Did Jyske Bank’s (CPSE:JYSK) Upgraded 2025 Profit Outlook Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, Jyske Bank raised its 2025 profit outlook, now forecasting a net profit between DKK 4.9 billion and DKK 5.3 billion, with expected earnings per share of DKK 77-84, up from previous guidance.

- This improved forecast follows broad-based gains driven by favorable financial markets, high asset management activity, solid credit quality, and growth in targeted customer segments.

- Next, we'll examine how Jyske Bank's upward profit revision and customer growth influence its investment narrative and future outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Jyske Bank Investment Narrative Recap

For investors considering Jyske Bank, the key belief centers on its ability to deliver sustainable growth through disciplined risk management, high customer satisfaction, and ongoing digital transformation. The upgraded profit guidance announced this week is a positive signal and, for now, supports the most important short-term catalyst: continued strong asset management and customer acquisition. However, it does little to reduce the biggest immediate risk, which remains the possibility of weakening momentum in digital adoption, potentially putting cost efficiency and margins under pressure.

Among recent announcements, Jyske Bank’s August earnings release stands out: despite raising its profit forecast, net interest income remained down year-on-year, reflecting ongoing structural pressures on lending margins. This highlights that much of the current optimism hinges on non-interest income growth and asset inflows, both of which are closely tied to the bank’s customer growth and digital capability, as seen in the revised outlook.

Yet, in contrast to these gains, investors should be aware that digital transformation continues to carry risks if adoption trends start to slow...

Read the full narrative on Jyske Bank (it's free!)

Jyske Bank's narrative projects DKK12.3 billion revenue and DKK4.3 billion earnings by 2028. This requires a 4.4% yearly revenue decline and a DKK0.7 billion decrease in earnings from the current DKK5.0 billion.

Uncover how Jyske Bank's forecasts yield a DKK738.75 fair value, in line with its current price.

Exploring Other Perspectives

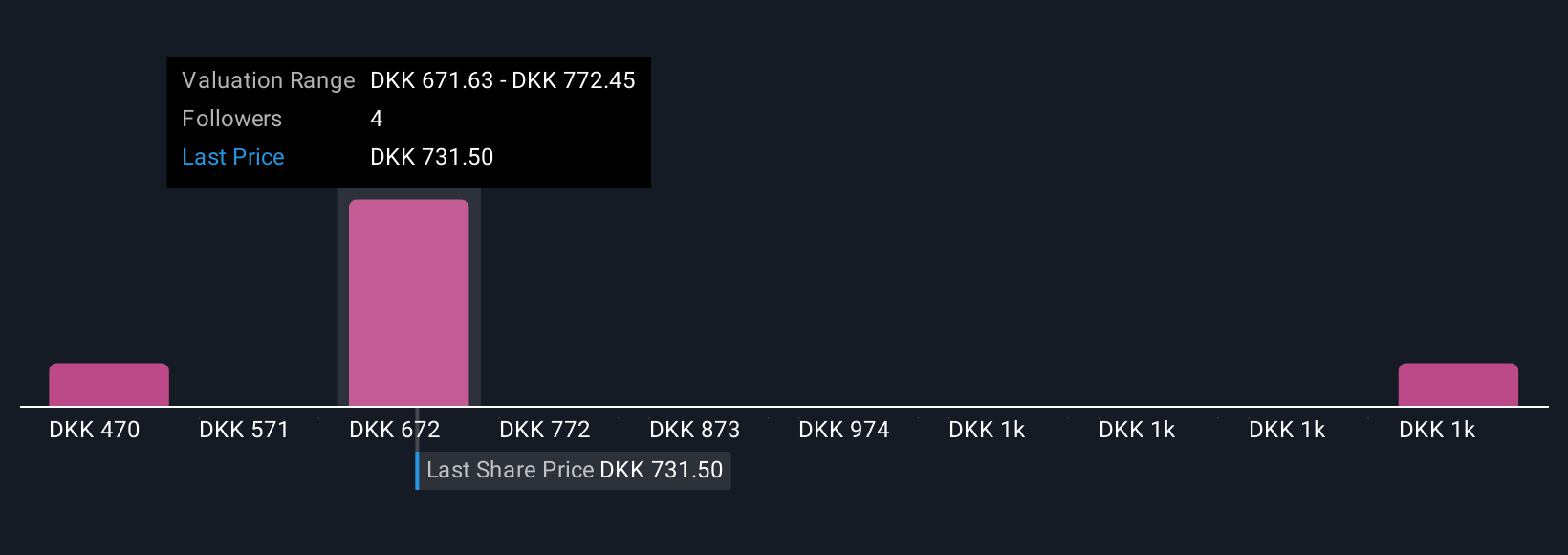

Three fair value estimates from the Simply Wall St Community span DKK470 to DKK1,450, with the highest at over DKK1,450. Some see upside as cost efficiencies and digital growth accelerate, but risks remain if digital adoption across the sector loses steam.

Explore 3 other fair value estimates on Jyske Bank - why the stock might be worth as much as 100% more than the current price!

Build Your Own Jyske Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jyske Bank research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Jyske Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jyske Bank's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:JYSK

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives