIT as an investment, you'll find it beneficial to know what risks this stock is facing. For example, we've found 3 warning signs for NNIT that we recommend you consider before investing in the business.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade NNIT, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NNIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:NNIT

NNIT

Provides information technology solutions for life sciences, public, and private sectors in Denmark, Europe, the United States, and Asia.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives