Is Danske Bank’s Recent 50% Surge Still Justified After Strong Earnings Growth?

Reviewed by Bailey Pemberton

Thinking about what to do with Danske Bank shares? You are not alone. Whether you are holding on after an incredible multi-year run, or just tuning in as the stock hovers near recent highs, now is the perfect time to get a pulse on its valuation. Over the past year, Danske Bank’s stock price has climbed an eye-catching 50.1%, reflecting a resurgence in investor confidence. Looking further back, the return over the last five years stands at a remarkable 272.4%. The stock is already up by over 30% since January. Despite a minor dip of 1.8% in the past week, the longer-term momentum has been unmistakably strong, aided in part by improving financial sector sentiment and broader market tailwinds in Northern Europe.

With these moves, you might wonder whether the stock’s current price fairly reflects its prospects or if there is further room to run. Our valuation checkup gives Danske Bank a score of 4 out of 6, indicating it is undervalued in most, but not all, tested ways. Each point in that score signals another method where the market might be underestimating Danske Bank’s true worth. In the next section, we will break down the main approaches used to judge whether Danske Bank is undervalued or not and explore how each adds or subtracts confidence for investors. Make sure to read on to discover not just what the numbers say, but also what matters even more when it comes to valuing a stock like this.

Why Danske Bank is lagging behind its peers

Approach 1: Danske Bank Excess Returns Analysis

The Excess Returns model looks at how much profit a company generates above the required return for its equity investors. In simpler terms, it measures whether Danske Bank is earning more than what shareholders would expect for the risk they are taking. The analysis pays special attention to the bank’s return on equity, growth in book value, and the difference between profit and cost of equity over time.

For Danske Bank, the numbers are strong. Book Value stands at DKK207.89 per share, while analysts expect a stable Earnings Per Share (EPS) of DKK27.73 going forward. This future EPS is based on projections from 11 analysts, reflecting consensus expectations. The Cost of Equity is DKK14.05 per share, so the bank’s current Excess Return is DKK13.67 per share. The calculated average Return on Equity over the long run is 12.28%. Stable Book Value is estimated at DKK225.85 per share, as sourced from eight analyst estimates.

Altogether, the model estimates Danske Bank’s intrinsic value is 48.8% higher than today’s share price. This suggests the stock is trading well below its fair worth. This result indicates a marked undervaluation, giving investors a clear margin of safety at current prices.

Result: UNDERVALUED

Our Excess Returns analysis suggests Danske Bank is undervalued by 48.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

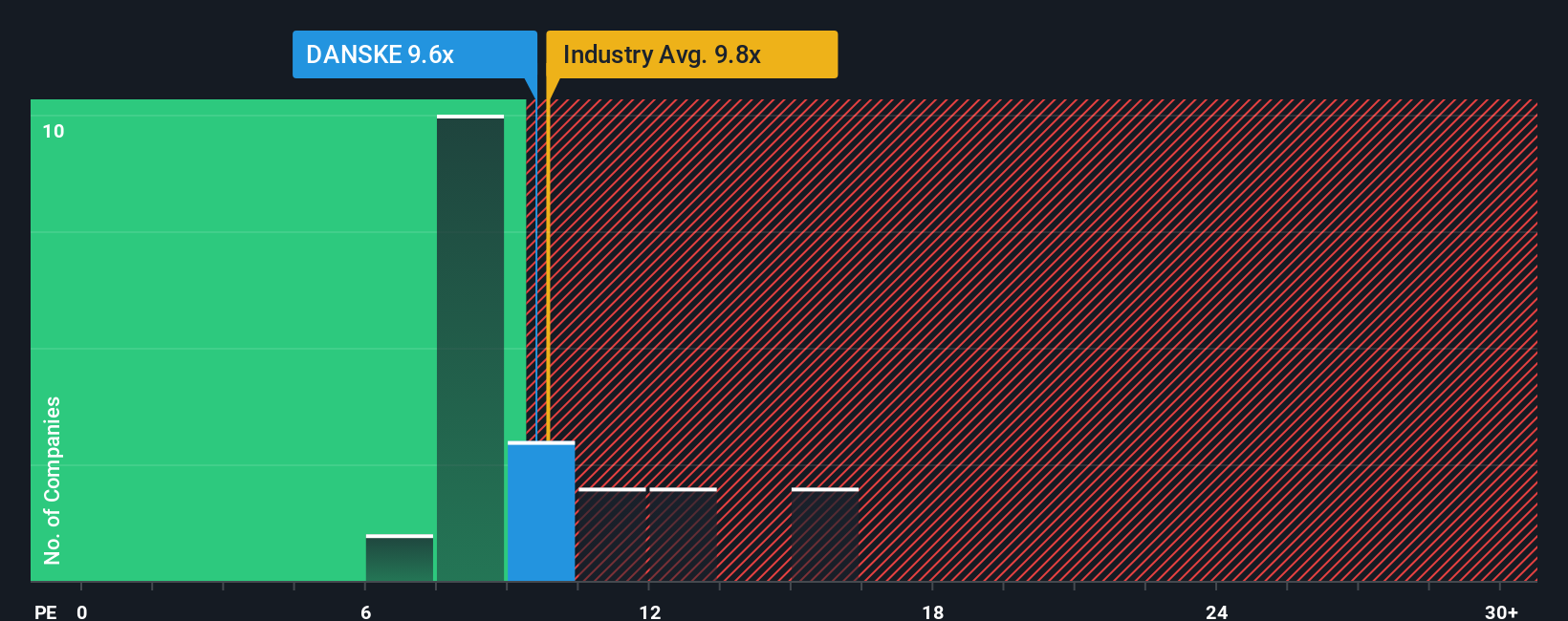

Approach 2: Danske Bank Price vs Earnings

For profitable companies like Danske Bank, the price-to-earnings (PE) ratio remains one of the most widely used and meaningful ways to value a stock. The PE ratio measures how much investors are willing to pay for each unit of a company’s earnings. Companies expected to grow faster or viewed as less risky generally command higher PE ratios, while those facing uncertainty or slower growth tend to trade at lower multiples.

Danske Bank currently trades on a PE ratio of 9.4x. To put that in perspective, the average PE for the European banking industry is 10.3x, and its direct peer group averages 9.2x. That positions Danske Bank almost exactly in line with peers, but slightly below the broader industry. This suggests the market values its earnings similarly to its closest competitors.

Instead of just comparing to peers or industry averages, Simply Wall St’s proprietary “Fair Ratio” method takes into account Danske Bank’s expected earnings growth, risk profile, profit margins, industry placement, and size. For Danske Bank, the Fair Ratio works out to 12.0x. Since this Fair Ratio is notably higher than the current PE, it suggests the market may not be fully appreciating the company’s potential or quality.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Danske Bank Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal take on a company’s story, connecting what you think will happen in the business, such as future revenue, profit margins, or competitive threats, to a financial forecast and then a fair value that makes sense for you.

Narratives bring numbers and real-world views together, so you can see how your convictions translate into buy or sell decisions. They are easy to use, accessible in the Simply Wall St Community page (used by millions of investors), and update automatically as soon as new news or results come out.

Say you believe Danske Bank’s digital transformation will overcome regulatory challenges and fuel steady profit growth. Your Narrative could support a higher Fair Value, like the most optimistic analysts, targeting DKK329. Or, if you expect digital competition and compliance costs to erode future earnings, your Narrative might imply a much lower Fair Value, such as DKK233, matching more cautious expectations. Narratives let you compare these different views directly to today’s share price, helping you decide if now is the right time to act.

Do you think there's more to the story for Danske Bank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:DANSKE

Danske Bank

Provides various banking products and services to corporate, institutional, and international clients.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives