Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, InterMail A/S (CPH:IMAIL) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for InterMail

How Much Debt Does InterMail Carry?

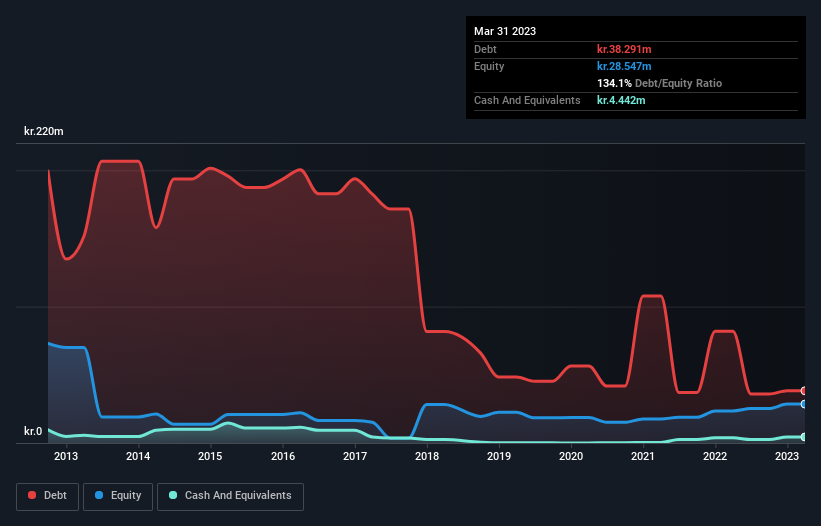

As you can see below, InterMail had kr.38.3m of debt at March 2023, down from kr.81.9m a year prior. However, it does have kr.4.44m in cash offsetting this, leading to net debt of about kr.33.8m.

A Look At InterMail's Liabilities

According to the last reported balance sheet, InterMail had liabilities of kr.35.2m due within 12 months, and liabilities of kr.75.3m due beyond 12 months. On the other hand, it had cash of kr.4.44m and kr.26.1m worth of receivables due within a year. So it has liabilities totalling kr.79.9m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the kr.42.5m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, InterMail would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While InterMail's low debt to EBITDA ratio of 1.5 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 2.8 times last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Unfortunately, InterMail saw its EBIT slide 5.6% in the last twelve months. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since InterMail will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, InterMail actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

We'd go so far as to say InterMail's level of total liabilities was disappointing. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Once we consider all the factors above, together, it seems to us that InterMail's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example InterMail has 3 warning signs (and 2 which are concerning) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:IMAIL

InterMail

Provides communication and marketing services in the Nordic region and rest of Europe.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives