Discover Scandinavian Tobacco Group And 2 More Top Dividend Stocks

Reviewed by Simply Wall St

As global markets continue to react positively to political developments and economic indicators, with major indexes reaching record highs, investors are increasingly looking for stable income sources amidst the fluctuating landscape. In this context, dividend stocks like Scandinavian Tobacco Group offer a compelling option due to their potential for consistent returns and resilience in diverse market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.91% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.76% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

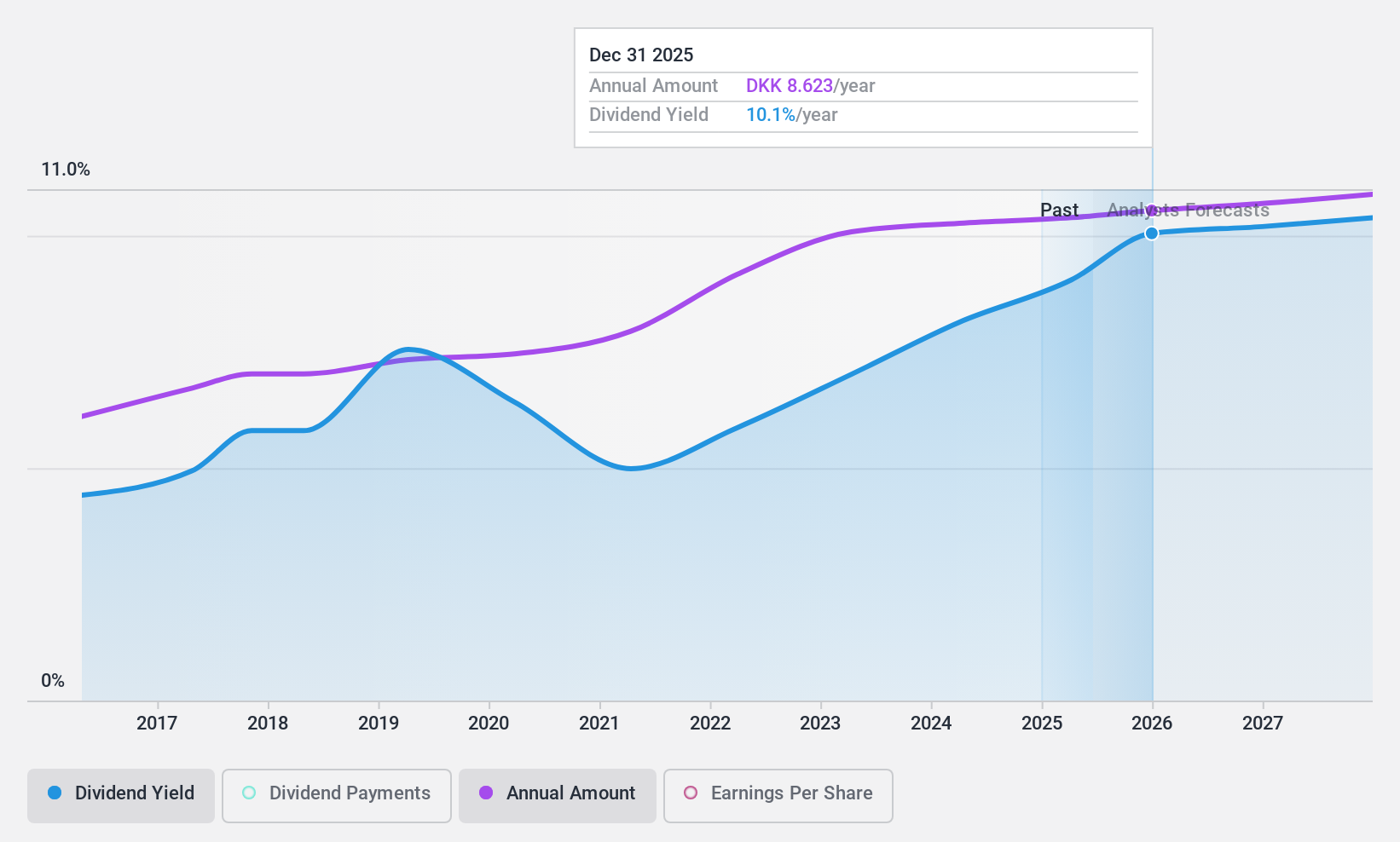

Scandinavian Tobacco Group (CPSE:STG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Scandinavian Tobacco Group A/S manufactures and sells cigars and pipe tobacco in the United States, Europe, and internationally, with a market cap of DKK8.16 billion.

Operations: Scandinavian Tobacco Group's revenue segments include Europe Branded at DKK3.04 billion, North America Online & Retail at DKK2.97 billion, and North America Branded & Rest of World (RoW) at DKK3.01 billion.

Dividend Yield: 8.1%

Scandinavian Tobacco Group offers a dividend yield of 8.11%, placing it in the top 25% of Danish market dividend payers. The company has maintained stable dividends for less than a decade, with payments covered by earnings (72% payout ratio) and cash flows (87.1% cash payout ratio). Despite declining profit margins and net income, STG trades at good value compared to peers, while its recent share buyback reflects confidence in financial stability amidst high debt levels.

- Navigate through the intricacies of Scandinavian Tobacco Group with our comprehensive dividend report here.

- Our valuation report here indicates Scandinavian Tobacco Group may be undervalued.

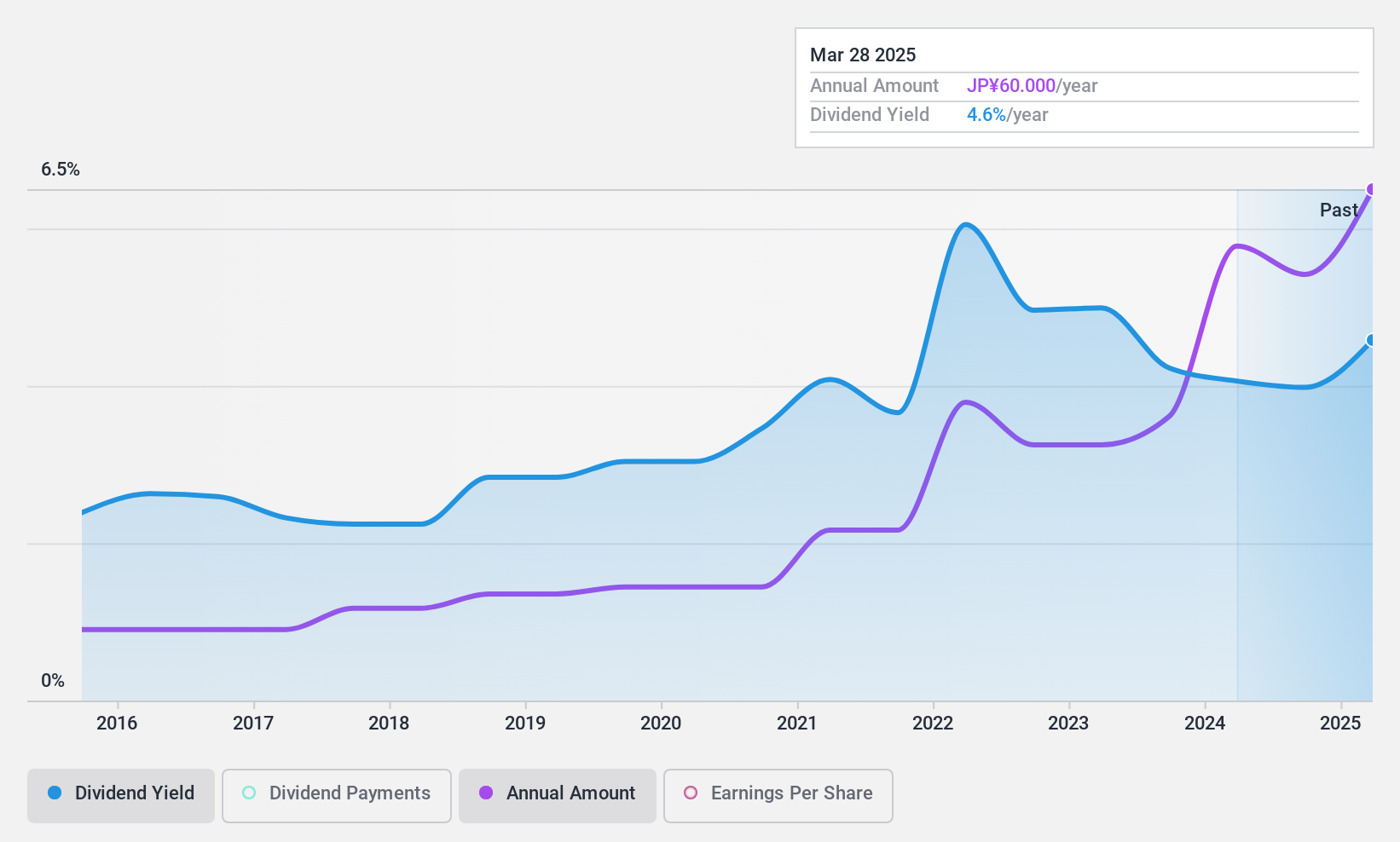

Yondenko (TSE:1939)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yondenko Corporation operates in Japan, focusing on the construction of electrical and electrical power transmission and distribution facilities, with a market cap of ¥71.44 billion.

Operations: Yondenko Corporation's revenue is primarily derived from its Facility Construction Segment, which generated ¥95.54 billion, supplemented by the Solar Power Generation Business contributing ¥2.19 billion, and the Lease Segment adding ¥2.81 billion.

Dividend Yield: 3.9%

Yondenko's dividend yield of 3.91% ranks in the top 25% of JP market payers, though its dividends are not well covered by free cash flows and have been volatile over the past decade. Despite this, earnings growth at 13.6% annually supports a reasonable payout ratio of 51.7%. Recent guidance revisions indicate improved financial performance, with expected net sales reaching ¥105 billion and increased dividends to ¥180 per share for FY2025, reflecting strategic focus on ROE improvement.

- Click here to discover the nuances of Yondenko with our detailed analytical dividend report.

- Our valuation report here indicates Yondenko may be overvalued.

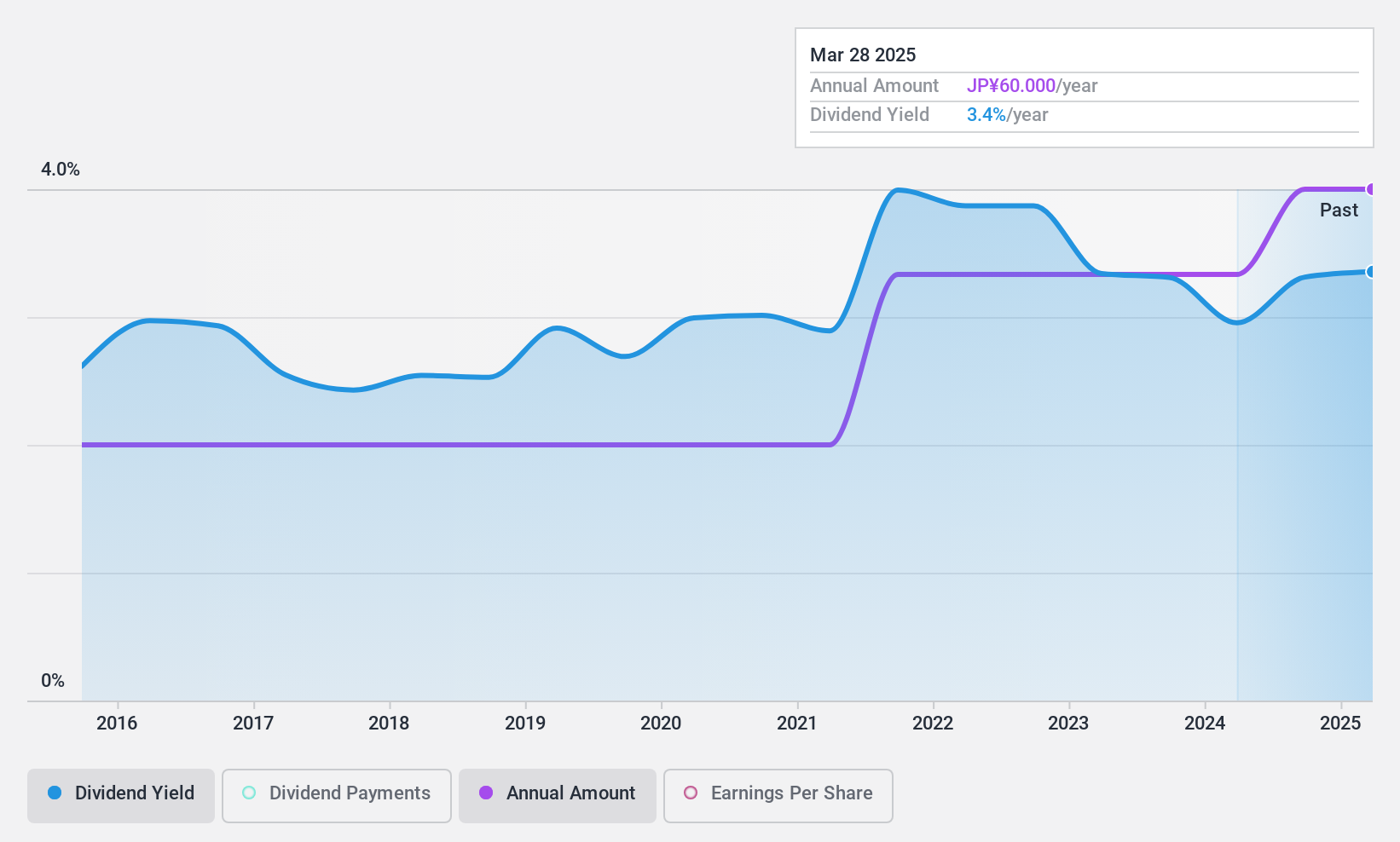

Maezawa Kasei Industries (TSE:7925)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Maezawa Kasei Industries Co., Ltd. produces and sells water and sewerage related products, as well as environmental equipment, with a market cap of ¥25.69 billion.

Operations: Maezawa Kasei Industries Co., Ltd. generates revenue from its segments in Plumbing Equipment (¥21.56 billion), Various Plastic Molding Fields (¥1.15 billion), and Water/Environmental Engineering (¥1.29 billion).

Dividend Yield: 3.5%

Maezawa Kasei Industries' dividend yield of 3.47% is below the top 25% in Japan, with dividends reliably growing and stable over the past decade. However, its high cash payout ratio of 105.4% indicates dividends are not well covered by free cash flows, posing sustainability concerns despite a reasonable earnings payout ratio of 52.5%. Earnings growth at 11.1% last year supports continued dividend payments but highlights potential risks if cash flow issues persist.

- Click to explore a detailed breakdown of our findings in Maezawa Kasei Industries' dividend report.

- Upon reviewing our latest valuation report, Maezawa Kasei Industries' share price might be too optimistic.

Make It Happen

- Get an in-depth perspective on all 1938 Top Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:STG

Scandinavian Tobacco Group

Manufactures and sells tobacco products in North America, Europe, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives