Most Shareholders Will Probably Agree With Carlsberg A/S' (CPH:CARL B) CEO Compensation

Key Insights

- Carlsberg's Annual General Meeting to take place on 13th of March

- Salary of kr.13.1m is part of CEO Cees ´t Hart's total remuneration

- The total compensation is similar to the average for the industry

- Carlsberg's total shareholder return over the past three years was 32% while its EPS grew by 5.5% over the past three years

CEO Cees ´t Hart has done a decent job of delivering relatively good performance at Carlsberg A/S (CPH:CARL B) recently. As shareholders go into the upcoming AGM on 13th of March, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Here is our take on why we think the CEO compensation looks appropriate.

View our latest analysis for Carlsberg

How Does Total Compensation For Cees ´t Hart Compare With Other Companies In The Industry?

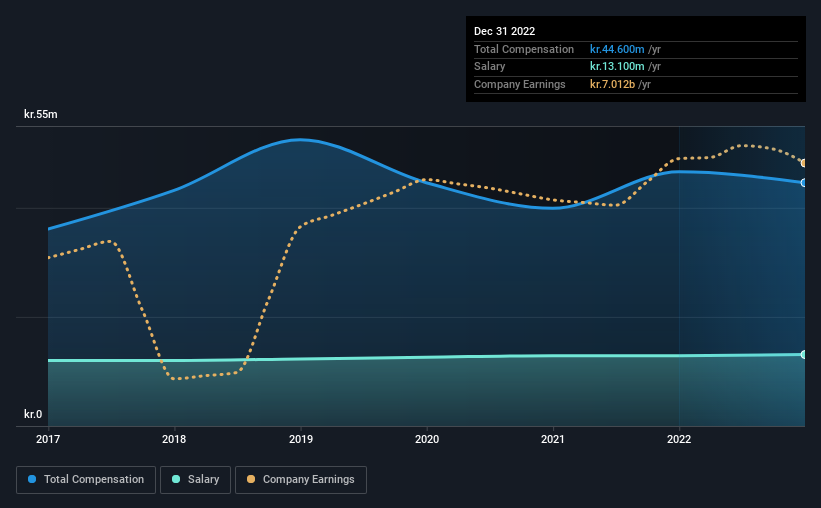

At the time of writing, our data shows that Carlsberg A/S has a market capitalization of kr.143b, and reported total annual CEO compensation of kr.45m for the year to December 2022. We note that's a small decrease of 4.3% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at kr.13m.

For comparison, other companies in the Denmark Beverage industry with market capitalizations above kr.56b, reported a median total CEO compensation of kr.45m. So it looks like Carlsberg compensates Cees ´t Hart in line with the median for the industry. Furthermore, Cees ´t Hart directly owns kr.53m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | kr.13m | kr.13m | 29% |

| Other | kr.32m | kr.34m | 71% |

| Total Compensation | kr.45m | kr.47m | 100% |

On an industry level, around 56% of total compensation represents salary and 44% is other remuneration. Carlsberg sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Carlsberg A/S' Growth

Over the past three years, Carlsberg A/S has seen its earnings per share (EPS) grow by 5.5% per year. Its revenue is up 17% over the last year.

We think the revenue growth is good. And the improvement in EPSis modest but respectable. So while performance isn't amazing, we think it really does seem quite respectable. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Carlsberg A/S Been A Good Investment?

Carlsberg A/S has generated a total shareholder return of 32% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for Carlsberg that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:CARL B

Carlsberg

Produces and markets beer and other beverage products in Denmark, China, the United Kingdom, and internationally.

Very undervalued established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.