- Denmark

- /

- Electrical

- /

- CPSE:VWS

Is Vestas (CPSE:VWS) Overvalued After Its Recent Share Price Rally? Exploring the Latest Valuation Narrative

Reviewed by Simply Wall St

Vestas Wind Systems (CPSE:VWS) has been quietly putting together a solid run, with the stock up roughly 52% year-to-date and about 30% over the past 3 months, outpacing many renewables peers.

See our latest analysis for Vestas Wind Systems.

That momentum is clearly building, with a 1 month share price return of just over 20% and a 1 year total shareholder return close to 49%, even though the 3 and 5 year total shareholder returns are still negative. This suggests investors are now reassessing both Vestas Wind Systems growth potential and its risk profile at a share price of $159.35.

If Vestas Wind Systems has you thinking about where the next wave of renewables linked growth might come from, it could be worth exploring fast growing stocks with high insider ownership as potential ideas to research next.

Yet with the share price hovering slightly above analyst targets and recent gains far outpacing earnings growth, investors must now ask: Is Vestas still undervalued, or is the market already pricing in its future expansion?

Most Popular Narrative Narrative: 2% Overvalued

Against a last close of DKK159.35, the most followed narrative points to a fair value of DKK156.26, framing Vestas as slightly ahead of its fundamentals.

The analysts have a consensus price target of DKK139.905 for Vestas Wind Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of DKK195.99, and the most bearish reporting a price target of just DKK60.0.

Curious how steady double digit earnings growth, firmer margins and a lower discount rate still produce only a modest upside case? Want to see which future profit multiple underpins that call and how ambitious the revenue trajectory really is? The full narrative reveals the exact assumptions that have nudged fair value just below today’s price.

Result: Fair Value of DKK156.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution setbacks in offshore projects and renewed policy uncertainty, particularly in the US, could quickly challenge the current fair value narrative.

Find out about the key risks to this Vestas Wind Systems narrative.

Another Way to Look at Value

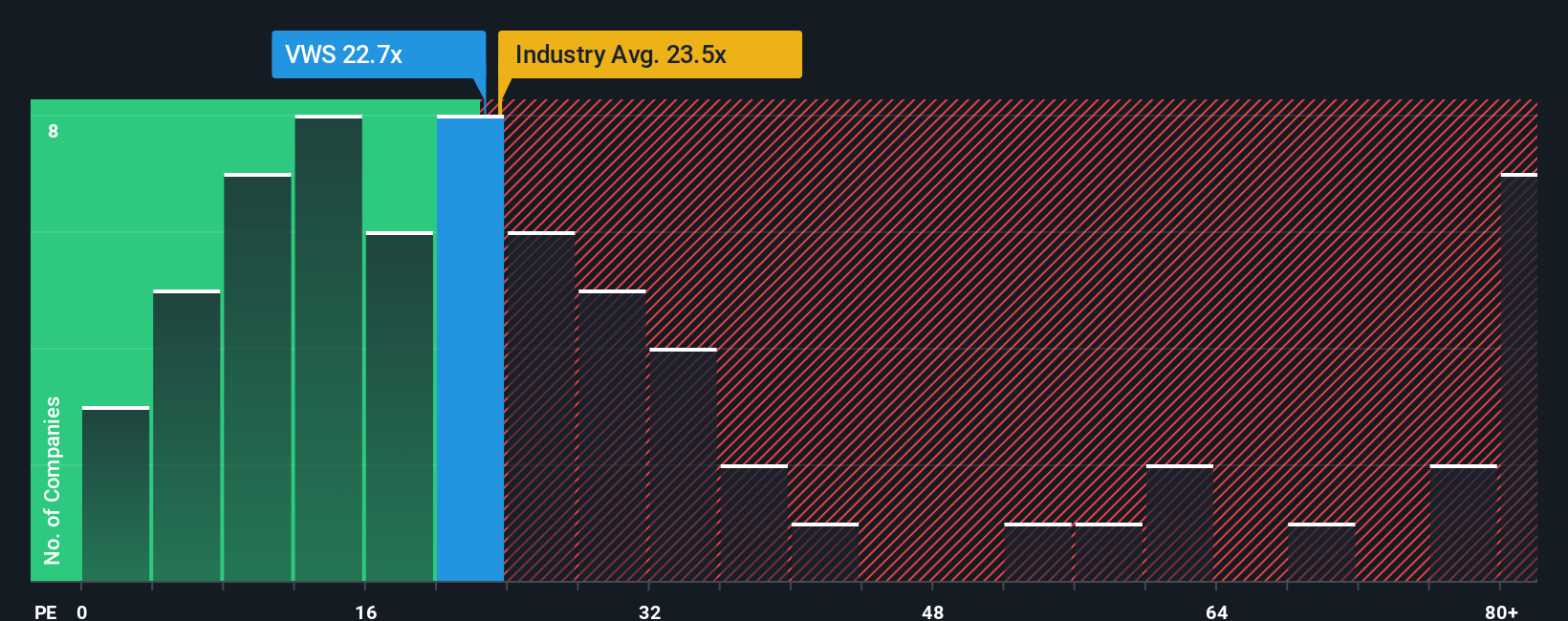

Analyst targets suggest Vestas is a touch overvalued, yet its current price to earnings ratio of 22.6 times still sits below both peers at 26.3 times and a fair ratio of 26.9 times. If sentiment turns, could that gap close in Vestas favor or widen instead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vestas Wind Systems Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Vestas Wind Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you can put the momentum you see in Vestas to work by scanning hand picked opportunities in other corners of the market using the Simply Wall St Screener.

- Capture potential pricing discrepancies by running through these 932 undervalued stocks based on cash flows that may offer a different profile from today’s market favorites.

- Focus on innovation by targeting these 24 AI penny stocks at the forefront of machine learning, automation, and next generation software.

- Explore income focused opportunities with these 14 dividend stocks with yields > 3% that aim to support long term returns even when markets become volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:VWS

Vestas Wind Systems

Engages in the design, manufacture, installation, and services of wind turbines the United States, Denmark, and internationally.

Outstanding track record and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026