- Denmark

- /

- Electrical

- /

- CPSE:GREENH

Even after rising 24% this past week, Green Hydrogen Systems (CPH:GREENH) shareholders are still down 63% over the past year

It's nice to see the Green Hydrogen Systems A/S (CPH:GREENH) share price up 24% in a week. But that isn't much consolation to those who have suffered through the declines of the last year. Specifically, the stock price slipped by 80% in that time. Some might say the recent bounce is to be expected after such a bad drop. Arguably, the fall was overdone.

The recent uptick of 24% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Green Hydrogen Systems

Because Green Hydrogen Systems made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Green Hydrogen Systems saw its revenue grow by 551%. That's a strong result which is better than most other loss making companies. So on the face of it we're really surprised to see the share price down 80% over twelve months. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. We'd recommend taking a very close look at the stock (and any available forecasts), before considering a purchase, because the share price is not correlated with the revenue growth, that's for sure. Of course, markets do over-react so share price drop may be too harsh.

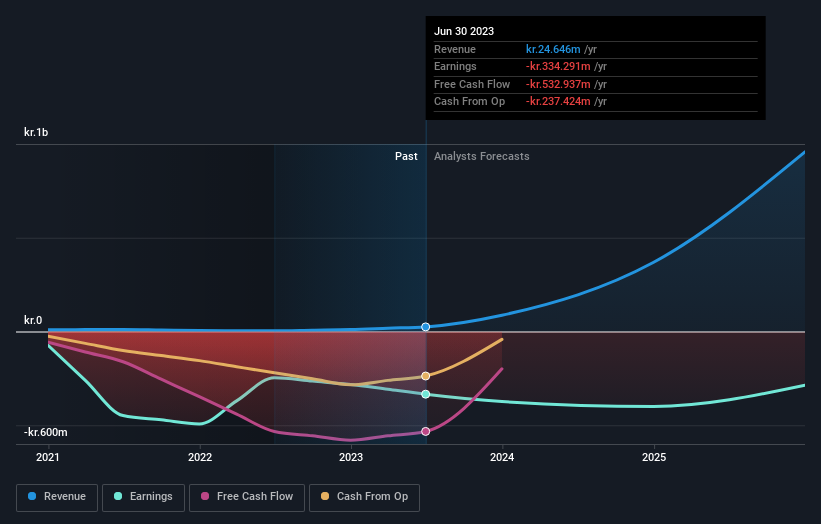

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

We've already covered Green Hydrogen Systems' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Green Hydrogen Systems hasn't been paying dividends, but its TSR of -63% exceeds its share price return of -80%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While Green Hydrogen Systems shareholders are down 63% for the year, the market itself is up 32%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 11%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Green Hydrogen Systems better, we need to consider many other factors. For example, we've discovered 5 warning signs for Green Hydrogen Systems (2 are a bit unpleasant!) that you should be aware of before investing here.

Of course Green Hydrogen Systems may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Danish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:GREENH

Green Hydrogen Systems

Develops and produces electrolysers for hydrogen production based on renewable energy in United Kingdom, Norway, Chile, and Switzerland.

Slight with limited growth.

Similar Companies

Market Insights

Community Narratives