Rockwool's (CPH:ROCK B) five-year earnings growth trails the strong shareholder returns

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of Rockwool A/S (CPH:ROCK B) stock is up an impressive 108% over the last five years. It's also good to see the share price up 16% over the last quarter.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Our free stock report includes 2 warning signs investors should be aware of before investing in Rockwool. Read for free now.While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

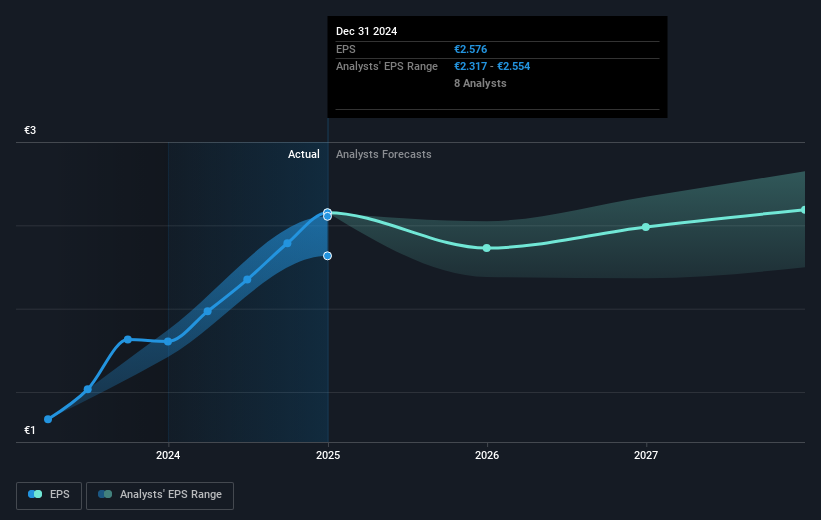

Over half a decade, Rockwool managed to grow its earnings per share at 15% a year. That makes the EPS growth particularly close to the yearly share price growth of 16%. That suggests that the market sentiment around the company hasn't changed much over that time. Indeed, it would appear the share price is reacting to the EPS.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Rockwool has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Rockwool will grow revenue in the future.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Rockwool's TSR for the last 5 years was 128%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Rockwool shareholders have received a total shareholder return of 33% over the last year. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 18% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Rockwool (of which 1 makes us a bit uncomfortable!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Danish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:ROCK B

Rockwool

Produces and sells stone wool insulation products in Western Europe, Eastern Europe, Russia, North America, Asia, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives