Ringkjøbing Landbobank (CPSE:RILBA) Margin Decline Challenges Defensive Growth Narrative

Reviewed by Simply Wall St

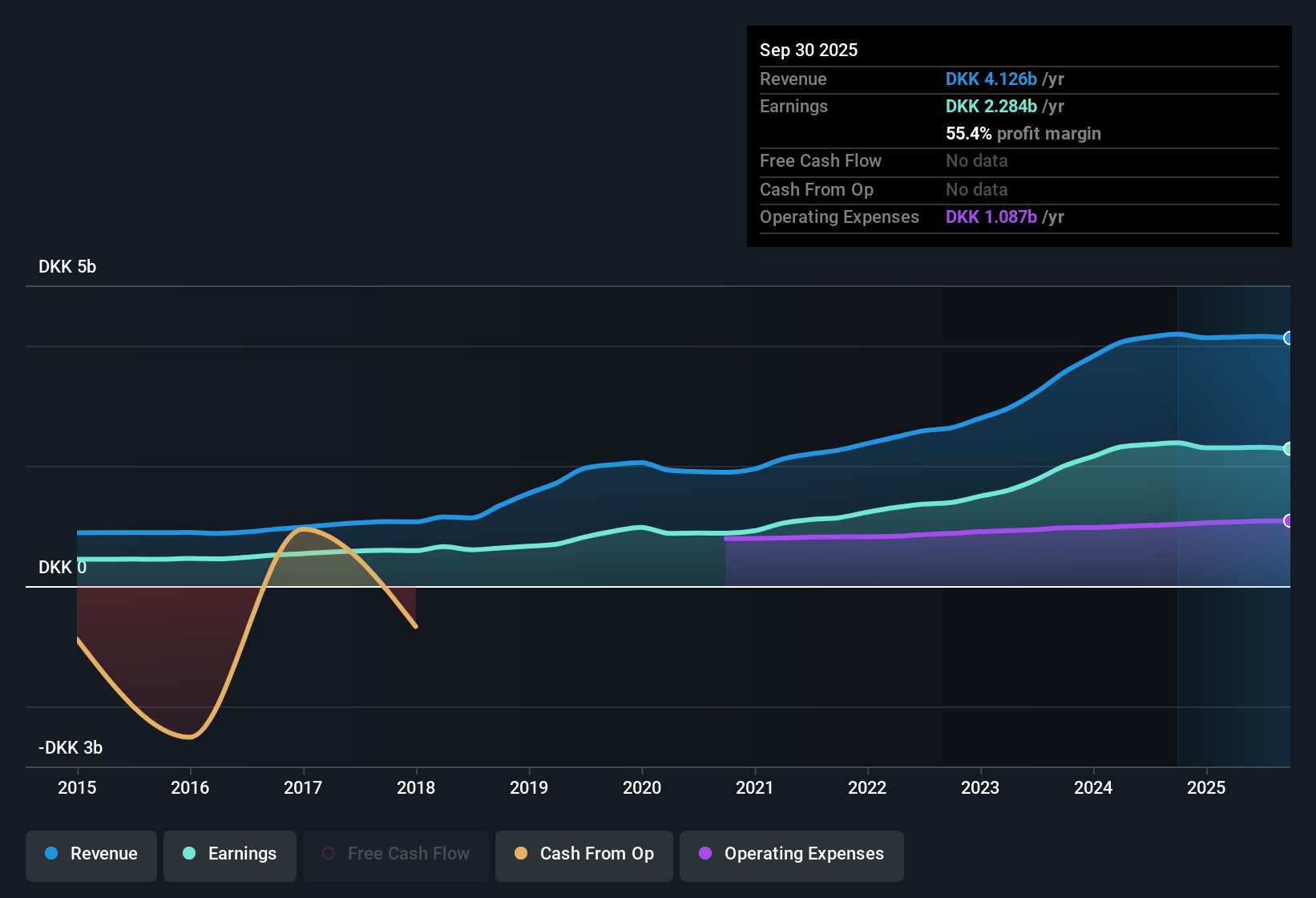

Ringkjøbing Landbobank (CPSE:RILBA) reported net profit margins of 55.7%, a slight decline from last year’s 56.9%. Earnings have grown at a robust 21.6% annually over the past five years but slipped into negative territory year-on-year. Revenue is forecast to rise 2.9% per year and earnings 1.4% annually, both trailing the Danish market growth rates. Despite these lower forward growth prospects, investors may be watching closely as the bank’s high-quality earnings profile and strong historical momentum are balanced by a current premium on its share price and moderating margins.

See our full analysis for Ringkjøbing Landbobank.Next, we will see how these results compare to the dominant narratives shaping investor sentiment and whether the numbers support or challenge the consensus view.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Earnings Momentum Slows Sharply

- Despite a 21.6% compound annual earnings growth rate over the past five years, Ringkjøbing Landbobank saw negative earnings growth last year as profit expansion stalled after a strong run.

- Recent trends invite closer scrutiny around the bank’s ability to maintain “defensive darling” status:

- Profit margins, though strong at 55.7%, edged down from 56.9%, signaling that outsized historical gains may be tough to sustain as industry growth slows.

- With forward earnings growth of just 1.4% annually, well below the Danish market’s 3.7%, investors favoring “sleep well at night” stocks must weigh whether stability alone is enough for future upside.

Share Price Trades Below DCF Value, Premium to Peers

- RILBA's current share price of DKK1400 stands at a discount to its DCF fair value estimate of DKK1661.85, but it trades at a 14.6x price-to-earnings multiple versus the peer average of 9.6x and the wider European banks industry at 9.7x.

- This duality supports a nuanced investment narrative:

- The below-fair-value share price, combined with historically high margins, supports optimism among investors betting on continued quality and potential for rerating, especially if digital initiatives or sector tailwinds play out.

- However, the evident P/E premium suggests some of the quality and growth story is already baked in, making it harder for upside surprises if growth lags expectations or margin pressure persists.

No Apparent Red Flags, But Growth Trails Market Pace

- Forecasts point to revenue growth of 2.9% per year for RILBA, behind the Danish market’s 5.3% average, with no major or minor risk flags currently present in regulatory filings.

- With risk signals muted and a strong capital base, the bank’s main challenge becomes re-accelerating growth:

- Analysts and investors will be closely watching whether RILBA can generate new catalysts to escape this lower-growth trajectory, a key differentiator in a market where competitors chase technology-driven gains.

- Any move to bridge the growth gap with the wider sector could reshape both the valuation premium and investor sentiment in the coming quarters.

See our latest analysis for Ringkjøbing Landbobank.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Ringkjøbing Landbobank's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Slowing earnings momentum, moderating margins, and growth now trailing the market mean RILBA’s future upside is less certain than in previous years.

If you want reliable performance and fewer growth surprises, focus your search on companies with consistent expansion by using our stable growth stocks screener (2093 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:RILBA

Ringkjøbing Landbobank

Provides various financial products and services in Denmark.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives