If you're looking for a multi-bagger, there's a few things to keep an eye out for. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. That's why when we briefly looked at Hove's (CPH:HOVE) ROCE trend, we were pretty happy with what we saw.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Hove:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.16 = kr.13m ÷ (kr.105m - kr.20m) (Based on the trailing twelve months to June 2024).

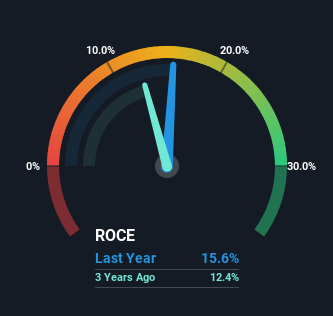

So, Hove has an ROCE of 16%. On its own, that's a standard return, however it's much better than the 11% generated by the Machinery industry.

See our latest analysis for Hove

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Hove.

What Can We Tell From Hove's ROCE Trend?

The trend of ROCE doesn't stand out much, but returns on a whole are decent. Over the past four years, ROCE has remained relatively flat at around 16% and the business has deployed 150% more capital into its operations. 16% is a pretty standard return, and it provides some comfort knowing that Hove has consistently earned this amount. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

On a side note, Hove has done well to reduce current liabilities to 20% of total assets over the last four years. Effectively suppliers now fund less of the business, which can lower some elements of risk.

The Bottom Line

To sum it up, Hove has simply been reinvesting capital steadily, at those decent rates of return. However, despite the favorable fundamentals, the stock has fallen 16% over the last three years, so there might be an opportunity here for astute investors. That's why we think it'd be worthwhile to look further into this stock given the fundamentals are appealing.

On a separate note, we've found 3 warning signs for Hove you'll probably want to know about.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Hove might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:HOVE

Hove

Develops, produces, and supplies advanced lubrication solutions for heavy machinery in Denmark and inetrnationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026