- Spain

- /

- Construction

- /

- BME:GSJ

3 Undiscovered European Gems with Promising Potential

Reviewed by Simply Wall St

As European markets experience a positive uptick, with the STOXX Europe 600 Index rising by 2.77% amid easing trade tensions and optimistic economic signals, investors are increasingly looking towards small-cap stocks for potential growth opportunities. In this dynamic environment, identifying promising stocks involves seeking companies that demonstrate resilience and adaptability in response to shifting market conditions and geopolitical developments.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Grupo Empresarial San José (BME:GSJ)

Simply Wall St Value Rating: ★★★★★★

Overview: Grupo Empresarial San José, S.A. operates in the construction industry both in Spain and internationally, with a market capitalization of approximately €376.50 million.

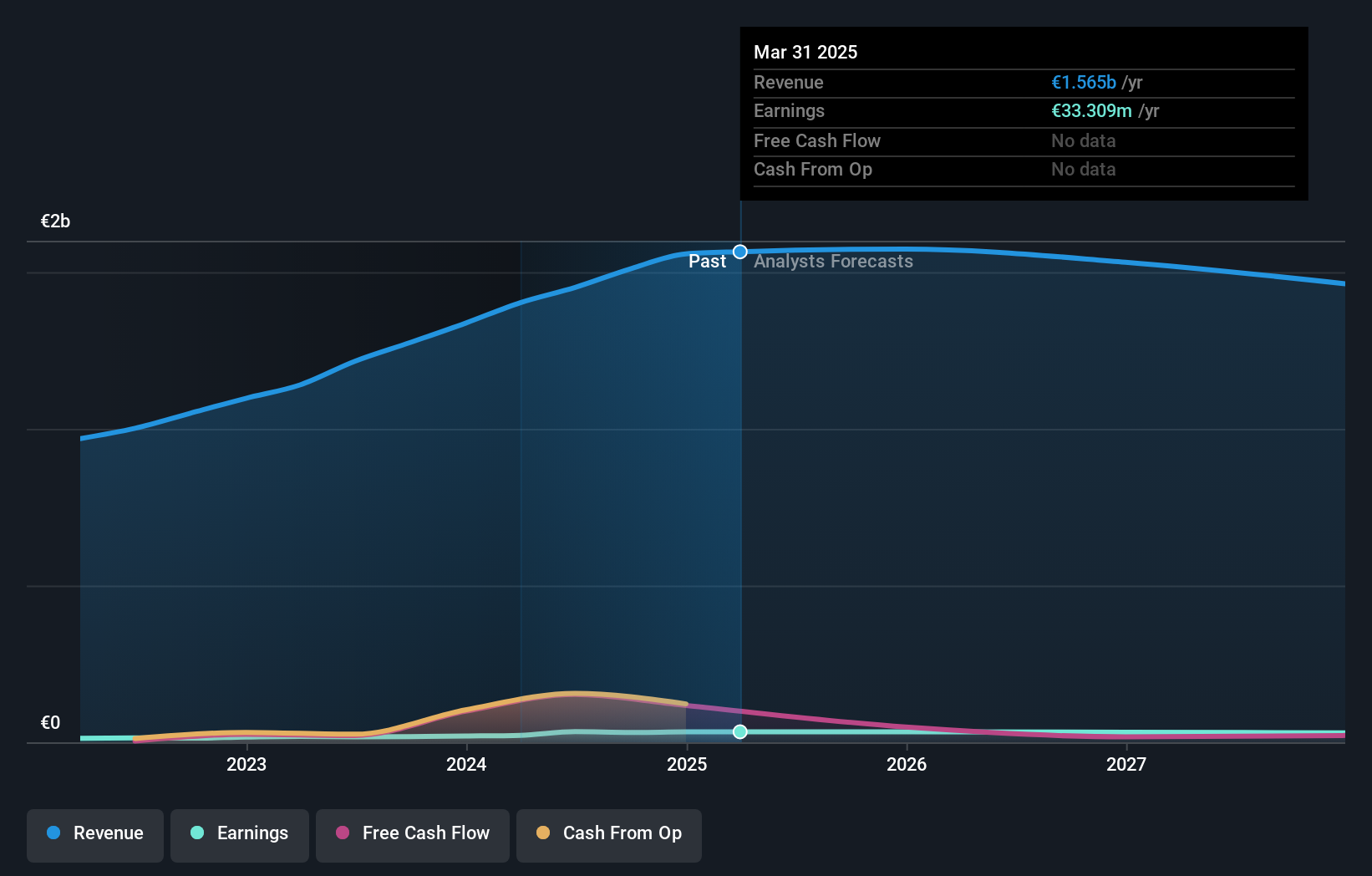

Operations: Grupo Empresarial San José generates revenue primarily from its construction segment, which accounts for €1.43 billion, followed by energy and concessions and services at €10.14 million and €79.51 million, respectively. The company also engages in real estate and urban development with revenues of €7.63 million.

GSJ, a notable player in the construction sector, has seen its debt to equity ratio drop significantly from 111.8% to 41.9% over the past five years, indicating improved financial stability. The company boasts a price-to-earnings ratio of 11.4x, which is lower than the Spanish market average of 18.5x, suggesting potential undervaluation. Despite earnings growth of 65.6% last year matching industry performance, future projections indicate an average annual decline of 1.7%. Recent earnings results show sales reaching €1.56 billion and net income at €33 million for 2024 compared to previous figures of €1.34 billion and €19 million respectively.

- Click to explore a detailed breakdown of our findings in Grupo Empresarial San José's health report.

Learn about Grupo Empresarial San José's historical performance.

Sparekassen Sjælland-Fyn (CPSE:SPKSJF)

Simply Wall St Value Rating: ★★★★☆☆

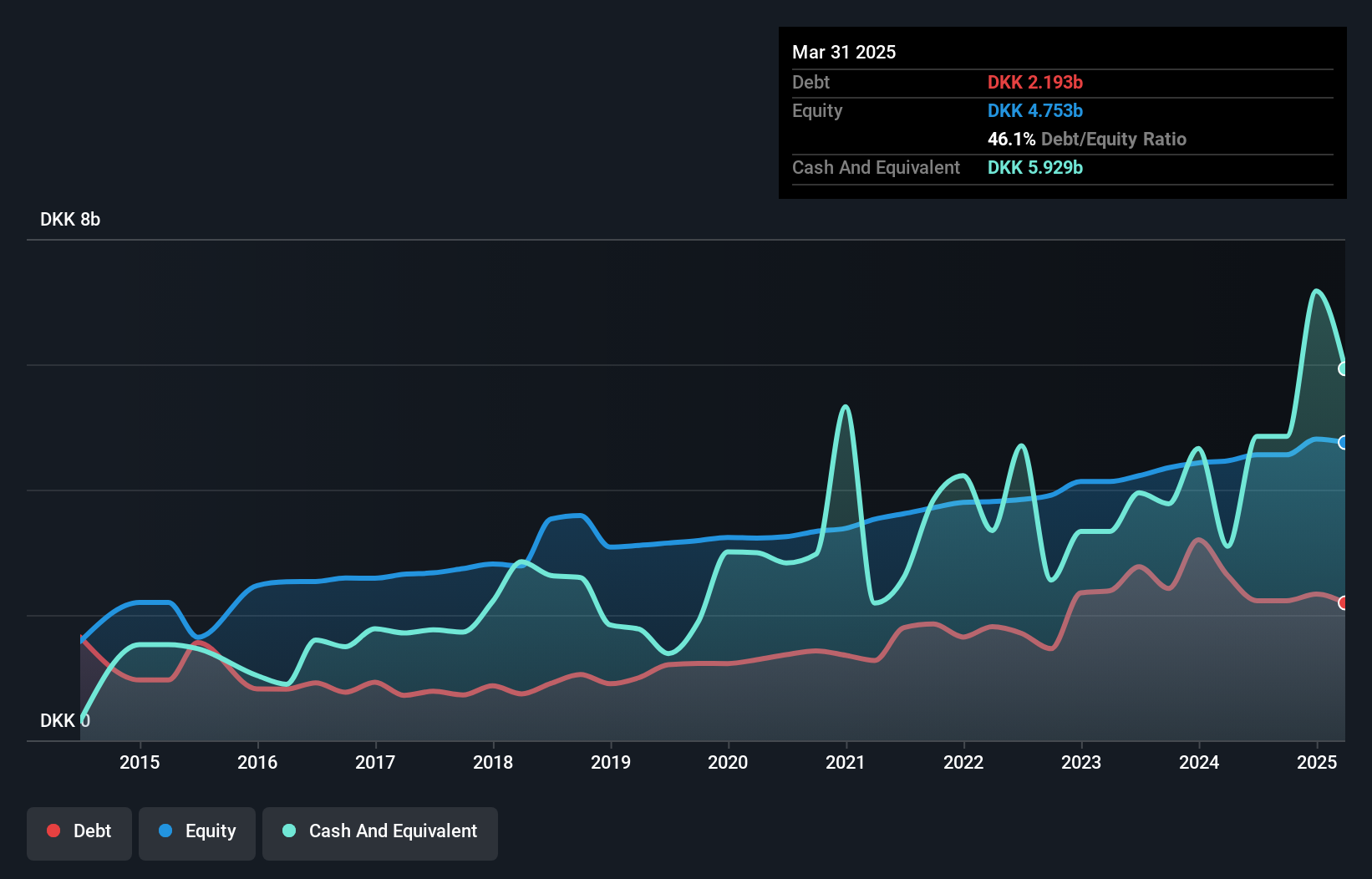

Overview: Sparekassen Sjælland-Fyn A/S is a savings bank that offers financial products and services to both private and corporate clients, with a market capitalization of DKK4.61 billion.

Operations: Sparekassen Sjælland-Fyn generates revenue primarily through its banking segment, amounting to DKK1.71 billion.

Sparekassen Sjælland-Fyn, with total assets of DKK32.1 billion and equity at DKK4.8 billion, is an intriguing player in the financial sector. The bank's earnings growth of 11% over the past year outpaced the industry average by a significant margin, showcasing its robust performance. With total deposits standing at DKK24.4 billion against loans of DKK12.8 billion, it operates on a solid foundation supported by primarily low-risk funding sources comprising 89% customer deposits. Trading at 42% below fair value estimates suggests potential upside for investors seeking undervalued opportunities in this space.

- Click here to discover the nuances of Sparekassen Sjælland-Fyn with our detailed analytical health report.

Understand Sparekassen Sjælland-Fyn's track record by examining our Past report.

Metall Zug (SWX:METN)

Simply Wall St Value Rating: ★★★★☆☆

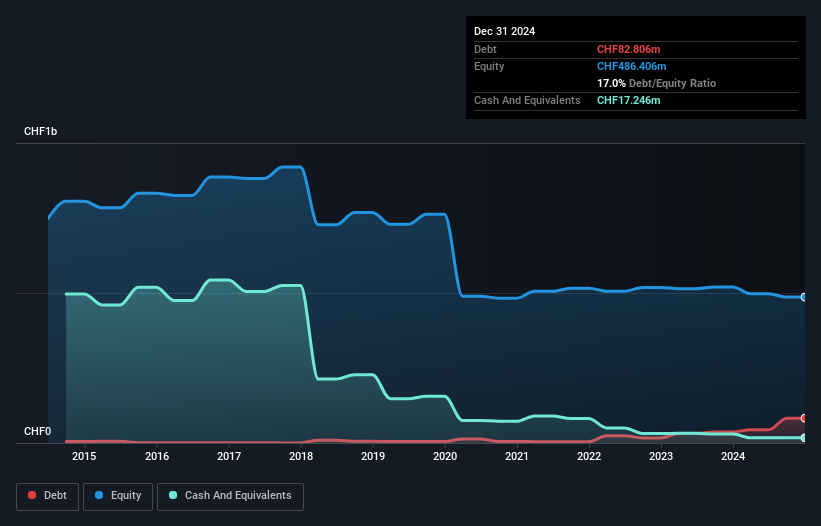

Overview: Metall Zug AG operates through its subsidiaries in the medical devices, infection control, technology cluster and infrastructure sectors across Switzerland and globally, with a market capitalization of CHF463.50 million.

Operations: The company generates revenue primarily from its Medical Devices segment at CHF167.57 million and Infection Control at CHF68.67 million, with additional contributions from Investments & Corporate amounting to CHF49.09 million.

Metall Zug, a smaller player in the Swiss market, recently reported sales of CHF 283.42 million for 2024, down from CHF 494.72 million the previous year, yet net income jumped to CHF 52.59 million from CHF 21.61 million. This jump in profitability highlights its high-quality earnings and effective cost management despite reduced sales figures. The company’s net debt to equity ratio stands at a satisfactory 13.5%, with interest payments well covered by EBIT at a remarkable 100 times coverage level, indicating strong financial health amidst industry challenges and forecasts of an average annual earnings decline of 8.6% over the next three years.

- Take a closer look at Metall Zug's potential here in our health report.

Gain insights into Metall Zug's historical performance by reviewing our past performance report.

Taking Advantage

- Unlock our comprehensive list of 350 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:GSJ

Grupo Empresarial San José

Engages in construction business in Spain and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives