We Think The Compensation For Scandinavian Tobacco Group A/S' (CPH:STG) CEO Looks About Right

CEO Niels Frederiksen has done a decent job of delivering relatively good performance at Scandinavian Tobacco Group A/S (CPH:STG) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 14 April 2021. We present our case of why we think CEO compensation looks fair.

View our latest analysis for Scandinavian Tobacco Group

How Does Total Compensation For Niels Frederiksen Compare With Other Companies In The Industry?

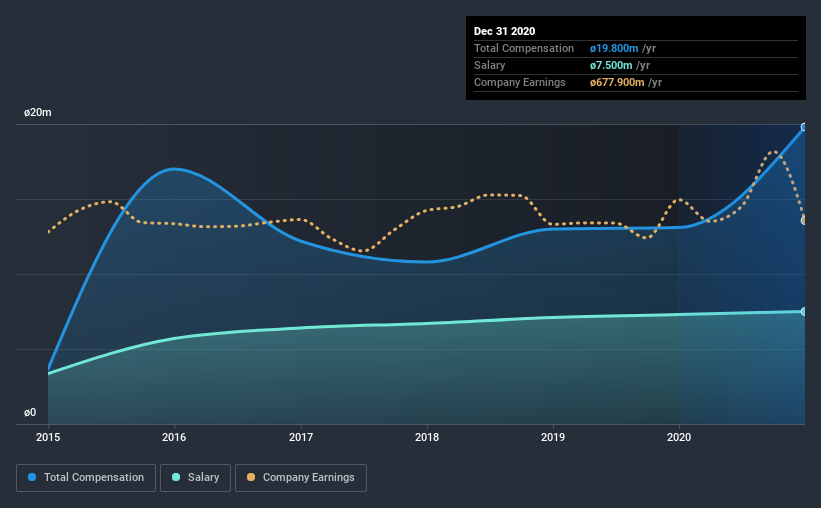

Our data indicates that Scandinavian Tobacco Group A/S has a market capitalization of kr.12b, and total annual CEO compensation was reported as kr.20m for the year to December 2020. We note that's an increase of 51% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at kr.7.5m.

On examining similar-sized companies in the industry with market capitalizations between kr.6.3b and kr.20b, we discovered that the median CEO total compensation of that group was kr.24m. From this we gather that Niels Frederiksen is paid around the median for CEOs in the industry. Furthermore, Niels Frederiksen directly owns kr.15m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | kr.7.5m | kr.7.3m | 38% |

| Other | kr.12m | kr.5.8m | 62% |

| Total Compensation | kr.20m | kr.13m | 100% |

On an industry level, roughly 40% of total compensation represents salary and 60% is other remuneration. Scandinavian Tobacco Group is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Scandinavian Tobacco Group A/S' Growth

Over the last three years, Scandinavian Tobacco Group A/S has shrunk its earnings per share by 1.5% per year. In the last year, its revenue is up 19%.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Scandinavian Tobacco Group A/S Been A Good Investment?

Most shareholders would probably be pleased with Scandinavian Tobacco Group A/S for providing a total return of 44% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Although the company has performed relatively well, we still think there are some areas that could be improved. Despite robust revenue growth, until EPS growth improves, shareholders may be hesitant to increase CEO pay by too much.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 2 warning signs for Scandinavian Tobacco Group that investors should be aware of in a dynamic business environment.

Switching gears from Scandinavian Tobacco Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Scandinavian Tobacco Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:STG

Scandinavian Tobacco Group

Manufactures and sells tobacco products in North America, Europe, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026