Investors Aren't Entirely Convinced By WindowMaster International A/S' (CPH:WMA) Revenues

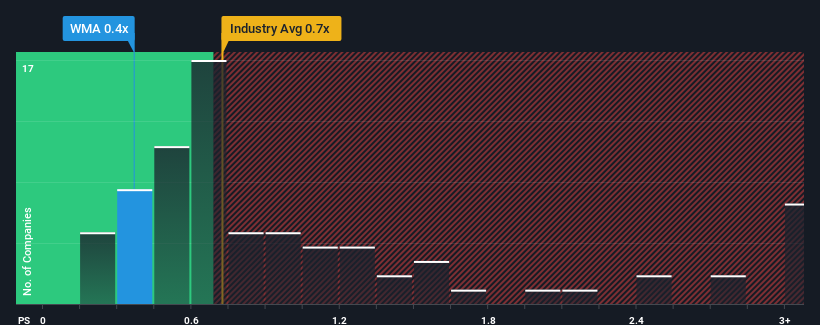

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Building industry in Denmark, you could be forgiven for feeling indifferent about WindowMaster International A/S' (CPH:WMA) P/S ratio of 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for WindowMaster International

What Does WindowMaster International's P/S Mean For Shareholders?

Revenue has risen firmly for WindowMaster International recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on WindowMaster International will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

WindowMaster International's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 20% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 3.7% shows it's noticeably more attractive.

In light of this, it's curious that WindowMaster International's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From WindowMaster International's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that WindowMaster International currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

You need to take note of risks, for example - WindowMaster International has 3 warning signs (and 2 which are potentially serious) we think you should know about.

If these risks are making you reconsider your opinion on WindowMaster International, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if WindowMaster International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:WMA

WindowMaster International

Engages in the development, production, marketing, and sale of natural and mixed mode ventilation, smoke and heat ventilation, and automatic window control solutions for the commercial construction industry worldwide.

Good value with mediocre balance sheet.

Market Insights

Community Narratives