- Denmark

- /

- Trade Distributors

- /

- CPSE:SOLAR B

Top Dividend Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and climbing stock indexes, investors are closely monitoring the potential impacts of trade policies and interest rate expectations. With major indices like the S&P 500 and Nasdaq Composite nearing record highs, dividend stocks may offer a compelling option for those seeking stable income amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.95% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.41% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.69% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.15% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1996 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

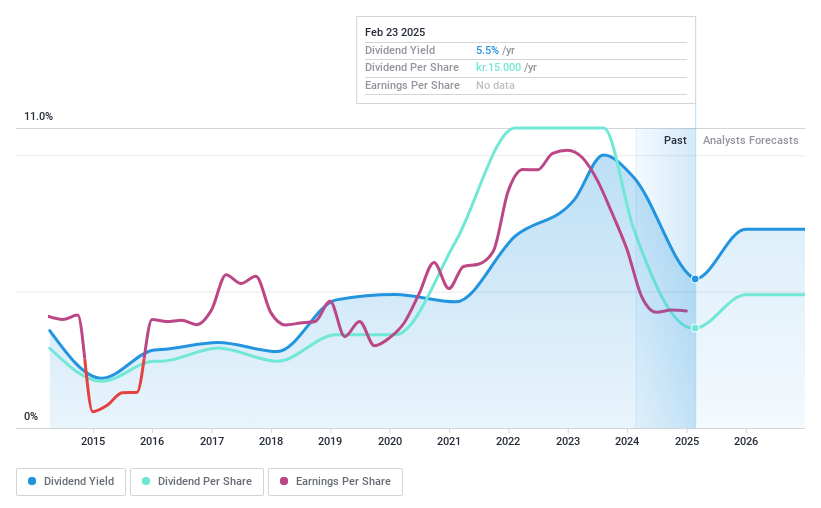

Solar (CPSE:SOLAR B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Solar A/S is a sourcing and services company specializing in electrical, heating and plumbing, ventilation, and climate and energy solutions across Denmark, Sweden, Norway, and the Netherlands with a market cap of DKK1.97 billion.

Operations: Solar A/S generates revenue from three main segments: Trade (DKK1.17 billion), Industry (DKK4.34 billion), and Installation (DKK6.72 billion).

Dividend Yield: 5.6%

Solar A/S has announced a proposed dividend of DKK 15 per share for 2024, with a payout ratio of 72%, aligning with its policy to distribute at least 35% of profits. Despite a decrease in net income and sales from the previous year, dividends are covered by both earnings and cash flows. The upcoming stock split aims to attract new investors. Dividend payments have been volatile historically, but the current yield is among the top in Denmark.

- Click here to discover the nuances of Solar with our detailed analytical dividend report.

- The analysis detailed in our Solar valuation report hints at an deflated share price compared to its estimated value.

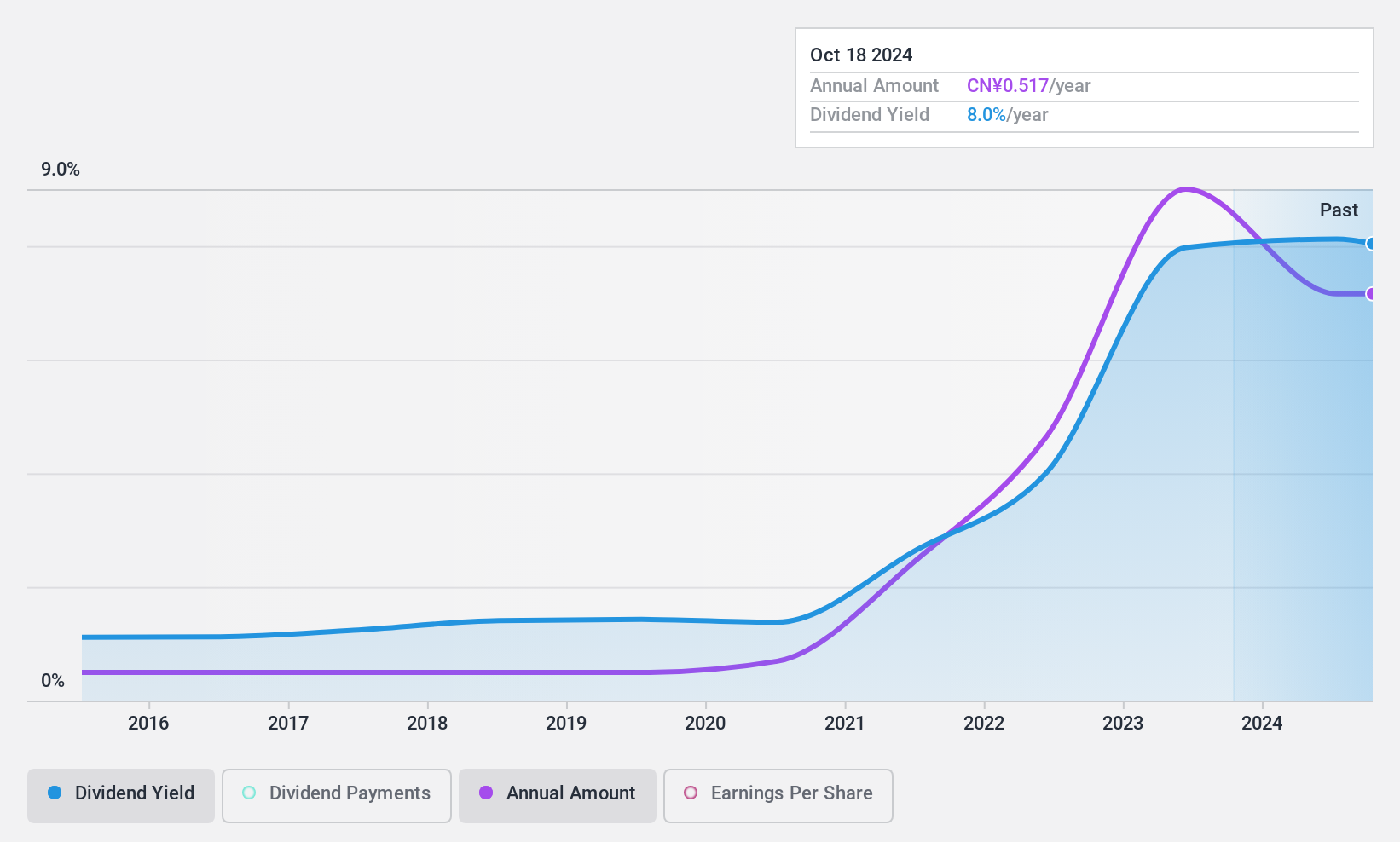

Sichuan Road & Bridge GroupLtd (SHSE:600039)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sichuan Road & Bridge Group Co., Ltd is involved in the investment, development, construction, and operation of engineering projects, mining, clean energy, and new materials both in China and internationally with a market cap of CN¥61.25 billion.

Operations: Sichuan Road & Bridge Group Co., Ltd generates its revenue from engineering construction (CN¥66.32 billion), mining (CN¥1.92 billion), and clean energy and new materials (CN¥2.56 billion).

Dividend Yield: 7.4%

Sichuan Road & Bridge Group Ltd. offers a dividend yield of 7.35%, placing it among the top 25% in China, yet its dividends are not supported by free cash flows despite being covered by earnings with a payout ratio of 79.4%. The company's dividends have been stable and reliable over the past decade, showing consistent growth. However, debt coverage through operating cash flow remains inadequate, raising concerns about long-term sustainability.

- Dive into the specifics of Sichuan Road & Bridge GroupLtd here with our thorough dividend report.

- The valuation report we've compiled suggests that Sichuan Road & Bridge GroupLtd's current price could be quite moderate.

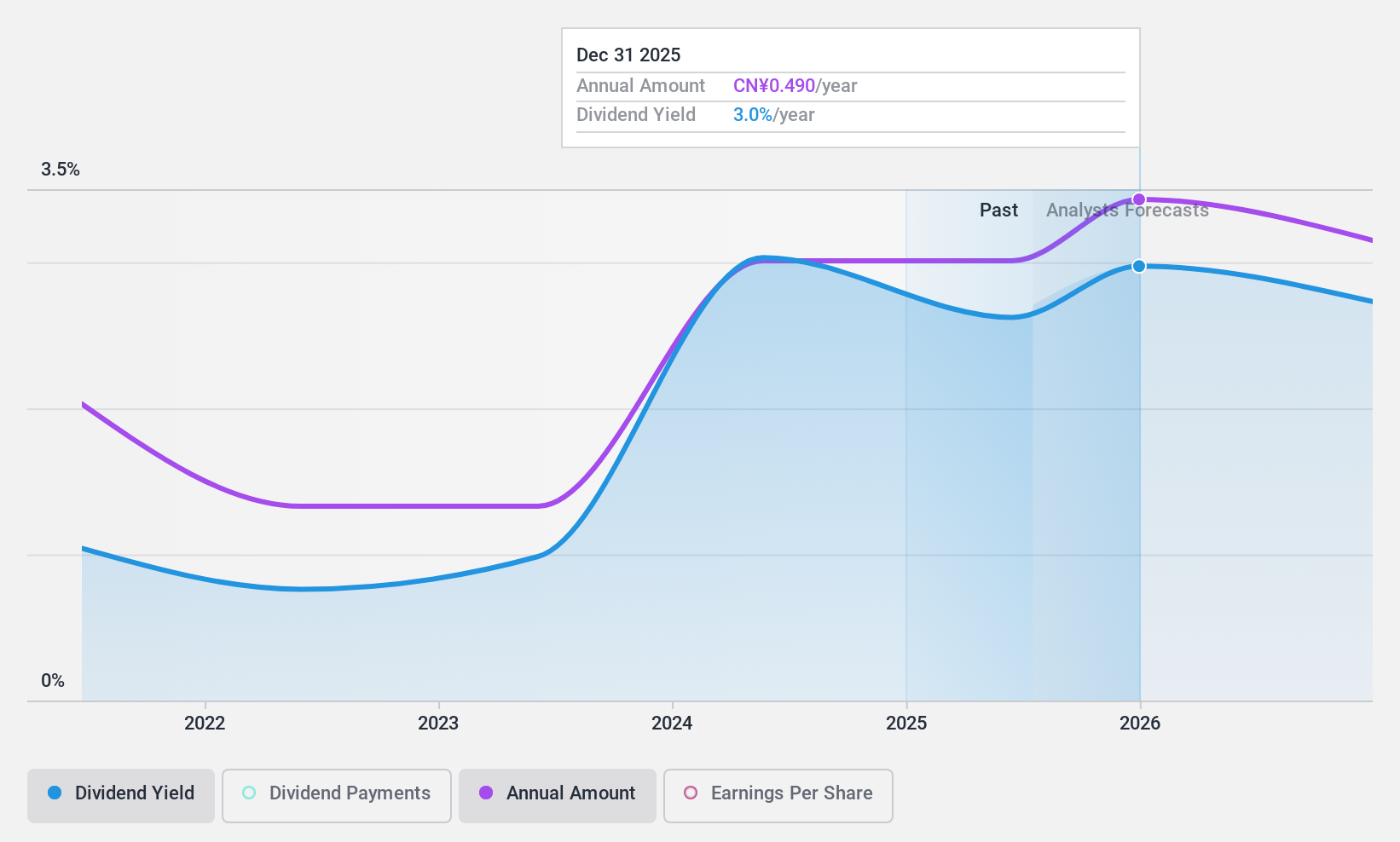

Wuhan Keqian BiologyLtd (SHSE:688526)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wuhan Keqian Biology Co., Ltd engages in the R&D, production, sales, and technical services for animal epidemic prevention of veterinary biological products in China with a market cap of CN¥6.27 billion.

Operations: Wuhan Keqian Biology Co., Ltd generates its revenue primarily from the Veterinary Biological Products Industry, amounting to CN¥902.14 million.

Dividend Yield: 3.2%

Wuhan Keqian Biology Ltd.'s dividend yield of 3.19% ranks in the top 25% in China, supported by a payout ratio of 67.1%, indicating coverage by earnings and cash flows. However, its dividend history is short and volatile over four years, raising sustainability concerns despite recent growth. The stock trades at a significant discount to estimated fair value, suggesting potential upside if stability improves. A recent buyback totaling CNY 34.76 million may signal management's confidence in future prospects.

- Unlock comprehensive insights into our analysis of Wuhan Keqian BiologyLtd stock in this dividend report.

- Our valuation report unveils the possibility Wuhan Keqian BiologyLtd's shares may be trading at a discount.

Summing It All Up

- Access the full spectrum of 1996 Top Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:SOLAR B

Solar

Operates as a sourcing and services company in electrical, heating and plumbing, ventilation, and climate and energy solutions in the Danish, Swedish, Norwegian, and Dutch markets.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives