Is Ringkjøbing Landbobank Still Attractive After Its 26.1% One Year Surge in 2025?

Reviewed by Bailey Pemberton

- Wondering if Ringkjøbing Landbobank is still a smart buy after its strong run, or if most of the upside is already priced in? This breakdown will help you decide whether the current tag around DKK 1,439 still offers value.

- The stock has dipped a modest 1.6% over the last month but remains up 18.1% year to date and 26.1% over the past year, with a 178.2% gain over five years that naturally raises questions about how much value is left.

- Recent moves have been shaped by the market continuing to reward well capitalised Nordic banks as interest rate expectations evolve, while investors gravitate toward lenders with consistent profitability and disciplined credit books. At the same time, sector wide debates about how long higher rates can last have injected some caution into bank valuations, which helps explain the short term wobble despite the longer term uptrend.

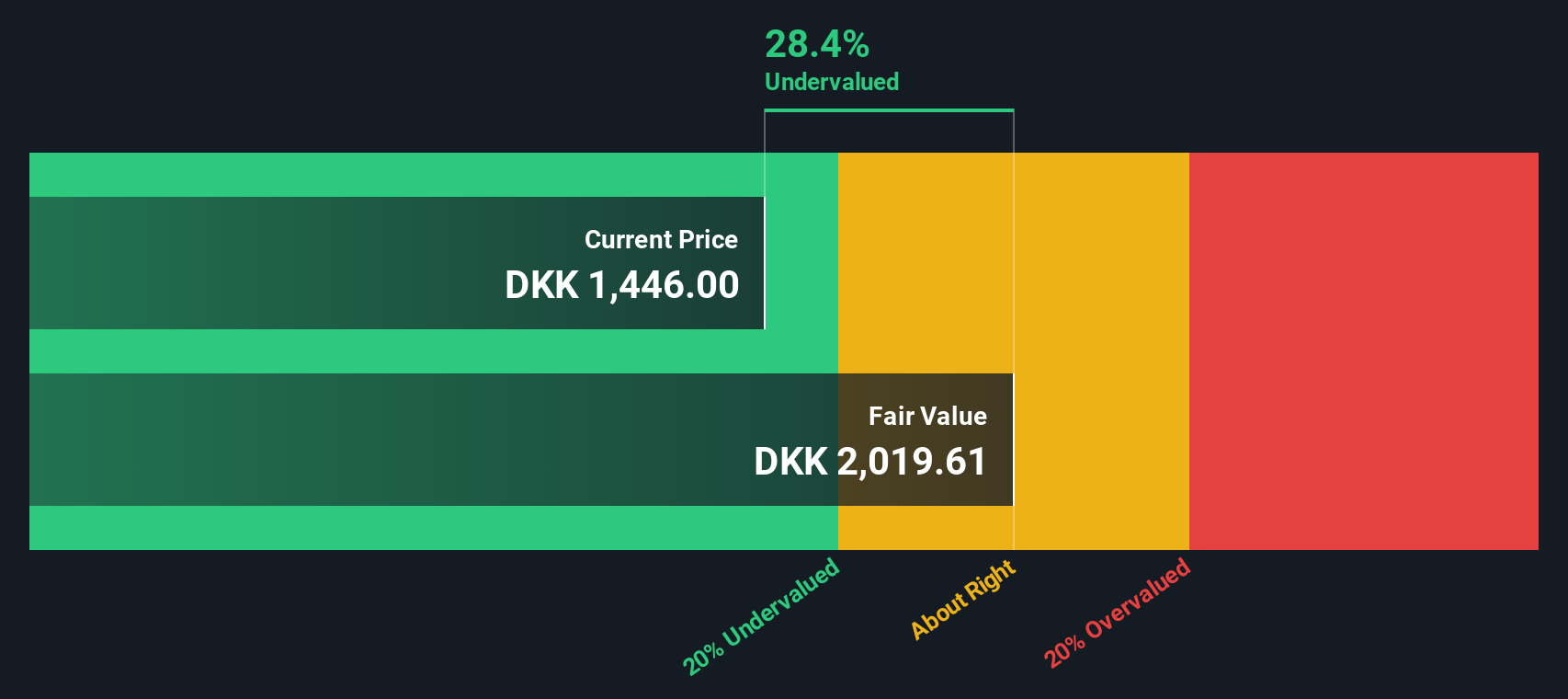

- On our framework Ringkjøbing Landbobank scores 2 out of 6 on undervaluation checks. You can see the detailed breakdown of that valuation score before we walk through DCF, multiples, and asset based approaches, and then look at a more intuitive way to think about what the market is really paying for here.

Ringkjøbing Landbobank scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ringkjøbing Landbobank Excess Returns Analysis

The Excess Returns model looks at how much value a bank creates over and above the minimum return shareholders require, then capitalises those surplus profits into an intrinsic value per share.

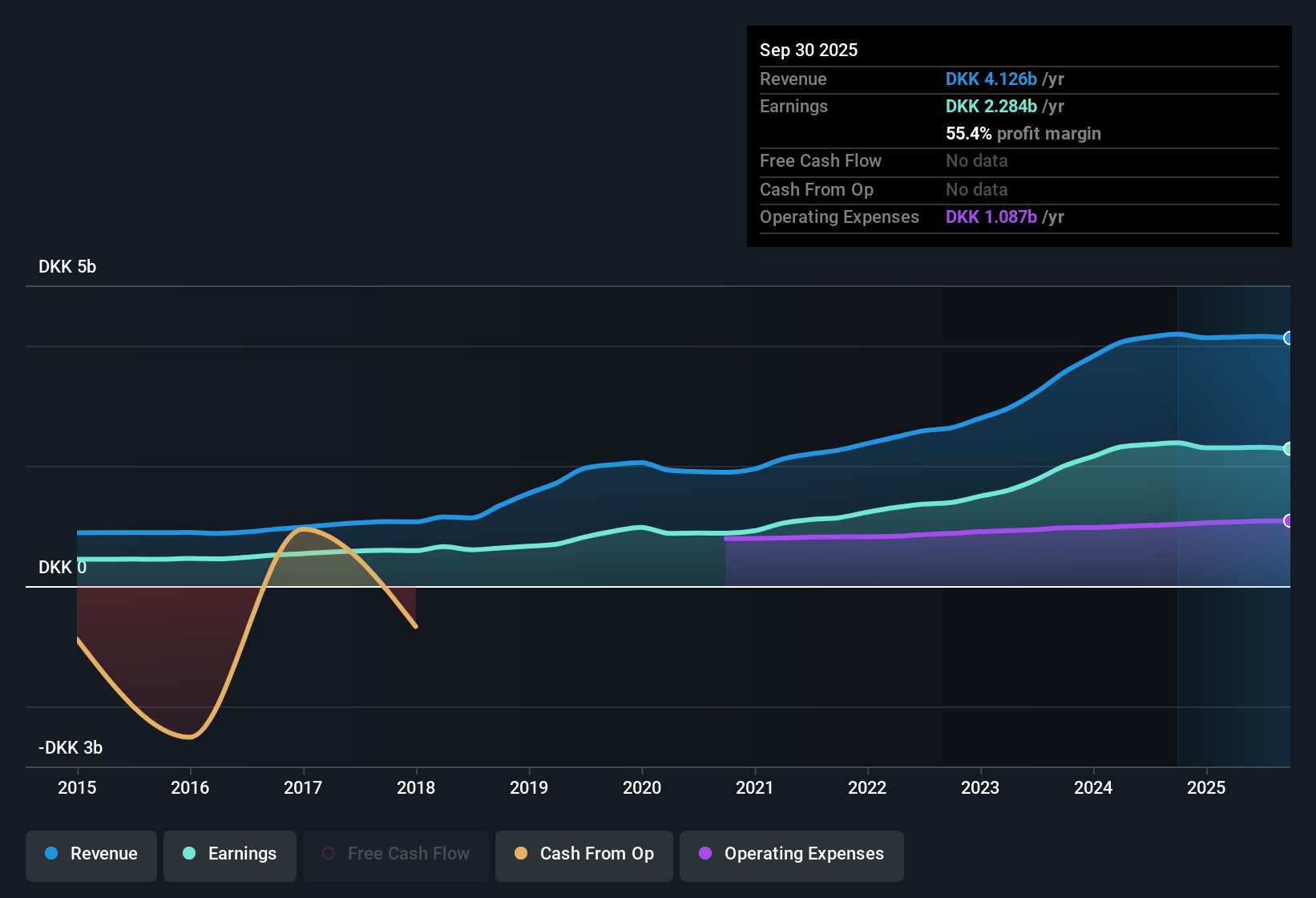

For Ringkjøbing Landbobank, the starting point is its Book Value of DKK462.87 per share and a Stable EPS of DKK109.59 per share, based on the median return on equity from the past 5 years. With an Average Return on Equity of 21.83% and a Cost of Equity of DKK31.17 per share, the bank is generating an Excess Return of DKK78.43 per share, which can be interpreted as a solid value creation signal for a mature lender.

Analysts also expect Stable Book Value to grow to around DKK501.93 per share, using weighted future book value estimates from two analysts. Feeding these assumptions into the Excess Returns framework produces an intrinsic value of roughly DKK2,245 per share. This implies the shares are about 35.9% below that estimate of fair value versus the current price around DKK1,439.

Result: UNDERVALUED

Our Excess Returns analysis suggests Ringkjøbing Landbobank is undervalued by 35.9%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Ringkjøbing Landbobank Price vs Earnings

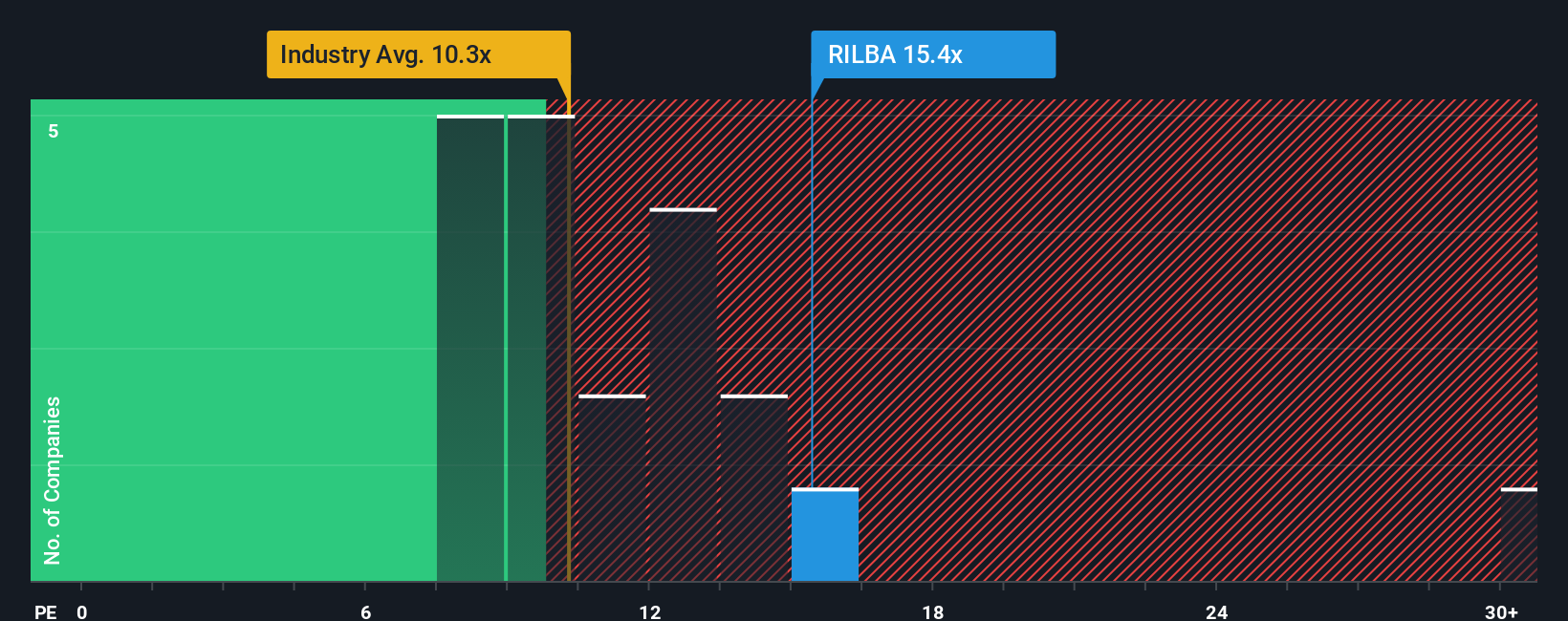

For a consistently profitable bank like Ringkjøbing Landbobank, the price to earnings (PE) ratio is a useful way to gauge how much investors are paying for each unit of current earnings. In general, higher growth and lower risk justify a higher PE, while slower growth or greater uncertainty should translate into a lower, more conservative multiple.

Ringkjøbing Landbobank currently trades on a PE of about 15.4x, which is above both the wider Banks industry average of roughly 10.6x and the peer group average of around 11.7x. That premium signals that the market already recognises the bank’s strong profitability and quality, and is willing to pay more than it does for a typical Nordic lender.

Simply Wall St’s Fair Ratio framework goes a step further than these simple comparisons. It estimates what PE a stock should trade on given its earnings growth profile, risk characteristics, profit margins, industry and market cap. For Ringkjøbing Landbobank, the Fair Ratio is 11.5x, noticeably below the current 15.4x. On this lens, the shares look priced ahead of what the fundamentals alone would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ringkjøbing Landbobank Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, expressed through the numbers you care about, like what you think its fair value is today and how you expect revenue, earnings and margins to evolve over time. Narratives connect three things: the business story, a financial forecast, and then a fair value estimate that you can compare to the current share price. On Simply Wall St, millions of investors build and share these Narratives on the Community page, using them as an easy, accessible tool to decide whether a stock looks like a buy, hold, or sell based on the gap between Fair Value and Price. Because Narratives are linked to live data, they update dynamically when fresh information, like results or news, comes in, helping your thesis stay current without extra effort. For Ringkjøbing Landbobank, one investor might build a Narrative around long term premium returns that justify a valuation well above today’s price, while another assumes slower growth and assigns a much lower fair value, leading to a completely different decision.

Do you think there's more to the story for Ringkjøbing Landbobank? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:RILBA

Ringkjøbing Landbobank

Provides various financial products and services in Denmark.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026