Undiscovered Gems in Europe with Strong Potential This May 2025

Reviewed by Simply Wall St

As European markets show resilience with the STOXX Europe 600 Index rising by 2.77% amid easing trade tensions, investors are keenly observing small-cap stocks for potential opportunities. In this environment, a good stock is often characterized by strong fundamentals and the ability to navigate economic uncertainties effectively, making it an attractive consideration for those seeking undiscovered gems in Europe's diverse market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

MT Højgaard Holding (CPSE:MTHH)

Simply Wall St Value Rating: ★★★★★☆

Overview: MT Højgaard Holding A/S provides construction, civil engineering, and infrastructure services to both private and public sectors in Denmark and internationally, with a market cap of DKK2.07 billion.

Operations: MT Højgaard Holding generates revenue primarily through its segments: MT Højgaard Danmark (DKK6.08 billion), Enemærke & Petersen (DKK4.19 billion), and MT Højgaard Property Development (DKK495.1 million). The company's net profit margin reflects the efficiency of its operations in converting revenue into actual profit, providing insight into profitability trends over time.

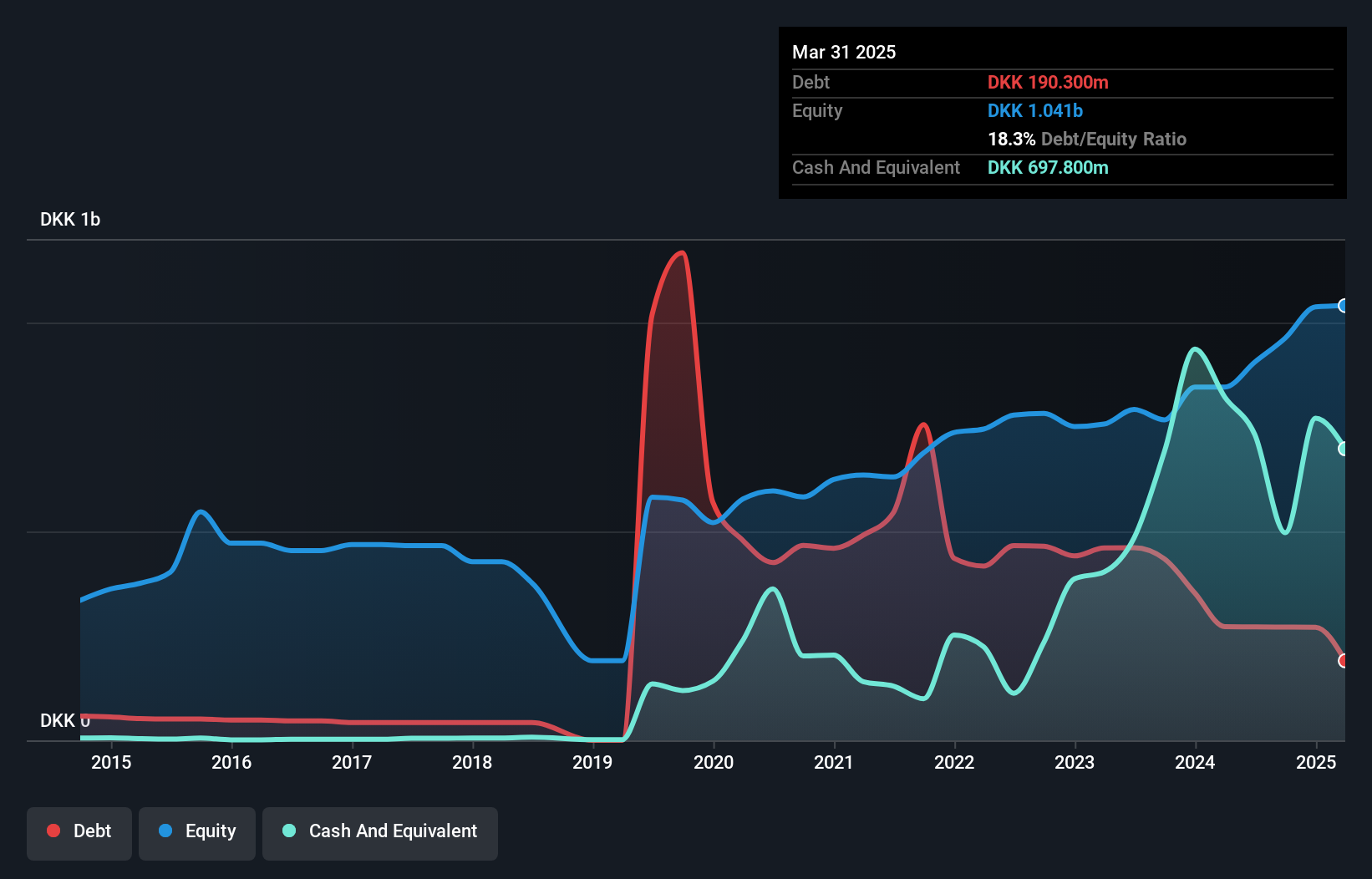

MT Højgaard Holding, a notable player in Denmark's construction sector, has demonstrated robust financial health with its debt to equity ratio dropping from 109.3% to 26.1% over five years. The company's earnings grew by 17.1%, outpacing the industry average of 7.3%. With a price-to-earnings ratio of 5.8x, significantly lower than the Danish market's 14.5x, it offers potential value for investors. Recent restructuring efforts aim to streamline operations and enhance synergies within MT Højgaard Danmark, potentially reducing complexity and costs while focusing on core activities like civil works and infrastructure projects in Denmark.

- Click here and access our complete health analysis report to understand the dynamics of MT Højgaard Holding.

Assess MT Højgaard Holding's past performance with our detailed historical performance reports.

Norion Bank (OM:NORION)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Norion Bank AB (publ) offers financial solutions to medium-sized corporates, real estate companies, merchants, and private individuals across Sweden, Germany, Norway, Denmark, Finland, and internationally with a market cap of approximately SEK8.12 billion.

Operations: Norion Bank generates revenue primarily from its Real Estate segment at SEK1.22 billion, followed by Consumer and Corporate segments at SEK930 million and SEK827 million, respectively. Payments contribute SEK501 million to the total revenue.

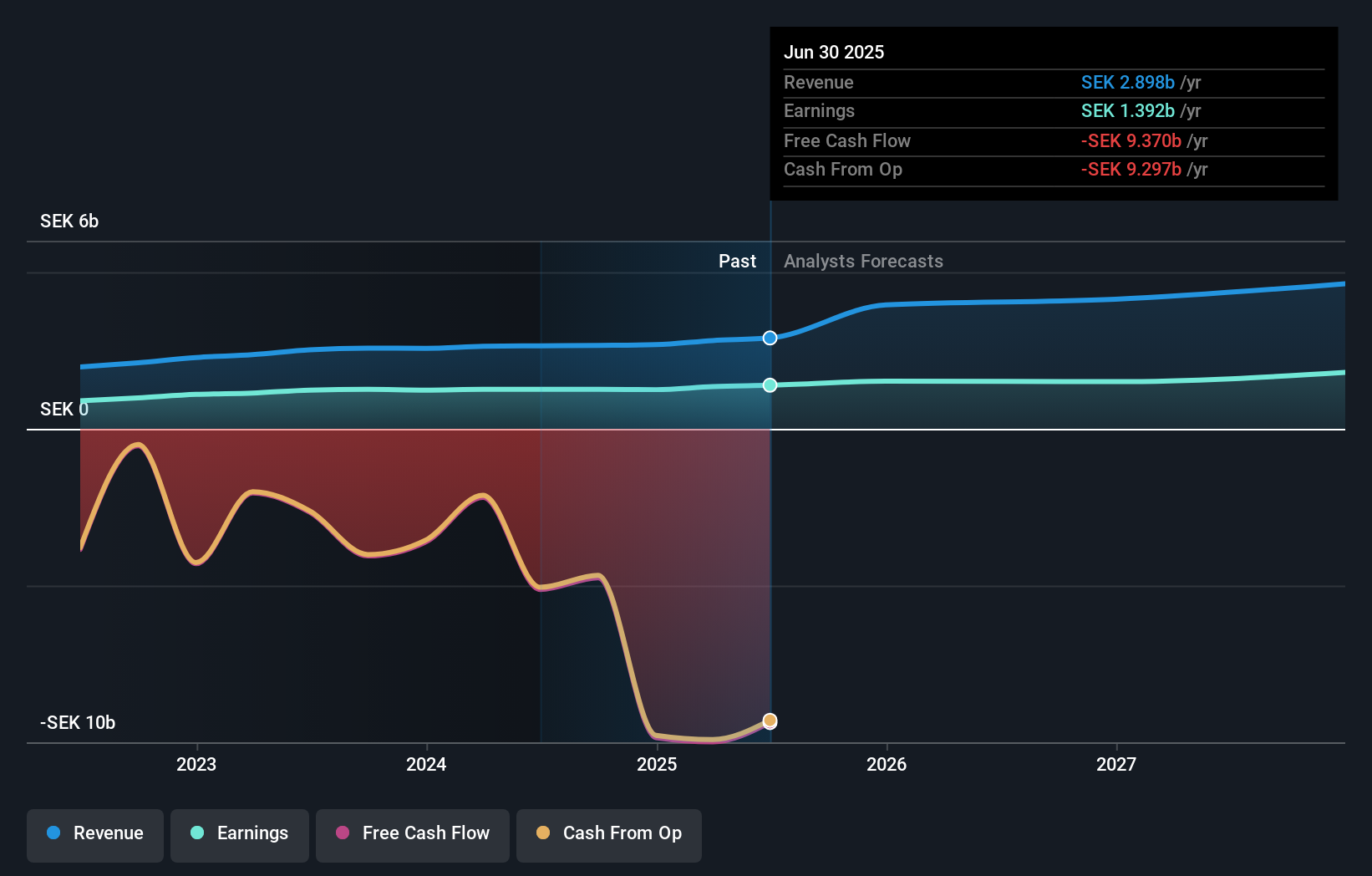

Norion Bank, a compact player in the financial sector, showcases a mixed bag of strengths and challenges. With total assets of SEK67.6 billion and equity at SEK9.5 billion, it operates on solid ground with 93% low-risk funding sources like customer deposits. However, bad loans are high at 21.2%, and the allowance for these is relatively low at 49%. Despite these hurdles, earnings grew by 7.2% last year, outpacing the industry average of -1.7%. Trading significantly below its estimated fair value by 78.8%, Norion offers intriguing potential for investors seeking undervalued opportunities in Europe’s banking landscape.

Cicor Technologies (SWX:CICN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cicor Technologies Ltd., along with its subsidiaries, is engaged in the development and manufacturing of electronic components, devices, and systems on a global scale, with a market capitalization of CHF483.33 million.

Operations: Cicor Technologies generates revenue primarily through its Electronic Manufacturing Services (EMS) Division, contributing CHF347.90 million, and the Advanced Substrates (AS) Division, which adds CHF43 million. The EMS division is the major revenue driver for the company.

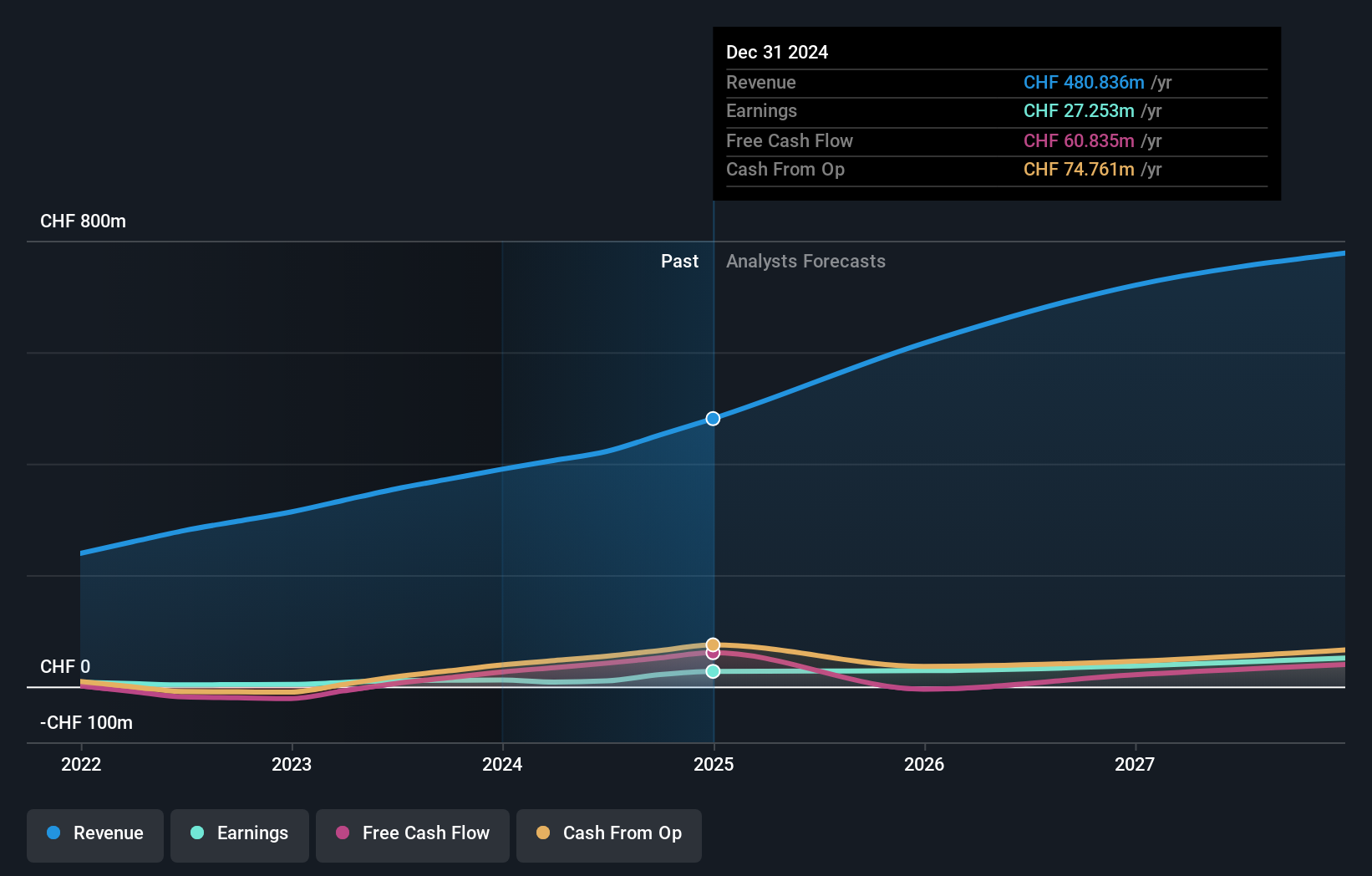

Cicor Technologies, a nimble player in the European electronics manufacturing space, is making waves with its strategic moves in the Aerospace and Defense sectors. The company recently inked a deal with Mercury Mission Systems International to enhance its production capabilities, which should bolster its presence across Europe. Cicor's earnings skyrocketed by 349% last year, far outpacing industry growth of 70%. Despite having a high net debt to equity ratio of 45%, interest payments are well-covered by EBIT at 14.6 times coverage. Trading at CHF 111, it sits close to analysts' target of CHF 103.78 but remains an intriguing prospect given its expansion plans and strong market positioning.

Make It Happen

- Dive into all 343 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CICN

Cicor Technologies

Develops, and manufactures electronic components, devices, and systems worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives