- Hong Kong

- /

- Electrical

- /

- SEHK:2551

Unveiling Hidden Opportunities in Undiscovered Gems November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, small-cap stocks have gained attention, with the Russell 2000 Index leading gains despite remaining below its record highs. In this dynamic environment, identifying promising small-cap companies requires a focus on those poised to benefit from potential regulatory changes and economic growth initiatives.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 86.64% | 24.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Gelsenwasser (DB:WWG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gelsenwasser AG operates in the water, wastewater, gas supply, and electricity sectors across Germany, the Czech Republic, and Poland with a market capitalization of €1.84 billion.

Operations: The company generates revenue primarily from energy sales (€3.93 billion) and energy grids (€271.20 million), with additional contributions from water services (€286.30 million) and wastewater management (€39.20 million).

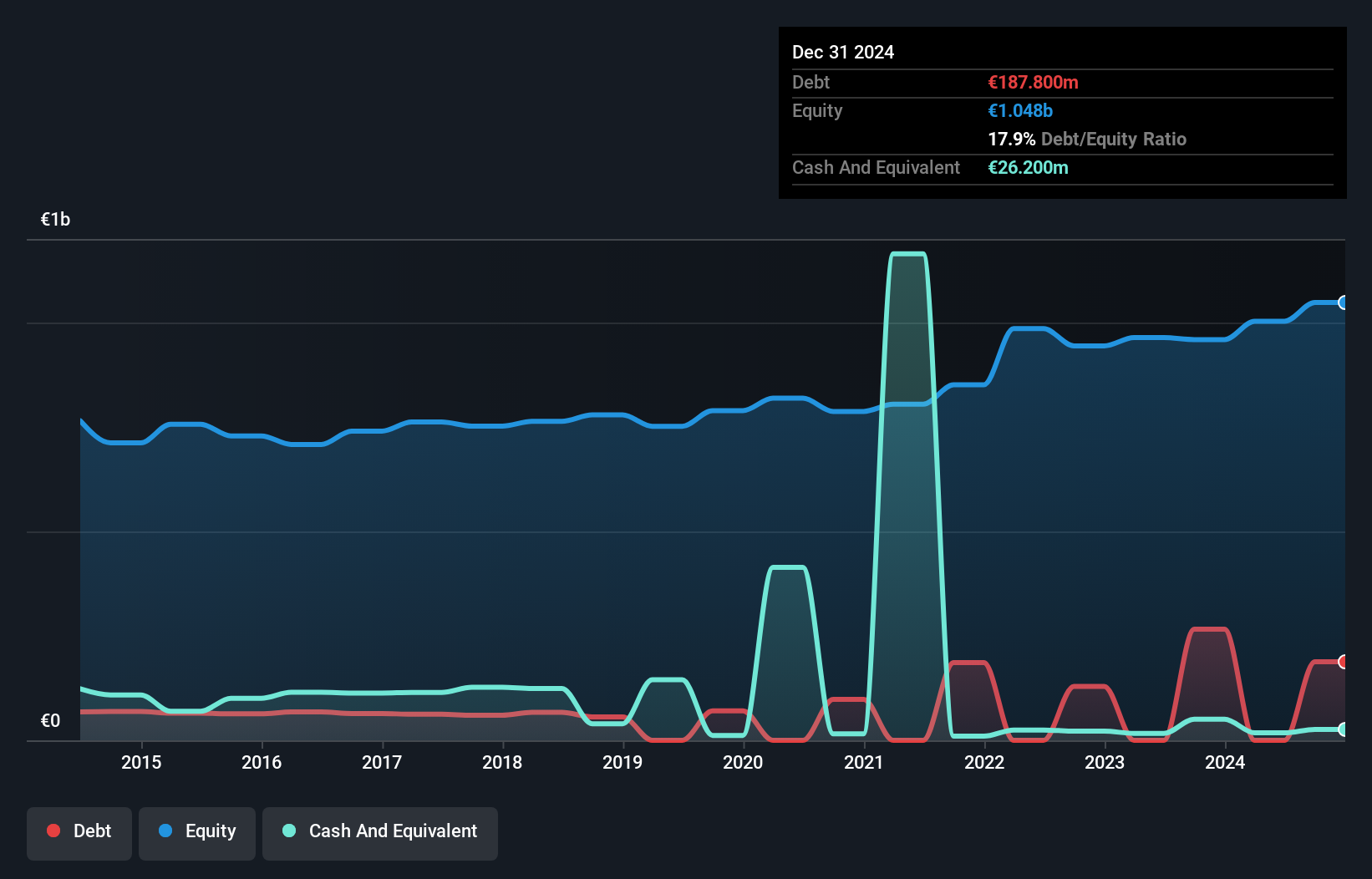

Gelsenwasser, a compact player in the market, has been making strides with its high-quality earnings and free cash flow positivity. Over the past year, earnings surged by 32.9%, outpacing the Integrated Utilities industry growth of 4.5%. Despite being debt-free for five years, recent reports show a dip in sales to €1.3 billion from €2.4 billion last year, with net income slightly lower at €68 million compared to €74 million previously. Trading at 86.6% below estimated fair value suggests potential undervaluation, although challenges remain evident from recent financial results.

- Delve into the full analysis health report here for a deeper understanding of Gelsenwasser.

Understand Gelsenwasser's track record by examining our Past report.

Latent View Analytics (NSEI:LATENTVIEW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Latent View Analytics Limited offers business analytics, consulting services, data engineering, generative AI, and digital solutions across India, the United States, Singapore, the United Kingdom, and the Netherlands with a market cap of ₹102.23 billion.

Operations: Latent View Analytics generates revenue primarily through its business analytics, consulting services, data engineering, generative AI, and digital solutions offered across multiple regions. The company has a market capitalization of ₹102.23 billion.

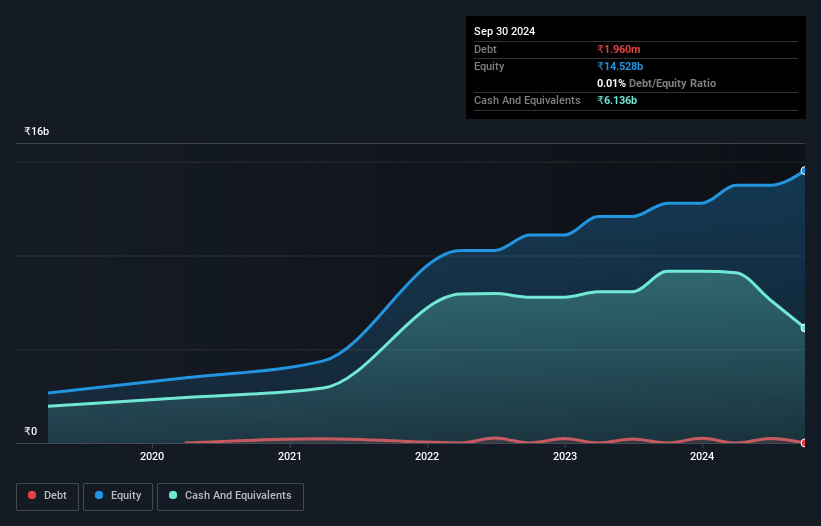

Latent View Analytics, a relatively small player in the analytics space, has been making waves with its robust financial performance. Over the past year, earnings grew by 11%, outpacing the industry average. The company boasts high-quality earnings and maintains a debt-to-equity ratio that increased slightly from 0% to 0.01% over five years, indicating prudent financial management. Recent results show revenue climbing to INR 2.32 billion for Q2 2024 from INR 1.73 billion a year prior, with net income rising to INR 398.86 million from INR 340.25 million last year. This growth trajectory suggests promising potential ahead for Latent View Analytics in its sector.

APT Electronics (SEHK:2551)

Simply Wall St Value Rating: ★★★★★★

Overview: APT Electronics Co., Ltd. specializes in providing intelligent vision products and system solutions, with a market capitalization of approximately HK$2.84 billion.

Operations: APT Electronics generates revenue primarily from its Electric Lighting & Other Fixtures segment, amounting to CN¥1.86 billion.

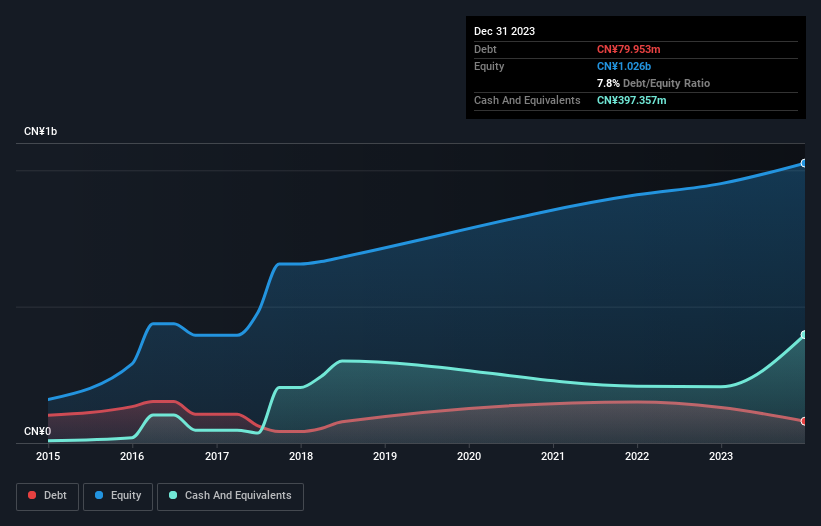

APT Electronics, a relatively small player in the market, recently completed an IPO raising HKD 139.49 million, offering shares at HKD 3.61 each with a slight discount of HKD 0.33 per share. The company boasts impressive earnings growth of 62.7% over the past year, outpacing the Electrical industry average of 22.4%. Trading significantly below its estimated fair value by about 93%, APT appears undervalued in current assessments. Notably, it holds more cash than its total debt and has reduced its debt-to-equity ratio from 12.3% to 7.8% over five years, reflecting sound financial management practices.

- Navigate through the intricacies of APT Electronics with our comprehensive health report here.

Gain insights into APT Electronics' past trends and performance with our Past report.

Key Takeaways

- Navigate through the entire inventory of 4673 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2551

APT Electronics

Provides intelligent vision products and system solutions.

Flawless balance sheet and fair value.