Investors Still Aren't Entirely Convinced By WindowMaster International A/S' (CPH:WMA) Revenues Despite 26% Price Jump

The WindowMaster International A/S (CPH:WMA) share price has done very well over the last month, posting an excellent gain of 26%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.4% in the last twelve months.

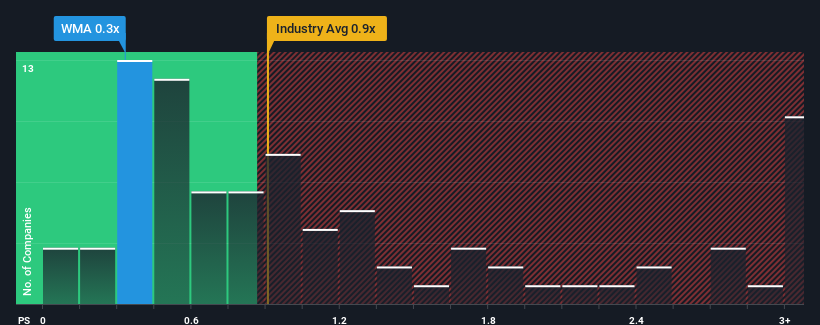

Although its price has surged higher, it would still be understandable if you think WindowMaster International is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in Denmark's Building industry have P/S ratios above 0.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for WindowMaster International

How Has WindowMaster International Performed Recently?

As an illustration, revenue has deteriorated at WindowMaster International over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on WindowMaster International's earnings, revenue and cash flow.How Is WindowMaster International's Revenue Growth Trending?

WindowMaster International's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 1.4% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 26% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 1.8% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that WindowMaster International is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

WindowMaster International's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We're very surprised to see WindowMaster International currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

And what about other risks? Every company has them, and we've spotted 3 warning signs for WindowMaster International (of which 1 doesn't sit too well with us!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if WindowMaster International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:WMA

WindowMaster International

Engages in the development, production, marketing, and sale of natural and mixed mode ventilation, smoke and heat ventilation, and automatic window control solutions for the commercial construction industry worldwide.

Good value with mediocre balance sheet.

Market Insights

Community Narratives