- Germany

- /

- Other Utilities

- /

- DB:WWG

One-Year Earnings Growth At Gelsenwasser Promising, But Shareholders Still In The Red

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. For example, the Gelsenwasser AG (FRA:WWG) share price is down 43% in the last year. That contrasts poorly with the market decline of 16%. Notably, shareholders had a tough run over the longer term, too, with a drop of 33% in the last three years. Unfortunately the share price momentum is still quite negative, with prices down 14% in thirty days.

With the stock having lost 5.3% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Gelsenwasser

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Gelsenwasser share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

Gelsenwasser managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

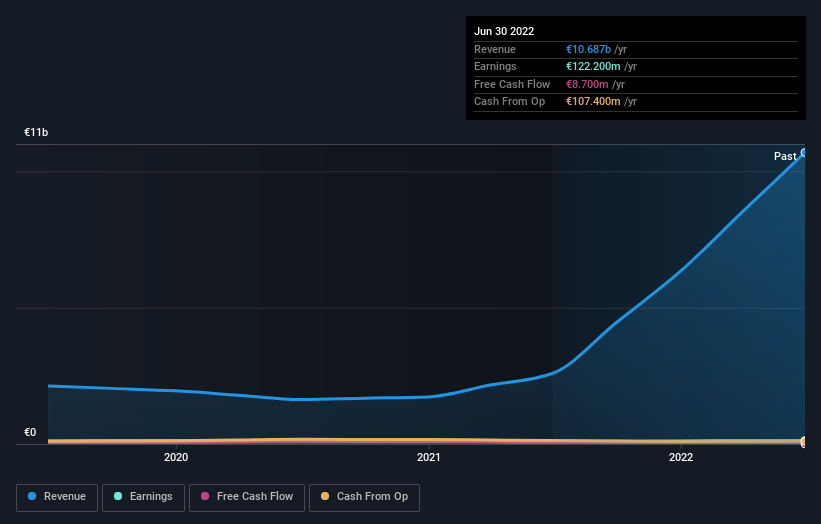

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Gelsenwasser's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 16% in the twelve months, Gelsenwasser shareholders did even worse, losing 42% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Gelsenwasser better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Gelsenwasser you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:WWG

Gelsenwasser

Engages in the water, wastewater, gas supply, and electricity businesses in Germany, the Czech Republic, and Poland.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives