Is Danske Bank Still a Bargain After Surging 50% on Legal Resolution?

Reviewed by Bailey Pemberton

If you’ve been paying attention to Danske Bank lately, you’ve probably noticed there’s been plenty of action in its share price. Maybe you’re even wondering whether now is the moment to jump in or take some profits off the table. Over the past year, Danske Bank has delivered a remarkable 50.2% return, with gains standing at a powerhouse 230.9% for the past three years and nearly tripling over five years. Even in the shorter term, its year-to-date return is a striking 33.8%. While the 7-day and 30-day changes are much tamer (0.1% and 1.1% respectively), the bigger picture shows clear, sustained momentum.

Much of this renewed confidence comes after a few headline-grabbing developments. The bank has successfully navigated some high-profile legal issues, clearing a path for renewed investor attention and changing how the market views Danske’s risk profile. Recent news has focused on the bank’s ongoing digital transformation and strengthening of its core Nordic operations, reinforcing optimism around its growth potential in a region known for stability and innovation.

From a valuation standpoint, Danske Bank currently scores a 4 out of 6 by standard undervaluation checks, suggesting it still offers investors substantial value compared to many of its peers. But with so many numbers and headlines circulating, what is the best way to decide if it is still a bargain? First, let’s look at traditional valuation methods. Then, I’ll share my favorite way to get a clearer picture of what this company is really worth.

Why Danske Bank is lagging behind its peers

Approach 1: Danske Bank Excess Returns Analysis

The Excess Returns valuation model examines a company’s ability to generate returns on its invested capital that surpass the required cost of equity. Essentially, it shows how effective Danske Bank is at turning its capital into real value for shareholders. This model cuts through the noise of market swings by focusing on fundamental profitability and the long-term growth of the business.

For Danske Bank, the key numbers are promising. The current Book Value sits at DKK207.89 per share, with analysts forecasting a Stable Book Value of DKK225.67 per share in the future. The Stable Earnings Per Share (EPS) is expected at DKK27.68, and Danske’s Cost of Equity is DKK14.06 per share. That leaves an Excess Return of DKK13.62 per share, powered by an average future Return on Equity of 12.27% (based on projections from 10 analysts).

Based on this approach, the model estimates Danske Bank’s intrinsic value at DKK516.68 per share. This means the stock is currently trading at a 47.2% discount. In plain terms, the shares appear significantly undervalued given their steady profitability and capital efficiency.

Result: UNDERVALUED

Our Excess Returns analysis suggests Danske Bank is undervalued by 47.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

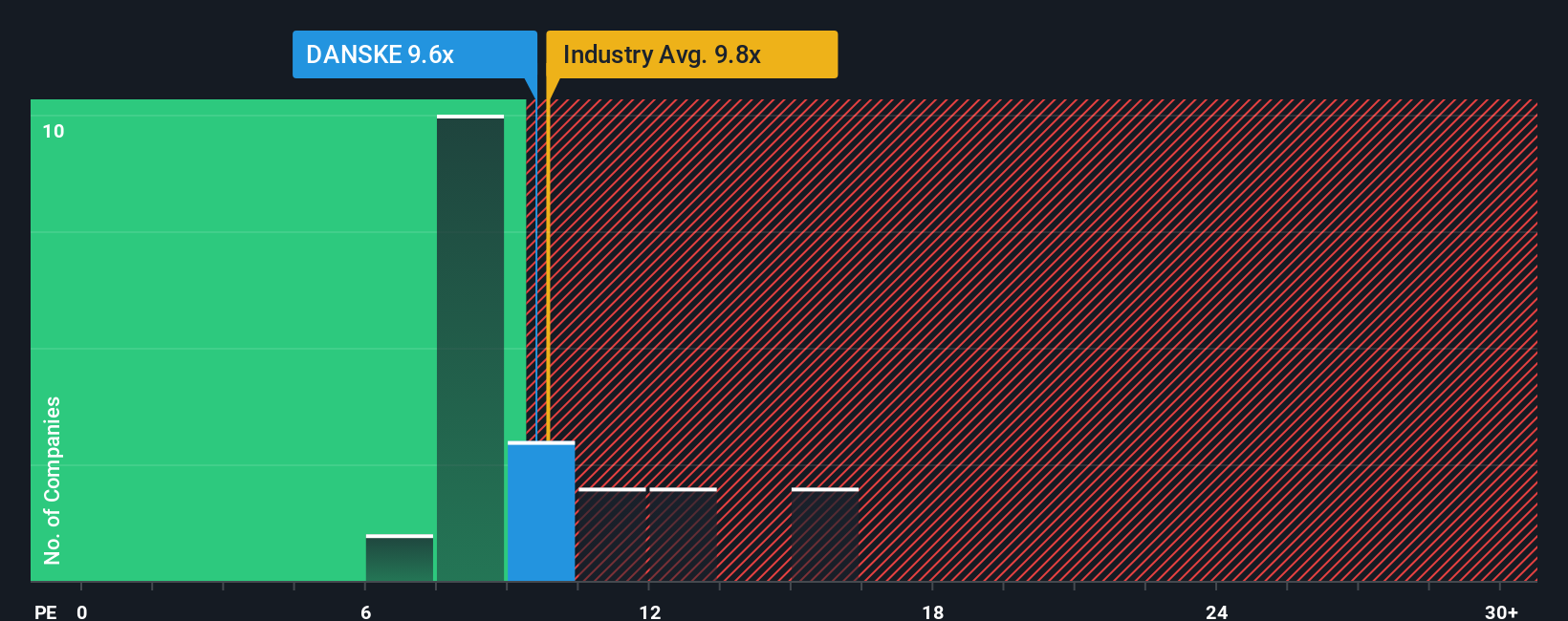

Approach 2: Danske Bank Price vs Earnings

For established, profitable banks like Danske, the Price-to-Earnings (PE) ratio is a tried-and-true metric for judging valuation. It directly links a company’s share price to the profits it generates, making it a quick snapshot of what the market is willing to pay for current earnings power. A "normal" or "fair" PE depends on expected earnings growth and perceived risk. Companies growing earnings quickly or viewed as less risky typically command higher PE ratios, while slower-growing or riskier firms see a lower ratio.

At present, Danske Bank is trading at a PE ratio of 9.6x. That is quite close to the average PE of similar banks, which stands at 9.3x, and a bit below the wider industry average of 10.3x. However, Simply Wall St's Fair Ratio for Danske is calculated at 12.1x, reflecting adjustments for the company’s growth prospects, profit margins, risk factors, and its place in the banking sector. This proprietary Fair Ratio goes beyond simple peer or industry comparison by factoring in forward-looking growth and risk, aiming for a more precise sense of fair value for each individual stock.

Comparing Danske’s actual multiple of 9.6x against its Fair Ratio of 12.1x, the stock appears attractively valued on this basis and could be considered undervalued according to the preferred multiple approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Danske Bank Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, an approach that lets you combine your perspective on Danske Bank's story with your own numbers, forecasts, and fair value estimates.

In simple terms, a Narrative is your story about where you think Danske Bank is heading, expressed through your expectations for future revenue, earnings, and margins. Narratives connect what you believe about the business and the industry with the underlying financial forecasts and, ultimately, with the company’s fair value.

Using Simply Wall St's Community page, millions of investors already leverage Narratives as an easy and accessible tool to document their views, compare them to others, and track how each scenario stacks up against market pricing.

Narratives help you cut through the noise and make confident buy or sell decisions by showing how your fair value compares to the current share price. These values update instantly as new earnings, news, or forecasts are released.

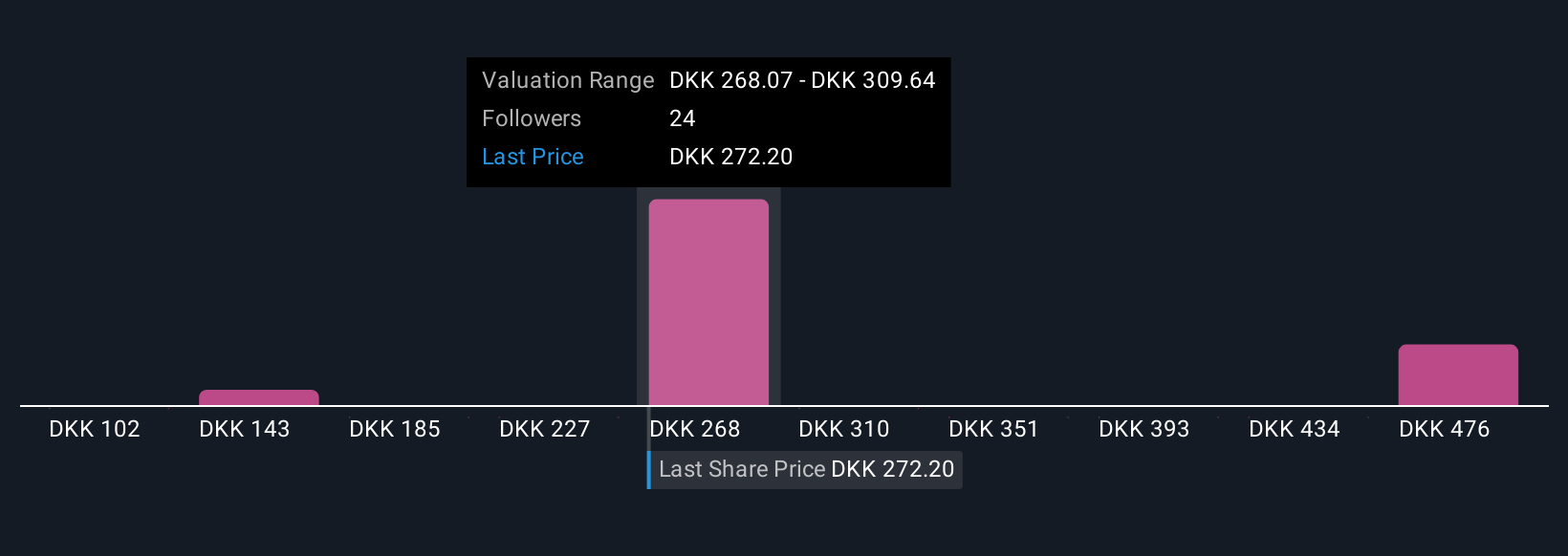

For example, looking at Danske Bank, some investors expect continued digital disruption and regulatory headwinds could keep the fair value as low as DKK233.0. Others, encouraged by operational improvements and sustained earnings momentum, see a potential fair value as high as DKK329.0. Narratives let you define your own outlook and sense-check it against both analyst consensus and other users’ perspectives.

Do you think there's more to the story for Danske Bank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:DANSKE

Danske Bank

Provides various banking products and services to corporate, institutional, and international clients.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives