- Japan

- /

- Trade Distributors

- /

- TSE:8078

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing significant fluctuations across sectors, with financials and energy seeing gains while healthcare and EV shares face challenges. In such a dynamic environment, dividend stocks can offer a degree of stability and income potential, making them an appealing option for those looking to balance risk with steady returns in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.59% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.85% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.04% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.59% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

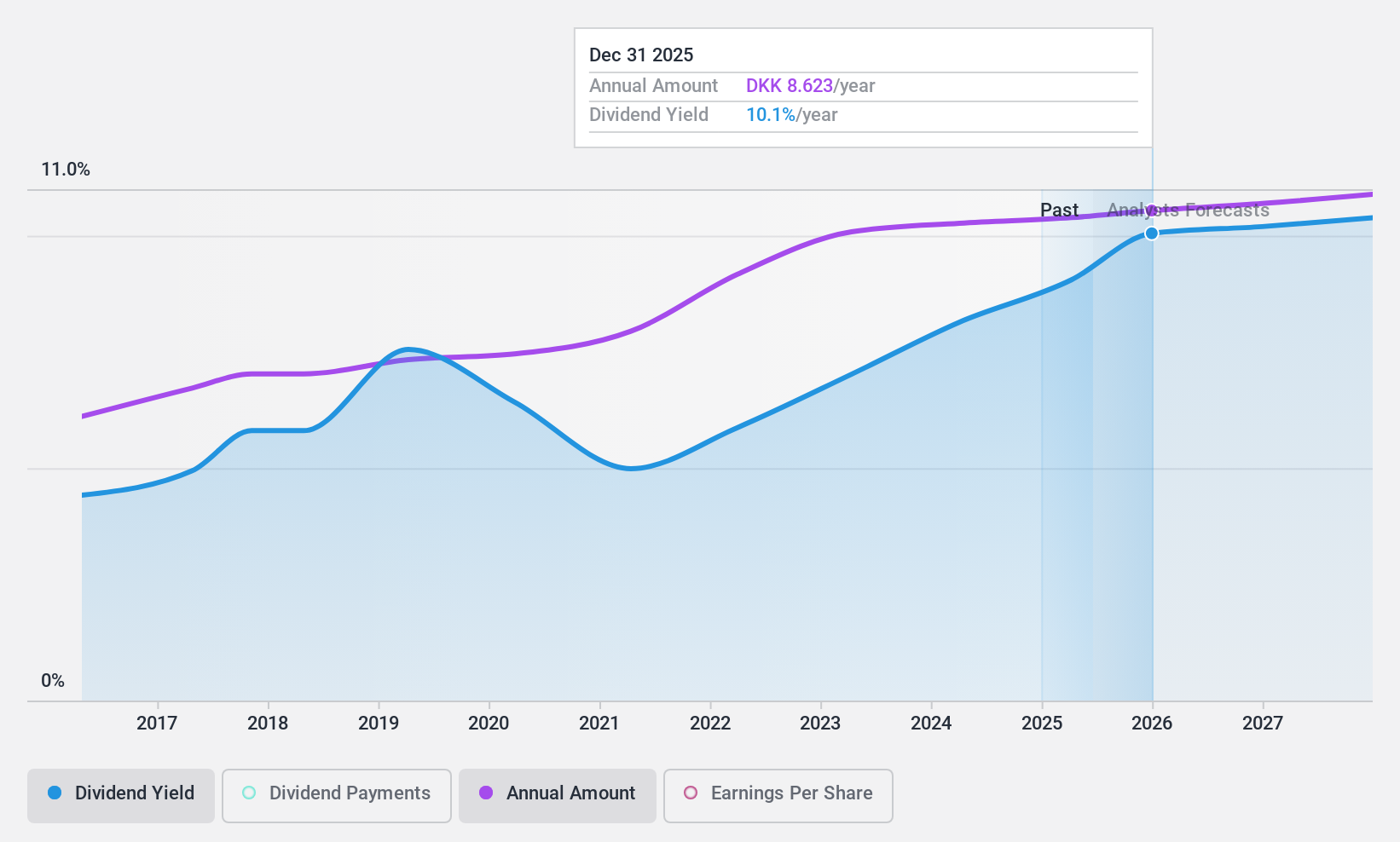

Scandinavian Tobacco Group (CPSE:STG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Scandinavian Tobacco Group A/S manufactures and sells cigars and pipe tobacco across the United States, Europe, and internationally, with a market cap of DKK7.71 billion.

Operations: Scandinavian Tobacco Group A/S generates revenue from three main segments: Europe Branded (DKK3.04 billion), North America Online & Retail (DKK2.97 billion), and North America Branded & Rest of World (Row) (DKK3.01 billion).

Dividend Yield: 8.7%

Scandinavian Tobacco Group offers a compelling dividend yield of 8.65%, ranking it in the top 25% of Danish dividend payers. Despite its relatively short history of nine years, the company's dividends have shown growth and stability, supported by a payout ratio of 72% and cash flow coverage at 87.6%. However, recent earnings show declining profit margins, with net income decreasing to DKK 297.1 million in Q3 from DKK 351 million last year.

- Get an in-depth perspective on Scandinavian Tobacco Group's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Scandinavian Tobacco Group's current price could be quite moderate.

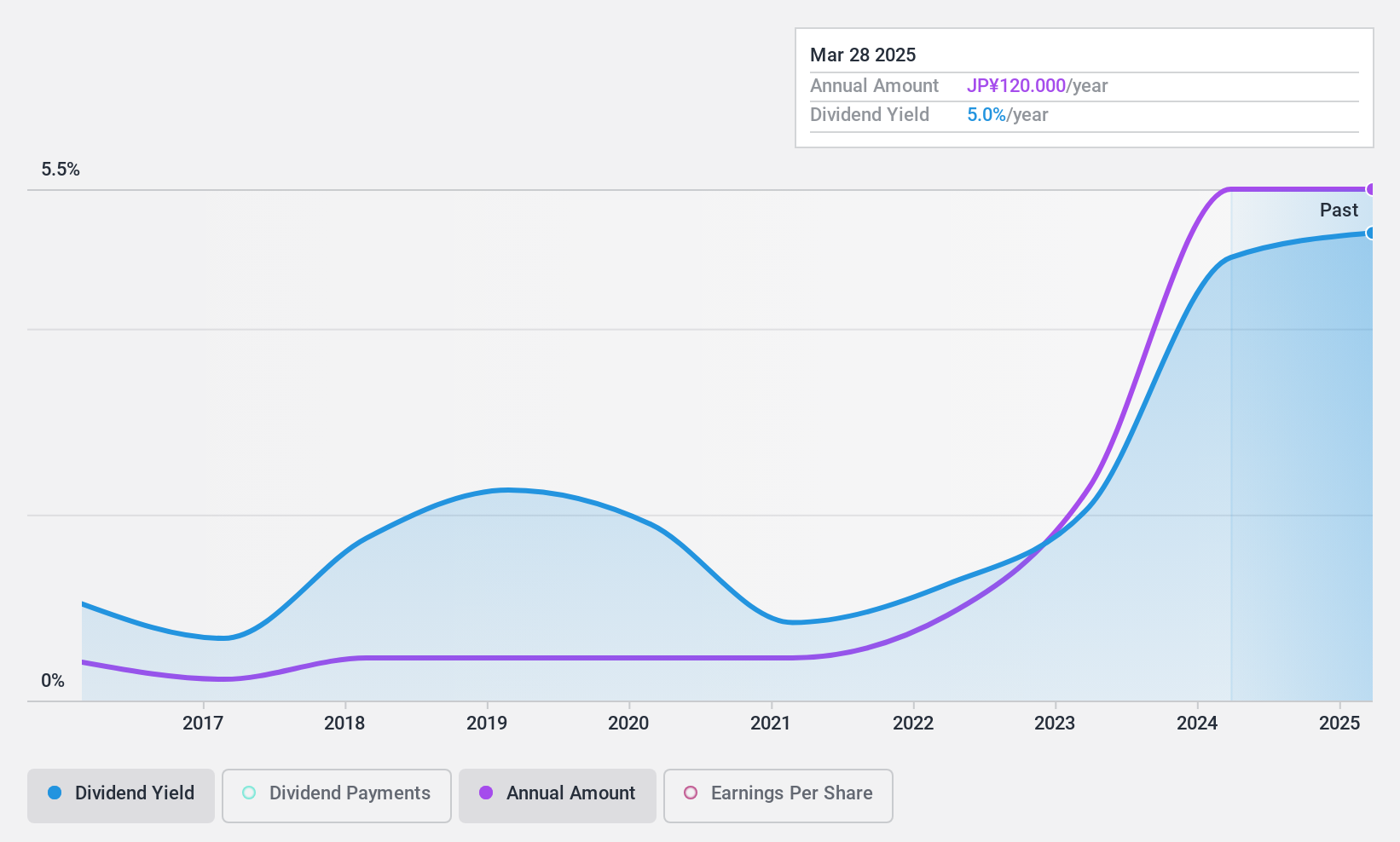

Careerlink (TSE:6070)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Careerlink Co., Ltd. offers human resource services in Japan and has a market cap of ¥30.47 billion.

Operations: Careerlink Co., Ltd.'s revenue from its Manufacturing Personnel Service Business is ¥7.08 billion.

Dividend Yield: 4.7%

Careerlink's dividend yield of 4.67% places it among the top 25% in Japan, supported by a low cash payout ratio of 22.8%, indicating strong coverage by cash flows. Despite this, the company's dividends have been unreliable and volatile over the past decade, with profit margins declining from last year's 10.3% to 5.3%. Trading significantly below its estimated fair value enhances its appeal as a potential value investment for dividend seekers.

- Unlock comprehensive insights into our analysis of Careerlink stock in this dividend report.

- Upon reviewing our latest valuation report, Careerlink's share price might be too pessimistic.

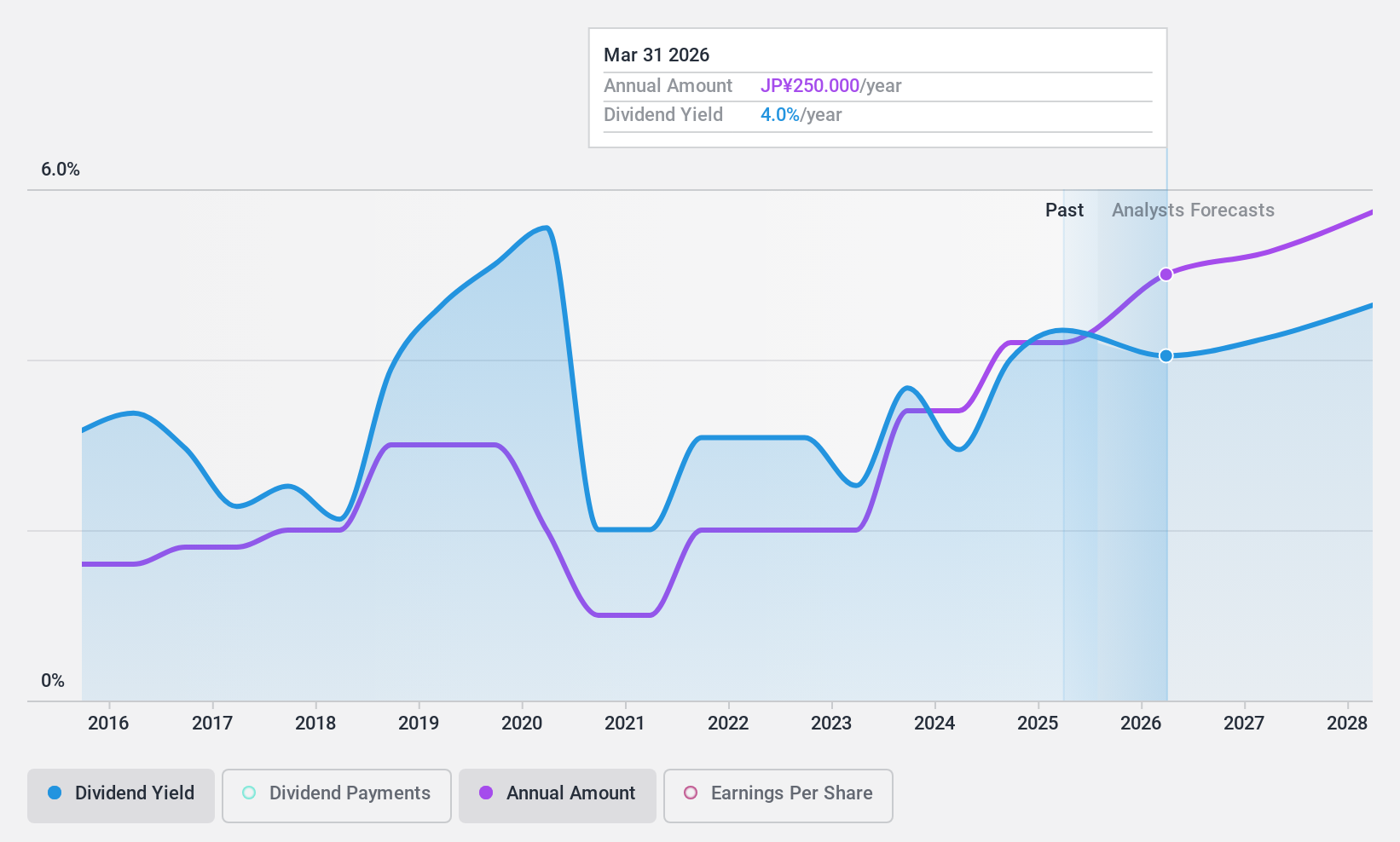

Hanwa (TSE:8078)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hanwa Co., Ltd. is a diversified trading company involved in the distribution of steel, metals and alloys, nonferrous metals, food products, petroleum and chemicals, lumber, machinery, and other products both in Japan and internationally with a market cap of ¥201.74 billion.

Operations: Revenue Segments (in millions of ¥): Steel ¥1,641,400; Metals and Alloys ¥1,176,500; Nonferrous Metals ¥1,092,300; Food Products ¥305,800; Petroleum and Chemicals ¥2,019,700; Lumber ¥68,100; Machinery ¥92,000.

Dividend Yield: 4.2%

Hanwa's dividend yield of 4.2% ranks it in the top 25% of Japanese dividend payers, with a low payout ratio of 10.3% indicating strong earnings coverage. Despite recent increases, dividends have been volatile over the past decade. The company trades at a significant discount to its estimated fair value, potentially appealing to value investors. Recent guidance suggests stable financial performance with expected net sales of ¥2,800 billion and profit attributable to owners at ¥43 billion for fiscal year ending March 2025.

- Click here to discover the nuances of Hanwa with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Hanwa is trading behind its estimated value.

Where To Now?

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1973 more companies for you to explore.Click here to unveil our expertly curated list of 1976 Top Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanwa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8078

Hanwa

Trades in steel, metals and alloys, nonferrous metals, food products, petroleum and chemicals, lumber, machinery, and other products in Japan and internationally.

Very undervalued established dividend payer.